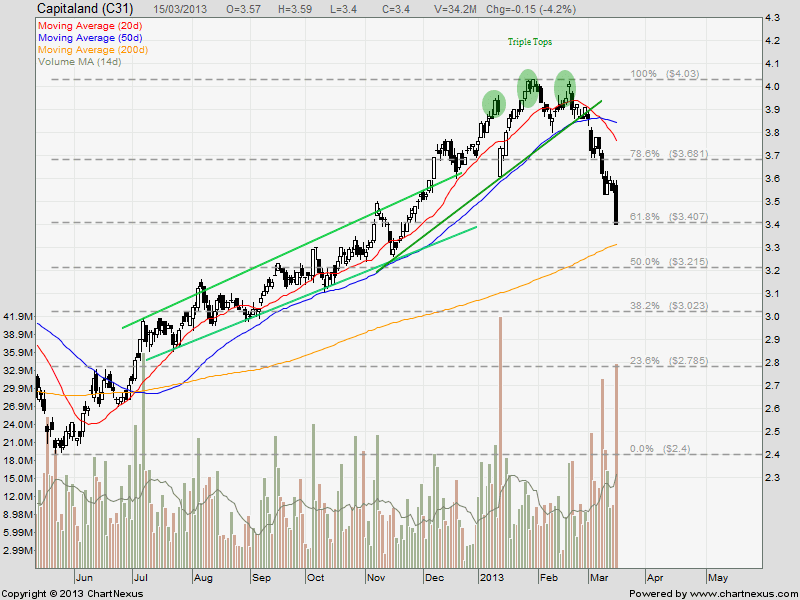

Capitaland: Big Fund Selling?

Capitaland broke out from the Triple Tops and reversed to the bearish trend. Capitaland is currently at Elliott Wave A and may be rebound from 61.8% FR (about $3.40) or 200D SMA ($3.30) to form Wave B before continue the down trend.

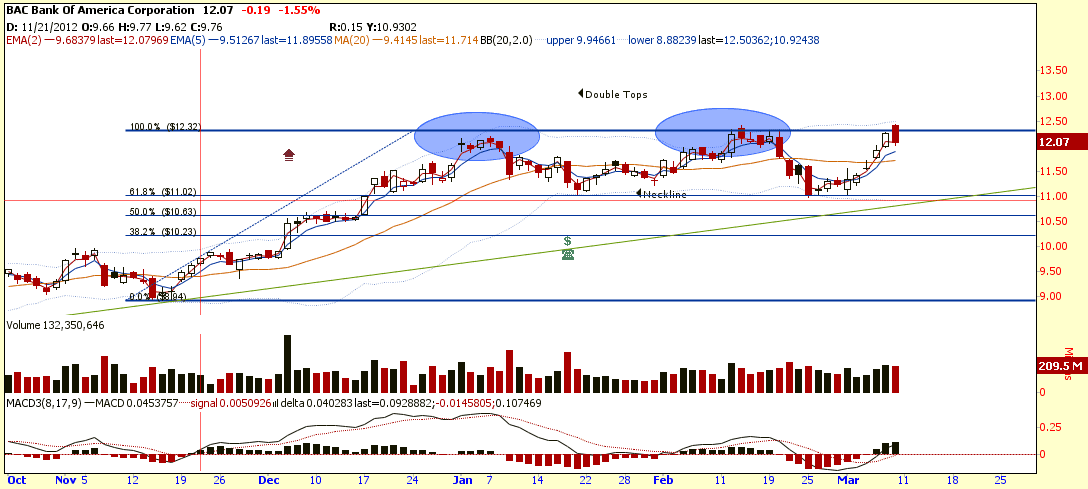

Another interesting observation to note on the Time & Sales after last Friday closing, there was a huge sell down from $3.52 to $3.40 with 16,091 lots transacted. This represent 47% of the whole day transacted volume. Who was selling “desperately” after trading hour? There were similar selling patterns on Wilmar and SIA also, with close to 50% of the whole day trading volume sell down after the market close. It is up to your imagination who are the BIG SELLERS but this type of selling is definitely not a good sign.