Will Hospitality REITs take off? An overview of Hospitality REITs

Are Singapore Hospitality REITs a good buy today? The IATA expects that personal and leisure travel will return from 2nd half of 2021, as travel bubbles form and vaccination continues. In this article we’ll be covering the 5 Hospitality REITs in Singapore (excl Eagle Hospitality Trust) in greater detail, comparing their portfolio information, financial ratios, etc. The 5 REITs are namely ARA Hospitality Trust, Ascott Residence Trust, CDL Hospitality Trust, Far East Hospitality Trust and Frasers Hospitality Trust.

REIT Portfolio Overview

ARA Hospitality Trust has a 100% US portfolio consisting of 41 upscale hotels across 22 states, which consists of Hyatt-branded and Mariott-branded hotels. It has a total portfolio valuation of approximately US$700 million.

The largest of the 5 REITs listed here, Ascott Residence Trust has a total portfolio valuation of about S$7.2 billion. It is the most globally diversified REIT in this list, with 86 properties in 15 countries, including China, Japan, Australia, France, Germany and the United States. Its properties in Singapore comprises 16% of the total portfolio valuation with 5 properties.

CDL Hospitality Trusts has 18 properties across 8 countries including Japan, United Kingdom, New Zealand, the Maldives, Australia, Germany and Italy. It has a portfolio valuation of S$2.597 billion. Its properties in Singapore comprises 66% of the total portfolio valuation with 7 properties.

Far East Hospitality Trust is the only REIT in this list with all its 9 Hotels and 4 Serviced Residences in Singapore. It has 3 in-house brands, namely Quincy, Village Hotels and Oasia Hotel, and has a total portfolio valuation of S$2.65 billion (which is similar to that of CDL Hospitality Trusts).

Frasers Hospitality Trust has 15 properties across Australia, Singapore, Japan, United Kingdom, Malaysia and Germany. It has a total portfolio valuation of S$2.25 billion. Its properties in Singapore comprises 35% of the total portfolio valuation with 2 properties.

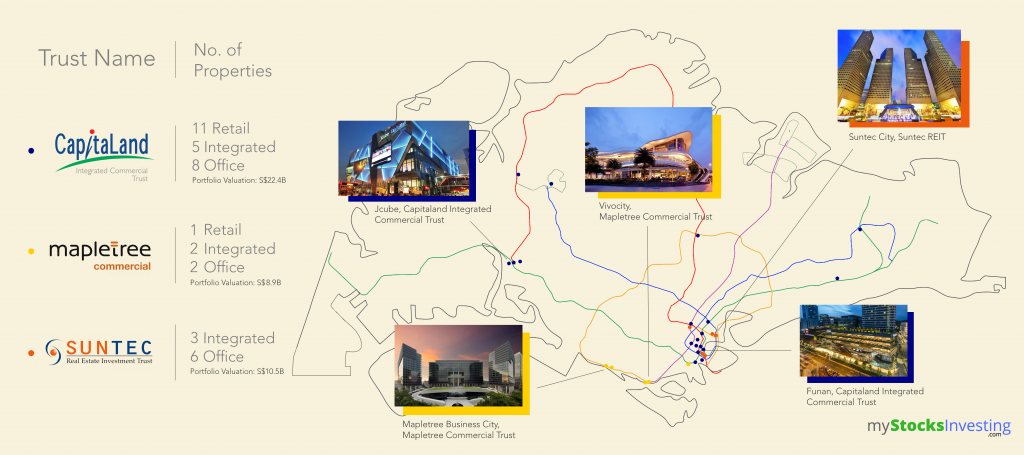

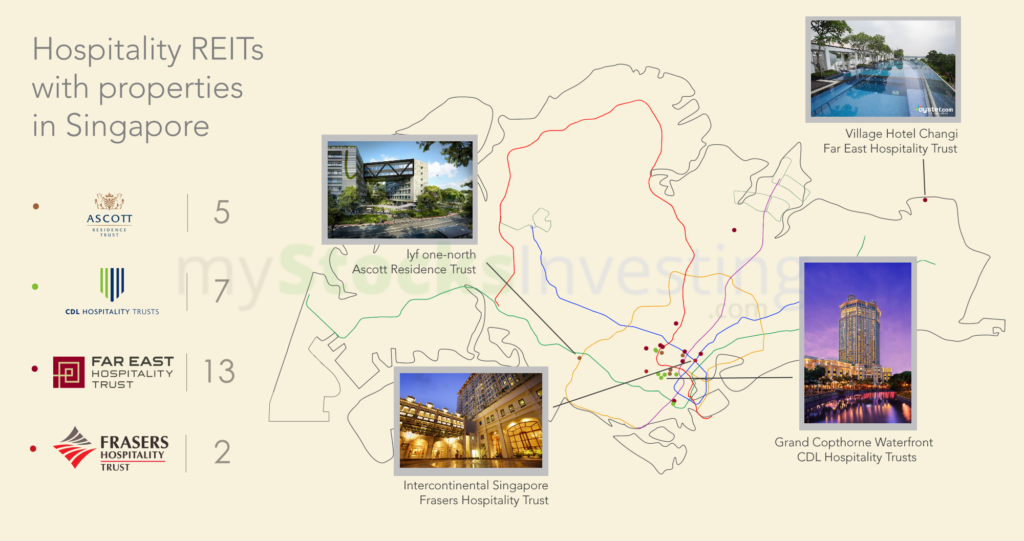

Portfolio Distribution (Singapore)

Some observations that can be drawn out include:

- Most hospitality properties are located in and around the Central area.

- Only 3 properties are located outside of Singapore’s Central. They are:

- lyf one-north, a co-living property in development, with estimated completion in 2021 (Ascott Trust)

- Village Residence Hougang and Village Hotel Changi (Far East Hospitality Trust)

Portfolio Distribution (World)

One observation that can be drawn out is that Ascott Residence Trust, Frasers Hospitality Trust and CDL Hospitality Trusts are quite geographically diversified. Below, we will be comparing the REITs in-depth, using the latest values taken from the StocksCafe REIT screener, which values are taken from each REIT’s Q4 2020 business updates.

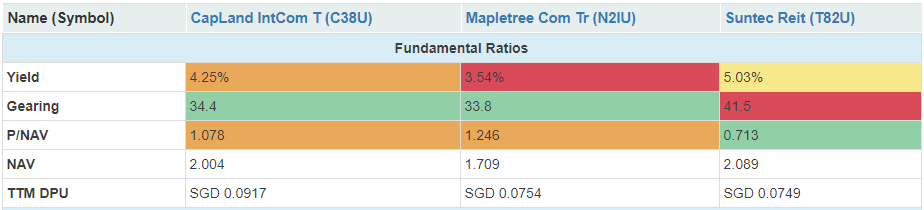

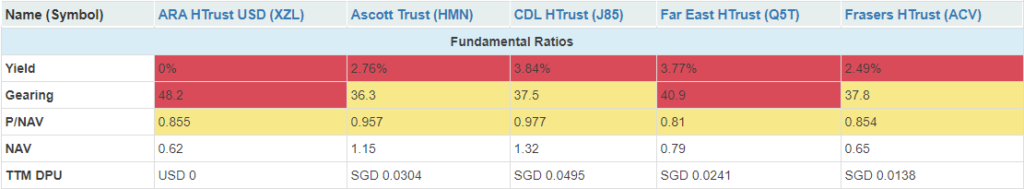

Fundamental Ratios

The above table shows the corresponding fundamental ratios of the 5 REITs. Some observations that can be made are shown below:

- Yield (ttm): As expected, due to the Covid-19 pandemic stemming almost all international travel, yield (ttm) for all 5 hospitality REITs are low, at below 4% for all REITs.

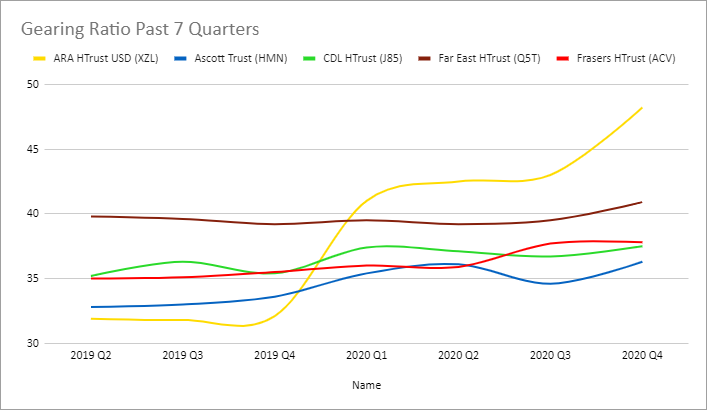

- Gearing: The gearing ratios for all 5 hospitality REITs have generally increased in the past 4 quarters largely due to the reduced revenue caused by the global pandemic. The gearing ratio trends for all 5 REITs are shown below for reference.

- Price/NAV: All 5 Hospitality REITs are relatively undervalued, with the exception of Ascott Trust and CDL Hospitality Trusts which are almost at book value with P/NAV values of about 0.95-0.98.

- NAV: Net Asset Value of each REIT

- TTM DPU: ARA Hospitality Trust has not had any dividend payouts for the past 4 quarters.

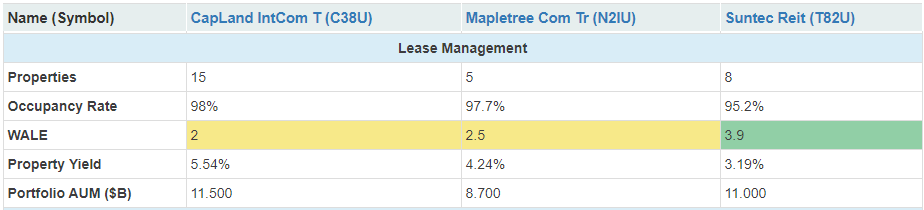

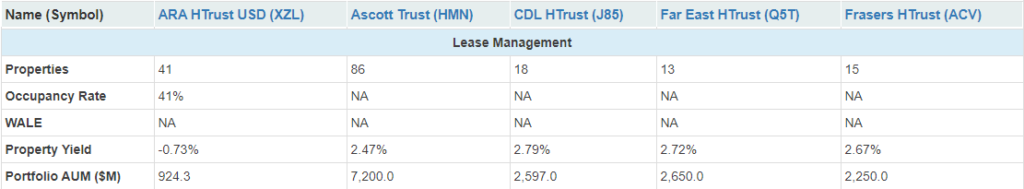

Lease Management

The above table shows the corresponding lease management values of the 5 REITs. Some observations that can be made are shown below:

- No. of Properties: Ascott Trust is the largest with 86 properties, followed by ARA Hospitality Trust. However do note that ARAHT has the lowest total portfolio valuation, despite having the 2nd most no. of properties.

- Occupancy Rate: N/A for Hospitality REITs, although ARAHT provided a 41% occupancy rate.

- Weighted Average Lease Expiry (WALE): N/A for Hospitality REITs

- Property Yield: Property Yields are low, but that is to be expected. 5 of the 8 S-REITs with the lowest Property Yield are Hospitality REITs (excl Eagle HT), shown below:

- Property Portfolio Value: ARAHT has the lowest total portfolio value, and Ascott Trust has the highest portfolio value. The rest have portfolio values of about $2-3B.

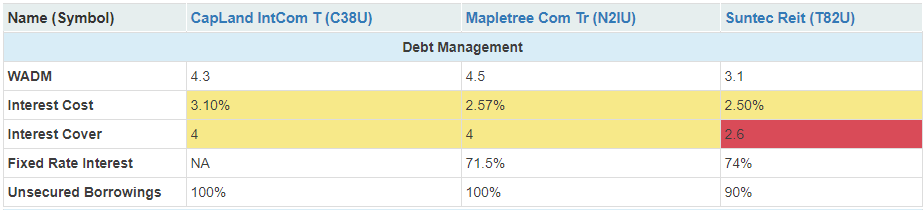

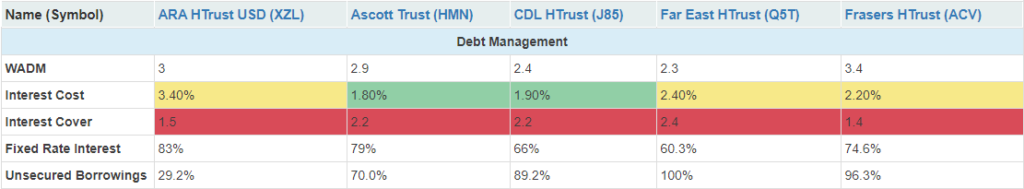

Debt Management

The above table shows the corresponding lease management values of the 5 REITs. Some observations that can be made are shown below:

- Weighted Average Debt Maturity (WADM): The WADM for all 5 REITs are between 2.3 and 3 years.

- Interest Cost/Cost of Debt: ARAHT has a higher cost of debt compared to the other REITs, at 3.4%.

- Interest Coverage Ratio: Interest Coverage Ratio is at or below 2.4 for all 5 REITs. This is expected due to the decreased revenue.

- Unsecured Borrowings: Most of the borrowings made by the 5 REITs are unsecured, with the exception of ARAHT, with 29.2% unsecured borrowings.

Want to invest in Singapore REITs but don’t know how to start? Or not happy with your current investment portfolio? Contact Kenny here at kennyloh@fapl.sg.

Kenny Loh is a Senior Consultant and REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also an invited speaker of REITs Symposium and Invest Fair. Kenny Loh also offers REIT Portfolio Advisory for a fee. Do contact him at kennyloh@fapl.sg