Fundamental Analysis

- Last Price = $0.445

- NAV = $0.5654

- Price / NAV = 0.7871 (Under Value)

- Distribution Yield = 6.595%

- Gearing Ratio = 24.2% (Low Gearing)

- Weighted Average Debt Maturity = 2.3 Years

- Total Portfolio Occupancy Rate = 95.1%

- WALE = 5.1 Years

Lippo Mall Indonesia Retail Trust (LMIR Trust) 2Q 2013 Result Presentation.

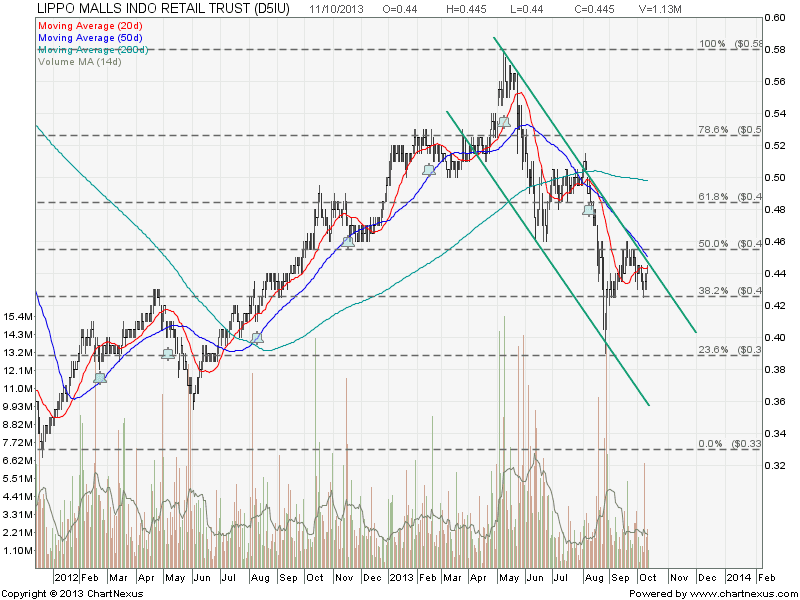

Technical Analysis

Lippo Mall is technically bearish (below 200D SMA) and currently seems like trading within a down trend channel. Currently the stock price is testing the down trend channel resistance at about $0.44. If rejected at this resistance and break the recent support of $0.425, Lippo Mall will continue the down trend.

See Singapore REIT Comparison Table here.

Hi Marubozu,

What do you think of Lippo’s performance given the weak Rupiah to SGD exchange rate over the last few months? Since Rupiah has depreciated by over 20%, I am weary that this might affect their financials when converting to SGD. Appreciate your thoughts/comments on this.

Thanks,

Alex

LMIR may have some hedging mechanism to manage the currency risk. We will see how good is their hedging strategy.

Actually we don’t need to guess. Let’s wait for the next earning result to see what is the impact on DPU, then we calculate the Distribution Yield again to make the final judgement.

Currently, the LMIRT is selling below its NAV, have a low gearing ratio, and because of the low price, the distribution yield become high. Do you think this is something sustainable ? What makes the price so low compared to other REITs in Singapore ? Does the market knows something else here about LMIRT ? I am very tempted to invest in the LMIRT because of the high yield but worry something I may not know.

Hi Rendra,

No one can predict the market as there are too many factors to consider. There are no way for retail investors to know everything and get in out get out at the right time. I would suggest you look at the chart and let the chart to talk to you when to get in and when to get out.

Another important factors in investing is understanding of the global economy. You can read some of my thoughts here:

https://mystocksinvesting.com/singapore-stocks/capitamall-trust/is-it-time-to-invest-in-singapore-reit-to-build-up-passive-income/