The Covid-19 pandemic has brought about lots of volatility, dividend cuts, and uncertainty in the stock market. However, there is one asset that is considered a safe-haven: Gold. It is also highly liquid, and can be easily converted back to cash.

Gold holds its value well, and is an inflation hedge. However, unlike gold, fiat currencies are subject to many factors, which can include inflation. For example, in 1975, the price of gold is about US$5000/kg. Today, it ranges USD60,000/kg. However, the purchasing power of a USD5000 bill would have dropped significantly.

Therefore, gold prices always spike in periods of uncertainty and recession, for example, in the current pandemic. Many investors place their money in gold as a safe haven.

8 Ways to Invest in Gold

- Gold Jewelry

Easiest to obtain, however most gold jewelry do not hold their value well, with the exception of collector items. They can either be sold and melted down for scrap, or it can be sold as a collector’s item. For example, gold bracelets from luxury brands, gold watches etc.

- Gold Bars

Gold bars are highly liquid, and are relatively easy to obtain. Prices can vary depending on purity, size and weight, and whether they are certified as investment-grade.

- Gold Coins

Similar to jewelry, gold coins are also collector items. Its value depends on rarity, metal quality, and the artwork on the coin. Depending on these attributes, its value can skyrocket into the millions.

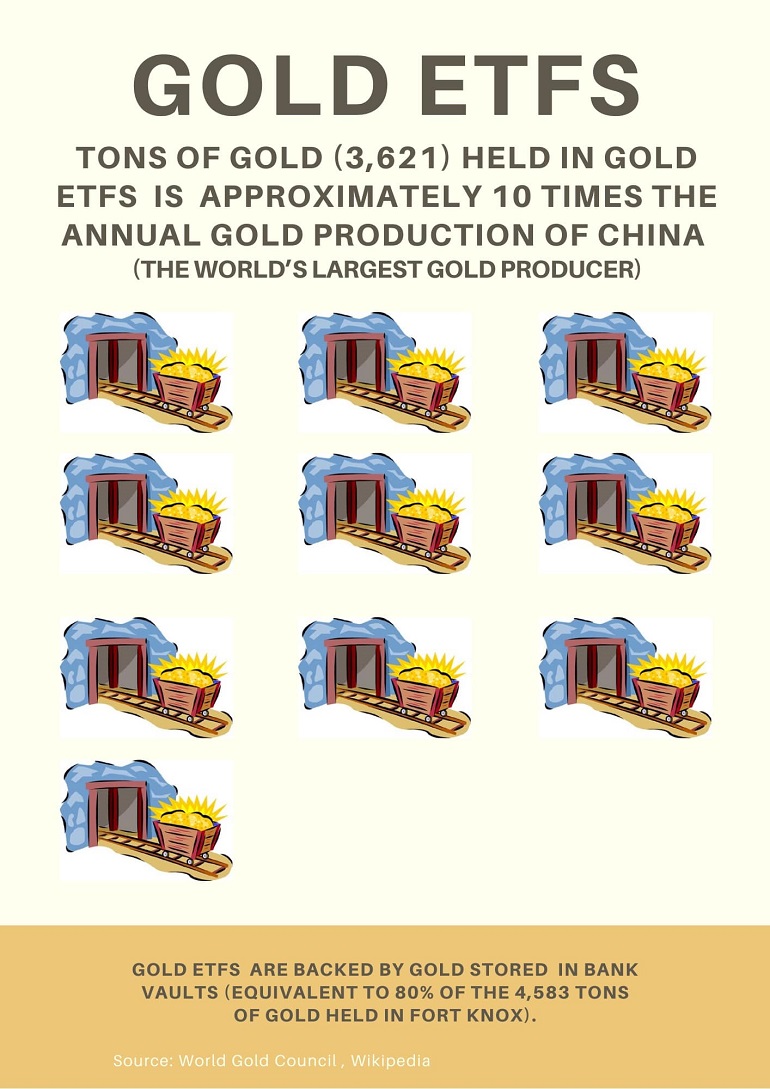

- Gold ETFs

Gold ETFs are exchange-traded funds (ETFs). They are convenient, low cost, and highly liquid, and instead of a investor physically holding onto gold, they are traded on the stock market, and are backed by physical gold stored in a bank vault.

- Gold Mining Stocks and Mutual Funds

- Gold Futures

- Gold Royalty Mineral Interests and Royalty Trusts

- Gold Certificates

Gold certificates are issued for a quantity of gold stored in a bank vault.

There are many ways to invest in gold with different instruments with Pro/Cons in each of them. Investors is advised to choose a suitable instrument according to their preference and risk appetite.