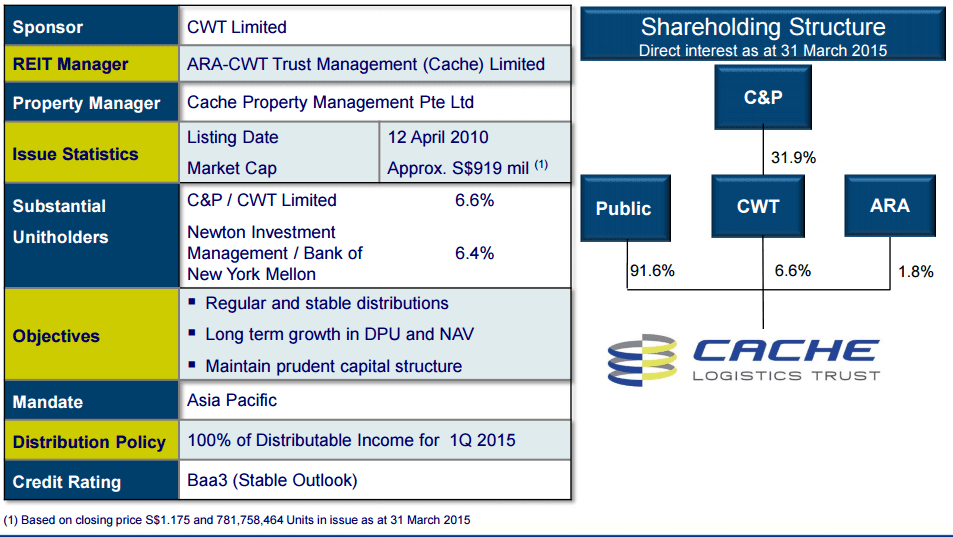

Cache Logistics Trust Fundamental and Technical Analysis

CACHE Logistics Trust Fundamental Analysis base on April 22, 2015 Quarterly Earning Presentation.

- Last Done Price = $1.155

- Market Cap = $904 M

- NAV = $0.98

- Price / NAV = 1.18 (18% Premium)

- Price / NAV (High) = 1.52

- Price / NAV (Low) = 1.09

- Distribution Yield = 7.5%

- Gearing Ratio = 36.6%

- WADB = 3.8 Years

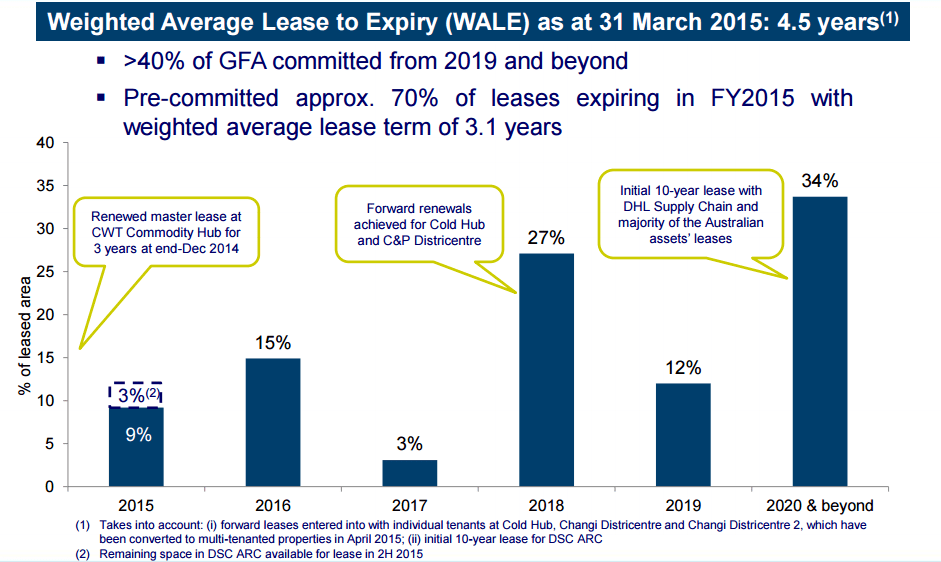

- WALE = 9.7 Years

- Occupancy Rate = 99.1%

CACHE Logistics Trust Technical Analysis

CACHE Logistics Trust is currently consolidating within a Rectangle chart pattern. Take note that the average trading volume has increased for the past 6 months. We will only know whether this is an Accumulation or Distribution after the breakout from the Rectangle.

Sign up and Learn how to Invest in Singapore REIT here.

Singapore REIT Course Detail here. https://mystocksinvesting.com/course/singapore-reits-investing/