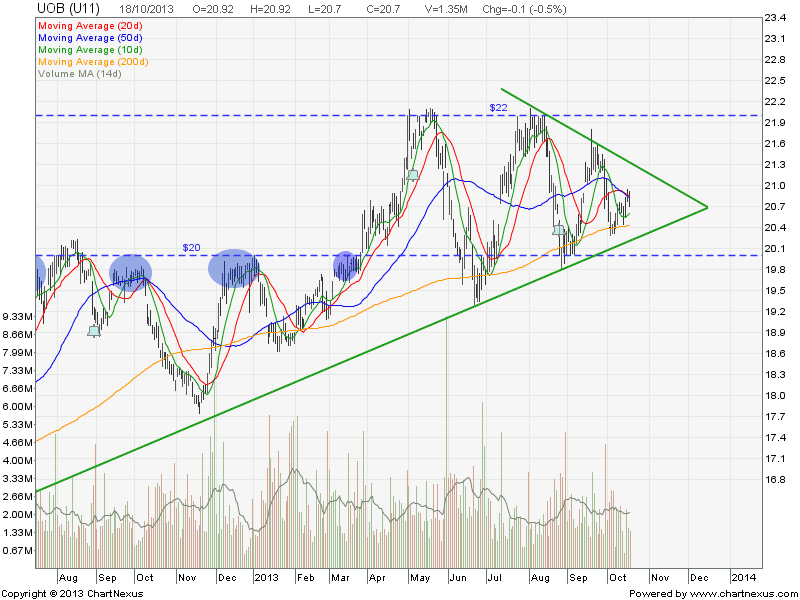

UOB Bank is currently consolidating in a Symmetrical Triangle. Nothing to trade at the moment.

Original Post by Marubozu @ My Stocks Investing Journey.

Key Statistics for UOB

| Current P/E Ratio (ttm) | 11.5966 |

|---|---|

| Estimated P/E(12/2013) | 11.7480 |

| Relative P/E vs. FSSTI | 0.8858 |

| Earnings Per Share (SGD) (ttm) | 1.7850 |

| Est. EPS (SGD) (12/2013) | 1.7620 |

| Est. PEG Ratio | 2.2305 |

| Market Cap (M SGD) | 32,607.34 |

| Shares Outstanding (M) | 1,575.23 |

| 30 Day Average Volume | 1,992,752 |

| Price/Book (mrq) | 1.3789 |

| Price/Sale (ttm) | 3.7875 |

| Dividend Indicated Gross Yield | 2.90% |

| Cash Dividend (SGD) | 0.2000 |

| Dividend Ex-Date | 08/26/2013 |

| 5 Year Dividend Growth | 1.49% |

| Next Earnings Announcement | 11/05/2013 |