When is “Fixed” Not a Fixed Rate

When mortgage interest rates are rising, home owners are tempted to switch to Fixed rates.

Home owners tend to baulk at Fixed rate because it is more expensive. They want to take a floating rate package that is cheaper than a fixed rate package and then hope that floating rate will not rise.

When the mortgage interest rate upward trend has been established, the fixed rates would have moved even higher.

Home owners on floating rate packages then start to receive letters from banks informing them of the new increased rates. Many will be shocked and upset.

Floating or Fixed Home Loan rates?

Home owners and property buyers are torn between taking advantage of the cheaper floating rates or securing the stability of the more expensive Fixed rates.

This is similar to choosing an Exciting and fun (guy/girl) versus the predictable, stable but boring (guy/girl).

Many want to have fun and yet want predictability that rates will not rise.

Types of Floating Home Loan Rates available

There are many types of floating rate structures. They are: –

- Pegged to bank’s internal board rate. (i.e. Board Rate – Discount)

- Pegged to Sibor Rate. (i.e. Sibor + 1%)

- Pegged to SOR Rate. (i.e. SOR + 1%)

- Pegged to Fixed Home Rate (FHR)

- FHR12 – based on 12 months fixed deposit rates (i.e. FHR12 + 1%)

- FHR18 – based on 18 months fixed deposit rates (i.e. FHR18 + 1%)

- Pegged to Fixed Deposit Mortgage Rate (FDMR)

- FDMR36 – based on 36 months fixed deposit rates (i.e. FDMR36 + 1%)

- Pegged to Cost of Funds. (i.e. COF + 1%)

It is almost certain many more types of floating rate packages will be created in the future.

Fixed Rate Packages

“Find me a home loan that is fixed. I want a fixed rate for the entire tenure of my loan.” Some property buyers will tell us.

We will ask, “Are you willing to pay 5% interest rates?” and we will hear a shocked property buyer say, “What?”

There are currently no banks that offer a perpetual fixed rate for the entire loan tenure.

Just as that stable, predictable (boy/girl) cannot be as fun and spontaneous as your less-stable but fun (boy/girl). You want the stable, predictable (boy/girl) that is of “marriage” material, but yet want him/her to be fun and stay fun for the rest of his/her life.

Now, how unreasonable is that wish?

Fixed rate packages are typically fixed for between 1 to 5 years of the loan tenure. After the Fixed rate period ends, the subsequent years revert back to floating rates.

Why are Fixed Rates more Expensive than Floating rates?

Fixed rate package are almost always more expensive than floating rate packages.

As banks are unsure of the future interest rate environment, they will need to enter into hedging contracts, which incur a fee, to guarantee you the future rates. It’s like buying an insurance policy against interest rates going crazy.

For example, if the current borrowing cost of the bank is 1.5%. The bank may then decide to create a fixed rate package that is 2% fixed for 3 years.

However, the bank does not know what will happen in year 2 and year 3. What if the cost of borrowing for the bank rises to 3% for year 2 and 3?

This would mean that the bank’s profit would be: –

- Year 1 = 2% – 1.5% (cost of funds) = 0.5%

- Year 2 = 2% – 3% (cost of funds) = -1%

- Year 3 = 2% – 3% (cost of funds) = -1%

- Total over 3 years = -1.5%

A bank is unlikely to create a product that has a risk of losing money. So banks typically pay a fee to go into a hedging contract.

The bank will buy a hedging product that would guarantee them 2% for year 2 and year 3 and maybe pay a fee of maybe 0.3% to do so. It is similar to insurance.

Hence the bank’s profit would be: –

- Year 1 = 2% – 1.5% (cost of funds) = 0.5%

- Year 2 = 2% – 1.5% Cost of funds + 0.3% Hedging cost = 0.2%

- Year 3 = 2% – 1.5% Cost of funds + 0.3% Hedging cost = 0.2%

- Total (over 3 years) = 0.9%

A guaranteed profit for each mortgage loan product is probably more important for the bank than the potential to make more money, but also open to the possibility to lose money.

When is a FIXED not a FIXED Rate?

Due to consumer’s fixation on cheap rates, DBS and OCBC have come up with innovative products that bears the word “Fixed”. This is confusing for the consumers, many consumers thought they had gotten a fixed rate package.

DBS calls it Fixed Home Rate (FHR) packages, while OCBC calls it Fixed Deposit Mortgage Rates (FDMR).

DBS’ Fixed Home Rate is pegged to the 12 months Fixed deposit rate and later versions of the FHR is pegged to 18 months Fixed deposit rate.

OCBC’ Fixed Deposit Mortgage Rate is pegged to their 36 months Fixed deposit rates.

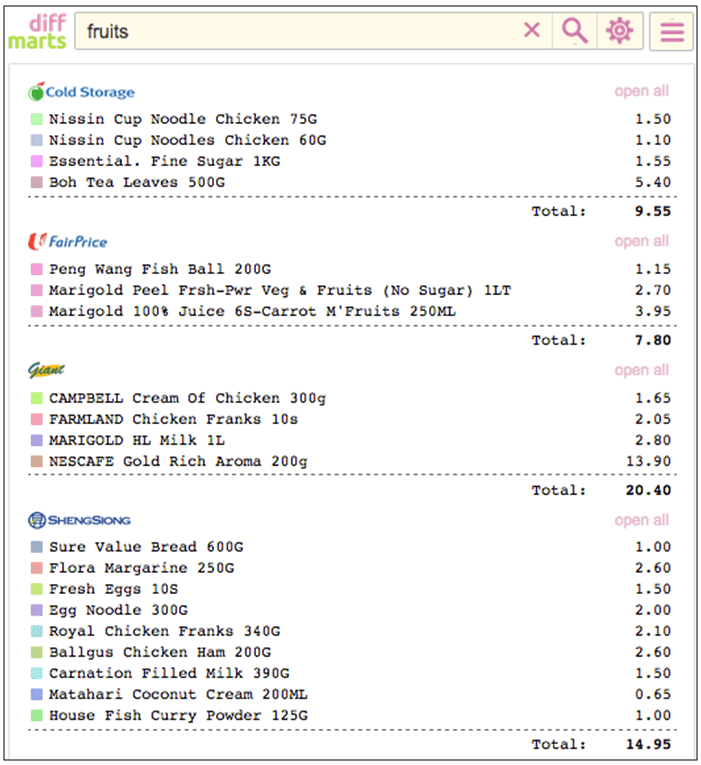

FDMR example with OCBC (illustrative purposes only): –

36 months Fixed Deposit Mortgage Rate (FDMR36) for deposit sizes $5,000 to $20,000 = 0.65%

- FDMR36 + 0.98% = 1.63%

FHR example with DBS (illustrative purposes only): –

18 months Fixed Deposit Rate – “Fixed Home Rate” (FHR18) = 0.6%.

- FHR18 + 1.25% = 1.85%.

Many people are confused. They tell us they got a 36 months fixed rate mortgage very cheaply. Upon closer investigation and to their horror, it was not a Fixed Rate for 36 months, it’s a Floating Rate package pegged to the 36 months fixed deposit rate.

Is Fixed Deposit Mortgage Rate (FDMR) or Fixed Home Rate (FHR) safe?

Depositors in Singapore are very loyal and risk-averse. Many have the mistaken belief that Singapore banks are safer than foreign banks in Singapore.

In Singapore, depositor’s funds are insured up to $50,000, what this means is, if you are depositing only $5,000 to $50,000, even if that foreign bank goes bankrupt, you will not lose your deposit. (Reference 1)

All Qualifying Full Banks (QFB) and Finance companies are members of the Deposit Insurance scheme (DI scheme), except those exempted by the Monetary Authority of Singapore. (Reference)

A list of banks and financial institutions covered under the deposit insurance scheme are found in Reference 2.

Maybank’s website (Reference 3) indicates 2% for their fixed deposit while CIMB (Reference 4) is paying 1.95% ($20,000 and above) for their 24 months fixed deposit (13 Feb 2016), while OCBC’s 36 month fixed deposit rate ($5,000 to $20,000) pays only 0.65%.

In short, depositors in OCBC or DBS are being underpaid by more than 1% in fixed deposit rates due largely to faith.

The interest rate difference indicates an inefficient market.

When the depositors finally realized that there is no difference depositing with DBS, OCBC or Maybank or CIMB, local banks will have to raise deposit rates or lose their Fixed Deposit funds to other banks who are paying much more interests to depositors.

When that happens, people who are on FHR or Fixed Deposit Mortgage Rate (FDMR) home loans will feel the pain when they receive letters from OCBC.

Perhaps, a surer bet will be to go directly for a Fixed Rate package if the difference is not very much more expensive.

REFERENCES

- Singapore Deposit Insurance Corporation Ltd, https://www.sdic.org.sg

Excerpts:

“All full banks and finance companies in Singapore are required to be members of the Deposit Insurance Scheme.” “So a foreign bank which has a full-banking license would be included under the Deposit Insurance Scheme.”

“all insured deposits placed with that member, except for deposits under the CPF Investment Scheme and CPF Minimum Sum Scheme, are aggregated and insured up to S$50,000. If you are a sole proprietor, your personal eligible accounts will be aggregated with the eligible accounts of your sole proprietorship(s). Trust and client accounts held by non-bank depositors are insured up to S$50,000 per account, without aggregation.”

- List of banks covered under Singapore Deposit Insurance Corporate Ltd, https://www.sdic.org.sg/di_scheme_members.php

Banks

- Australia And New Zealand Banking Group Limited

- Bangkok Bank Public Company Limited

- Bank of America, National Association

- Bank of China Limited

- Bank of East Asia Ltd

- Bank of India

- Bank of Singapore Limited

- Bank of Tokyo-Mitsubishi UFJ, Ltd

- BNP Paribas

- CIMB Bank Berhad

- Citibank NA

- Citibank Singapore Limited

- Credit Agricole Corporate and Investment Bank

- DBS Bank Ltd

- Far Eastern Bank Ltd

- HL Bank

- Hongkong and Shanghai Banking Corporation Limited

- Industrial and Commercial Bank of China Limited

- ICICI bank Limited

- Indian Bank

- Indian Overseas Bank

- JPMorgan Chas Bank, NA

- Malayan Banking BHD

- Mizuho Bank, Ltd

- Oversea-Chinese Banking Corpn Ltd

- PT Bank Negara Indonesia (Persoro) TBK

- RHB Bank Berhad

- Standard Chartered Bank

- Standard Chartered Bank (Singapore) Limited

- State Bank of India

- Sumitomo Mitsui Banking Corporation

- UCO Bank

- United Overseas Bank Ltd

Finance Companies

- Hong Leong Finance Limited

- Sing Investments & Finance Limited

- Singapura Finance Ltd

- Maybank, Singapore Dollar Time Deposit, http://info.maybank2u.com.sg/personal/deposits-banking/time-deposits/singapore-dollar.aspx?

- CIMB SGD Fixed Deposit Promotion, http://www.cimbbank.com.sg/en/personal/news-and-promotions/promotions/accounts/cimb-sgd-fixed-deposit-promotion.html

ABOUT THE AUTHOR: PAUL HO

Paul holds an a B.Eng(Hons) Aberdeen University (UK) and a Masters of Business Administration (MBA) from a Macquarie Graduate School of Business (MGSM) Australia. He also serves as current President of Macquarie University Alumni Association of Singapore and Hon. Secretary of British Alumni. He is founder of www.iCompareLoan.com, his articles have been syndicated/featured on STproperty, iProperty, BTInvest, TheEdgeProperty, Propwise, Propquest, Yahoo and TheOnlineCitizen amongst many other sites. He has also given speeches, guest speeches, trainings and/or seminars at NUH Lunch time talk, iProperty, David Poh and Associates, Getty Goh’s Ascendant Asset property, NTU (Guest Lecture on SEO), Panel discussions at GPS Alliance, C&H, Skillup just to name a few. He is passionate about helping people enhance their wealth and in making money work harder for them.