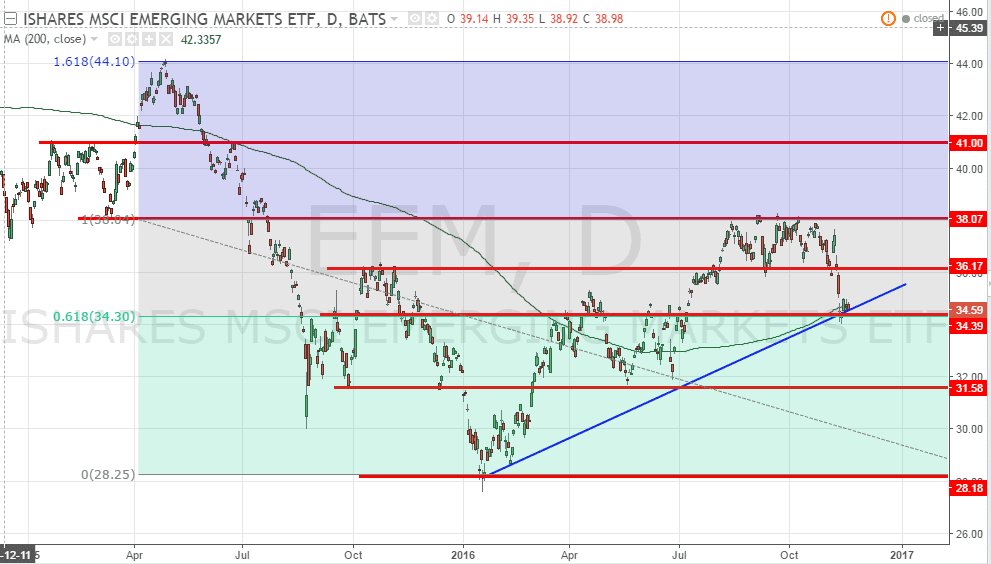

iShares MSCI Emerging Market ETF (EEM): Going to rebound from the support?

iShares MSCI Emerging Market ETF (EEM) is currently testing the 200D SMA support and also the uptrend support line. This support also coincides with 61.8% Fibonacci Retracement Level. Will EEM rebound from the support?

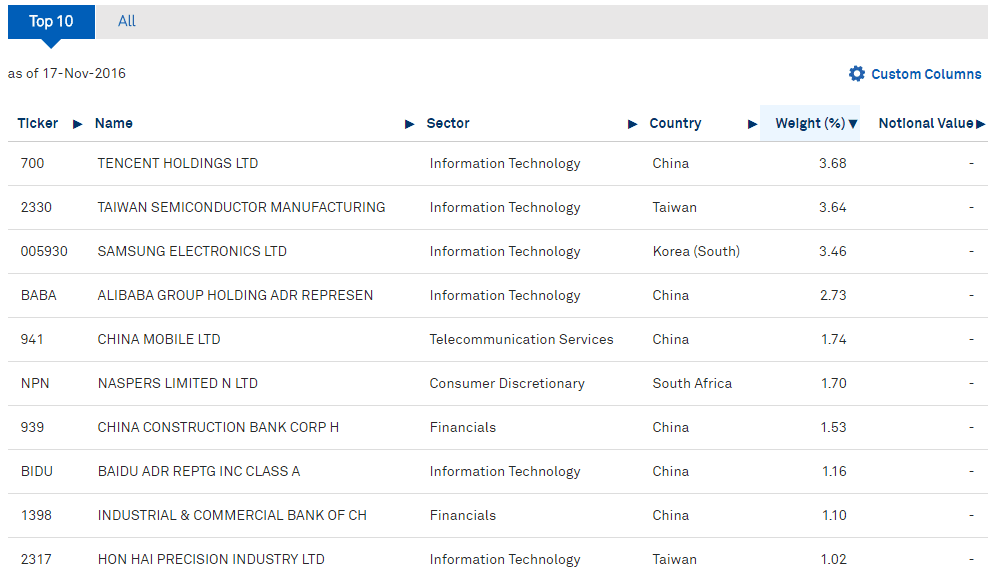

What is EEM?

INVESTMENT OBJECTIVE

The iShares MSCI Emerging Markets ETF seeks to track the investment results of an index composed of large- and mid-capitalization emerging market equities.