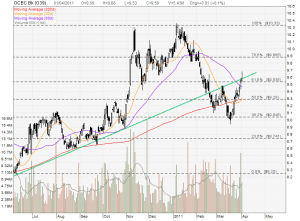

City Development: Hanging Man at $12.00 Resistance!

Hanging Man candlestick at resistance is a potential reversal pattern. Need to wait for the next candle to confirm the reversal. $12.00 has been a tough resistance to break for past few occasions.Immediate support is at $11.60 (50D SMA).