Singapore REITs Monthly Update (June 15th, 2025)

Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased from 631.68 to 638.78 (1.12%) compared to last month’s update. It has continued to trade between 622 and 200D SMA (658 currently) following the April flash crash caused by “Liberation Day” announced by US President Donald Trump. Immediate support is at 622, tested 4 times between April 2024 and most recently on 15th May.

- Short-term direction: Sideways

- Medium-term direction: Sideways

- Long-term direction: Sideways

- Immediate Support: Blue Support Line (622), followed by 586 (Mar 2020 crash)

- Immediate Resistance: 200D SMA

FTSE REIT Index Chart (2 years)

Previous chart on FTSE ST REIT index can be found in the last post: Singapore REIT Fundamental Comparison Table on May 11th, 2025.

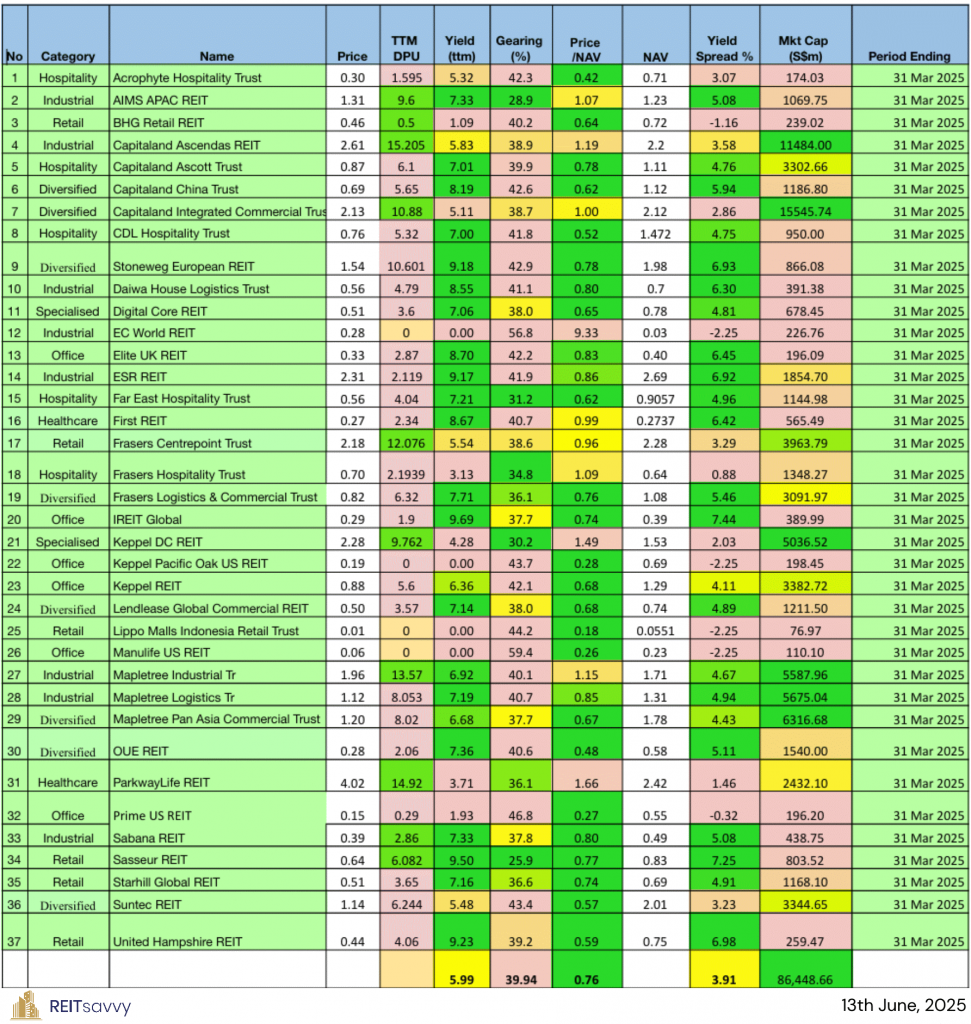

Fundamental Analysis of 37 Singapore REITs

The following is the compilation of 37 Singapore REITs with colour-coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- The Financial Ratios are based on past data and these are lagging indicators.

- All REITs have the latest Q1 2025 values.

- I have introduced weighted average (weighted by market cap) to the financial ratios, in addition to the existing simple average ratios. This is another perspective where smaller market cap REITs do not disproportionately affect the average ratios. As of May 2025 I have removed EC World REIT from these calculations.

- Following its delisting, Paragon REIT has been removed.

Data from REITsavvy Screener. https://screener.reitsavvy.com/

What does each Column mean?

- FY DPU: If Green, FY DPU for the recent 4 Quarters is higher than that of the preceding 4 Quarters. If Lower, it is Red.

- Yield (ttm): Yield, calculated by DPU (trailing twelve months) and Current Price as of June 13th, 2025.

- Gearing (%): Leverage Ratio.

- Price/NAV: Price to Book Value. Formula: Current Price over Net Asset Value per Unit.

- Yield Spread (%): REIT yield (ttm) reference to Gov Bond Yields. REITs are referenced to SG Gov Bond Yield.

As of May 2024, all REITs’ Yield Spread will be referenced to SG Gov Bond Yields, regardless of trading currency.

Price/NAV Ratios Overview

- Price/NAV remained at 0.76 (Weighted Average: 0.95)

- Remained at 0.76 in May 2025.

- Singapore Overall REIT sector is slightly undervalued

- Most overvalued REITs (based on Price/NAV)

ParkwayLife REIT 1.66 Keppel DC REIT 1.49 Capitaland Ascendas REIT 1.19 Mapletree Industrial Tr 1.15 Frasers Hospitality Trust 1.09 AIMS APAC REIT 1.07 EC World REIT is currently suspended, however at current Price and NAV/Unit values it has a value of 7.00 (N.M)

- Most undervalued REITs (based on Price/NAV)

Lippo Malls Indonesia Retail Trust 0.18 Manulife US REIT 0.26 Prime US REIT 0.27 Keppel Pacific Oak US REIT 0.28 Acrophyte Hospitality Trust 0.42 OUE REIT 0.48

Distribution Yields Overview

- TTM Distribution Yield decreased slightly to 5.99%. (Weighted Average decreased to 6.08%)

- Decreased from 6.27% in May 2025. (Weighted Average was 6.17%)

- 19 of 37 Singapore REITs have ttm distribution yields of above 7%.

- Highest Distribution Yield REITs (ttm)

IREIT Global 9.69 Sasseur REIT 9.50 United Hampshire REIT 9.23 Stoneweg European REIT 9.18 ESR REIT 9.17 Elite UK REIT 8.70 Reminder that these yield numbers are based on current prices.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

- A High Yield should not be the sole ratio to look for when choosing a REIT to invest in.

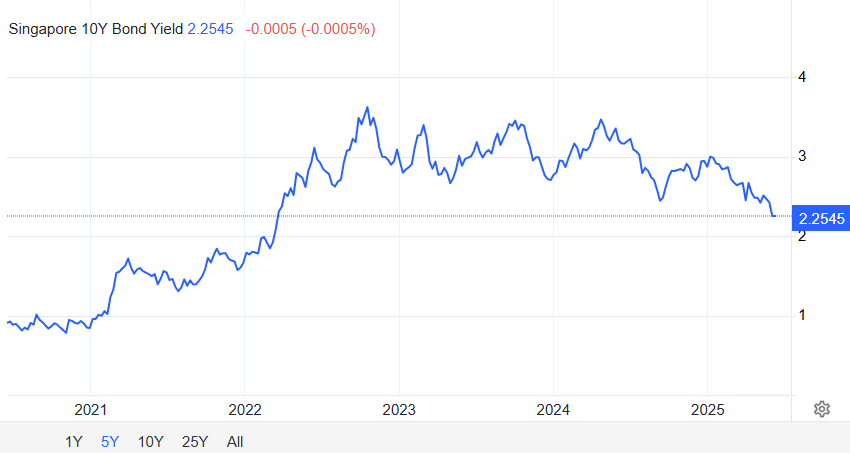

- Yield Spread tightened slightly to 3.91%. (Weighted Average tightened slightly to 3.74%)

- Tightened from 3.93% in May 2025. (Weighted Average was 3.79%)

- From May 2024 onwards, all my yield spread measurements are now in relation to SG Gov Bond Yields, no longer a mix with US Gov Bond Yields.

Gearing Ratios Overview

- Gearing Ratio increased to 39.94%. (Weighted Average: 38.35%)

- Increased from 39.80% in May 2025. (Weighted Average: 38.27%)

- Gearing Ratios are updated quarterly. All values are based on the most recent Q4 2024 updates.

- S-REITs Gearing Ratio has been on a steady uptrend. It was 35.55% in Q4 2019.

- Highest Gearing Ratio REITs

Manulife US REIT 59.4 EC World REIT 56.8 Prime US REIT 46.8 Lippo Malls Indonesia Retail Trust 44.2 Keppel Pacific Oak US REIT 43.7 Suntec REIT 43.4 MUST and EC World REIT’s gearing ratio has exceeded MAS’s gearing limit of 50%. However, the aggregate leverage limit is not considered to be breached if exceeding the limit is due to circumstances beyond the control of the REIT Manager.

Market Capitalisation Overview

- Total Singapore REIT Market Capitalisation decreased by 2.01% to S$86.45 Billion.

- Decreased from S$88.23 Billion in May 2025.

- This decrease can be attributed one-time, due to the delisting of Paragon REIT.

- Biggest Market Capitalisation REITs (S$m):

Capitaland Integrated Commercial Trust 15545.74 Capitaland Ascendas REIT 11484.00 Mapletree Pan Asia Commercial Trust 6316.68 Mapletree Logistics Tr 5675.04 Mapletree Industrial Tr 5587.96 Keppel DC REIT 5036.52

- Smallest Market Capitalisation REITs (S$m):

Lippo Malls Indonesia Retail Trust 76.97 Manulife US REIT 110.10 Acrophyte Hospitality Trust 174.03 Elite UK REIT 196.09 Prime US REIT 196.20 Keppel Pacific Oak US REIT 198.45

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you want to know more about investing in REITs, scroll down for more information on the REITs courses.

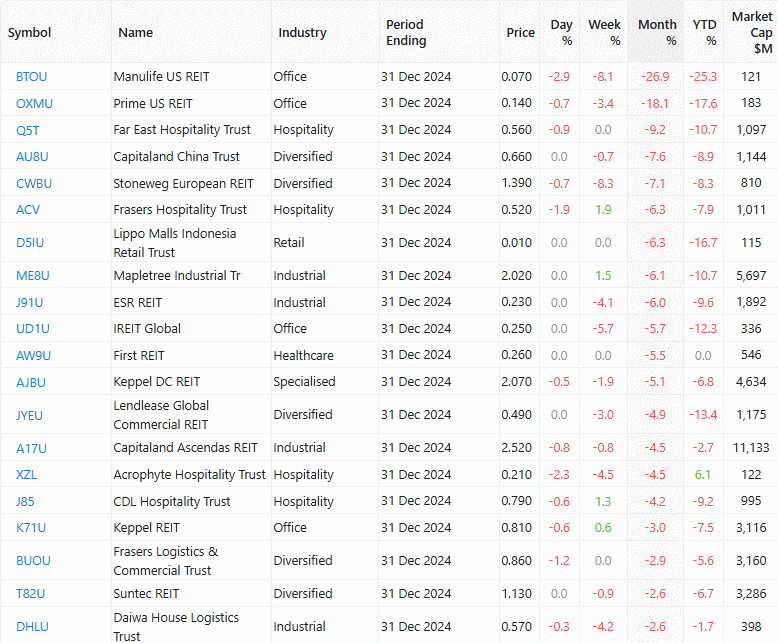

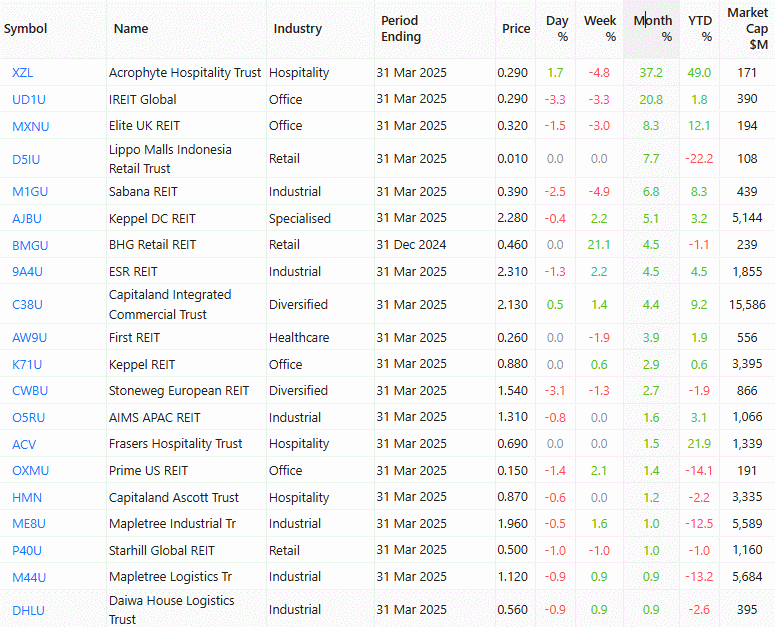

Top 10 Best/Worst Performers of May 2025

Refer to the Detailed 2024 S-REITs Performance Here.

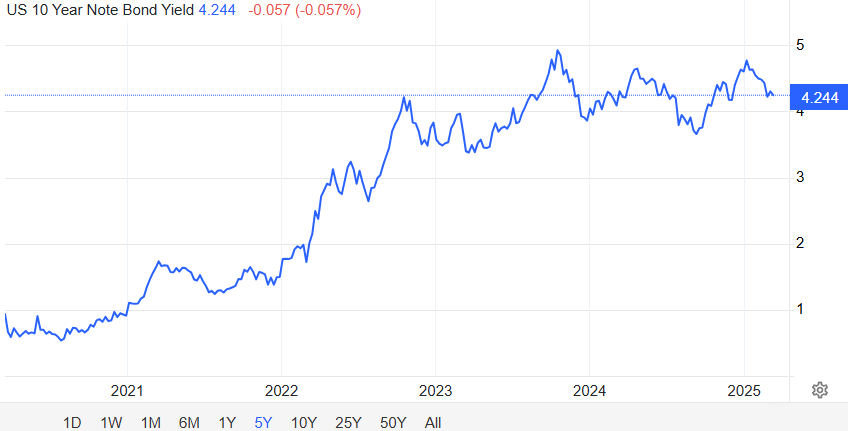

SG 10 Year Government Bond Yield

- SG 10 Year: 2.25% (decreased from 2.51%)

Summary

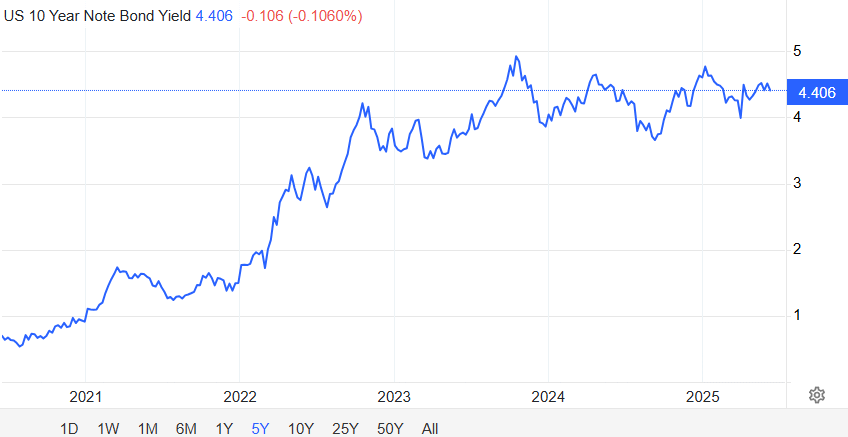

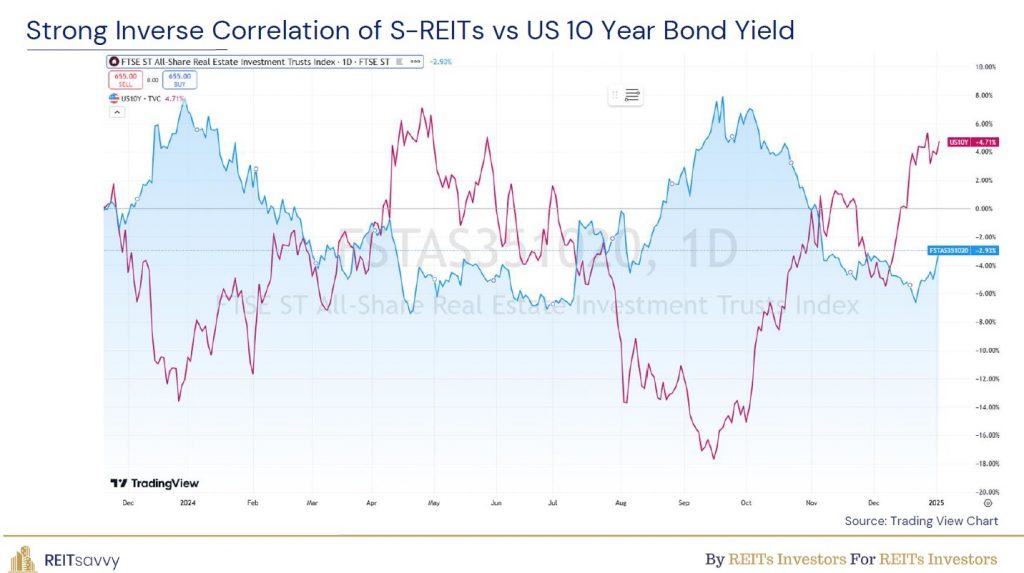

Singapore REITs sector is within a range between 620 and 660. The US 10Y Risk Free Rate has decreased to 4.41%, while the SG 10Y Risk Free Rate decreased by 0.26%. However, average yield decreased due to the slight increase in the index, explaining the slight tightening of the Yield Spread w.r.t to the SG Risk Free Rate.

Singapore REITs sector has very strong inversed correlation with US 10Y Risk Free Rate. For S-REIT to come back to live again, we need the US 10 year risk free rate to come down otherwise the performance of Singapore REIT index will continue to be muted.

US 10 Year Risk Free Rate

Fundamentally, the S-REIT sector is trading at a 24% discount (5% if using weighted average) to its fair value, with an average trailing twelve-month (TTM) yield of 6.03%. This is very undervalued and at levels only seen previously in the March 2020 COVID crash.

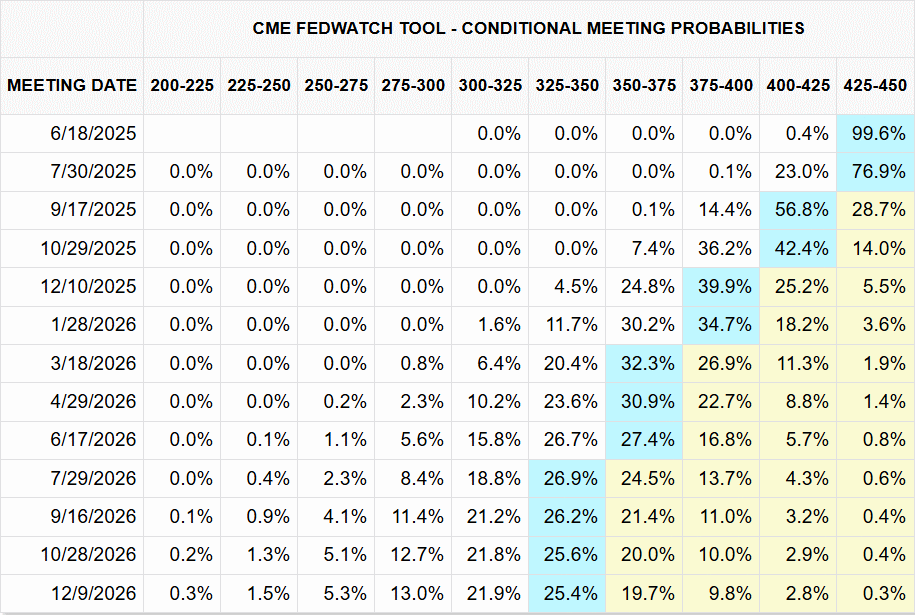

According to the current Fed Fund Rate projections from the CME Group, the market expects a 25 basis point cut by Q3 2025. The cut in interest rate will help to boost the DPU of the REITs which have shorter debt maturity profile and higher percentage of floating rate. However, the impact will only be reflected in the financial statement probably in Q3 or Q4 2025.

Kenny Loh is a distinguished Wealth Advisory Director with a specialization in holistic investment planning and estate management. He excels in assisting clients to grow their investment capital and establish passive income streams for retirement. Kenny also facilitates tax-efficient portfolio transfers to beneficiaries, ensuring tax-efficient capital appreciation through risk mitigation approaches and optimized wealth transfer through strategic asset structuring.

In addition to his advisory role, Kenny is an esteemed SGX Academy trainer specializing in S-REIT investing and regularly shares his insights on MoneyFM 89.3. He holds the titles of Certified Estate & Legacy Planning Consultant and CERTIFIED FINANCIAL PLANNER (CFP).

With over a decade of experience in holistic estate planning, Kenny employs a unique “3-in-1 Will, LPA, and Standby Trust” solution to address clients’ social considerations, legal obligations, emotional needs, and family harmony. He holds double master’s degrees in Business Administration and Electrical Engineering, and is an Associate Estate Planning Practitioner (AEPP), a designation jointly awarded by The Society of Will Writers & Estate Planning Practitioners (SWWEPP) of the United Kingdom and Estate Planning Practitioner Limited (EPPL), the accreditation body for Asia.

You can join his Telegram channel #REITirement – SREIT Singapore REIT Market Update and Retirement related news. https://t.me/REITirement

US 10 Year Risk Free Rate

US 10 Year Risk Free Rate