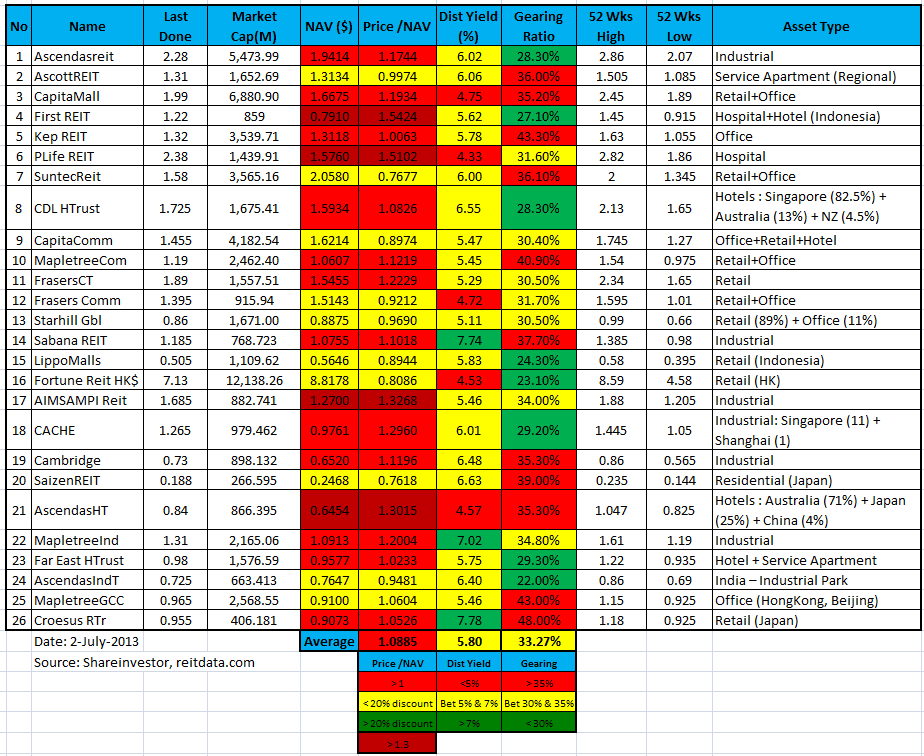

Singapore REITs Comparison Table for Dividend Investing as Passive Income – July 2013

Technically Singapore REITs enter bear market because FTSE S-REIT Index has dropped below 200D SMA. Current FTSE S-REIT Index is 761.62 and trading in a down trend channel.

Compare to last month SREIT comparison table:

- Price/NAV decreases from 1.12 to 1.09.

- Dividend Yield increases from 5.6% to 5.8%

- Gearing Ratio remain the same as 33.27%.

Doing Fundamental Analysis of Singapore REIT is relatively easier than stock. If you are interested to learn how to do research on Singapore REIT and also time the entry / exit by learning the simple Trend Analysis, you may want to check out my next public tutorial “How to pick Singapore REIT for Dividend Investing” .