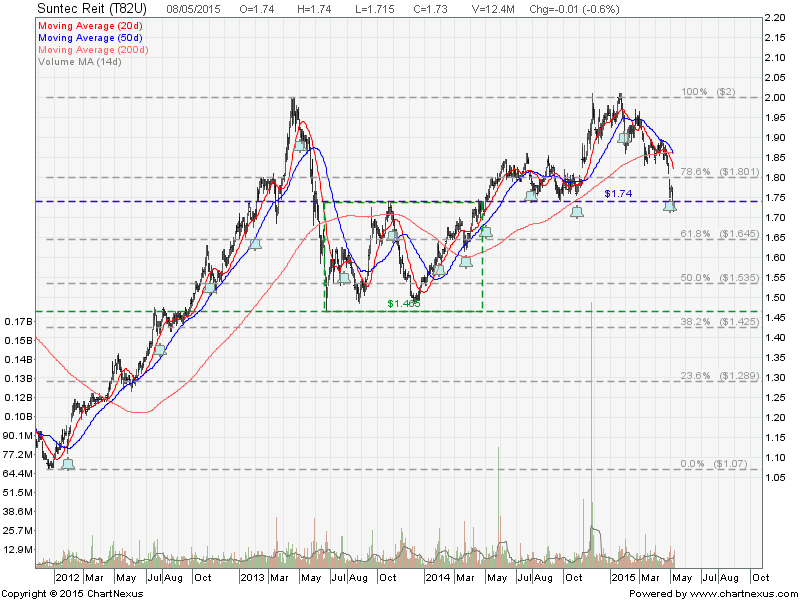

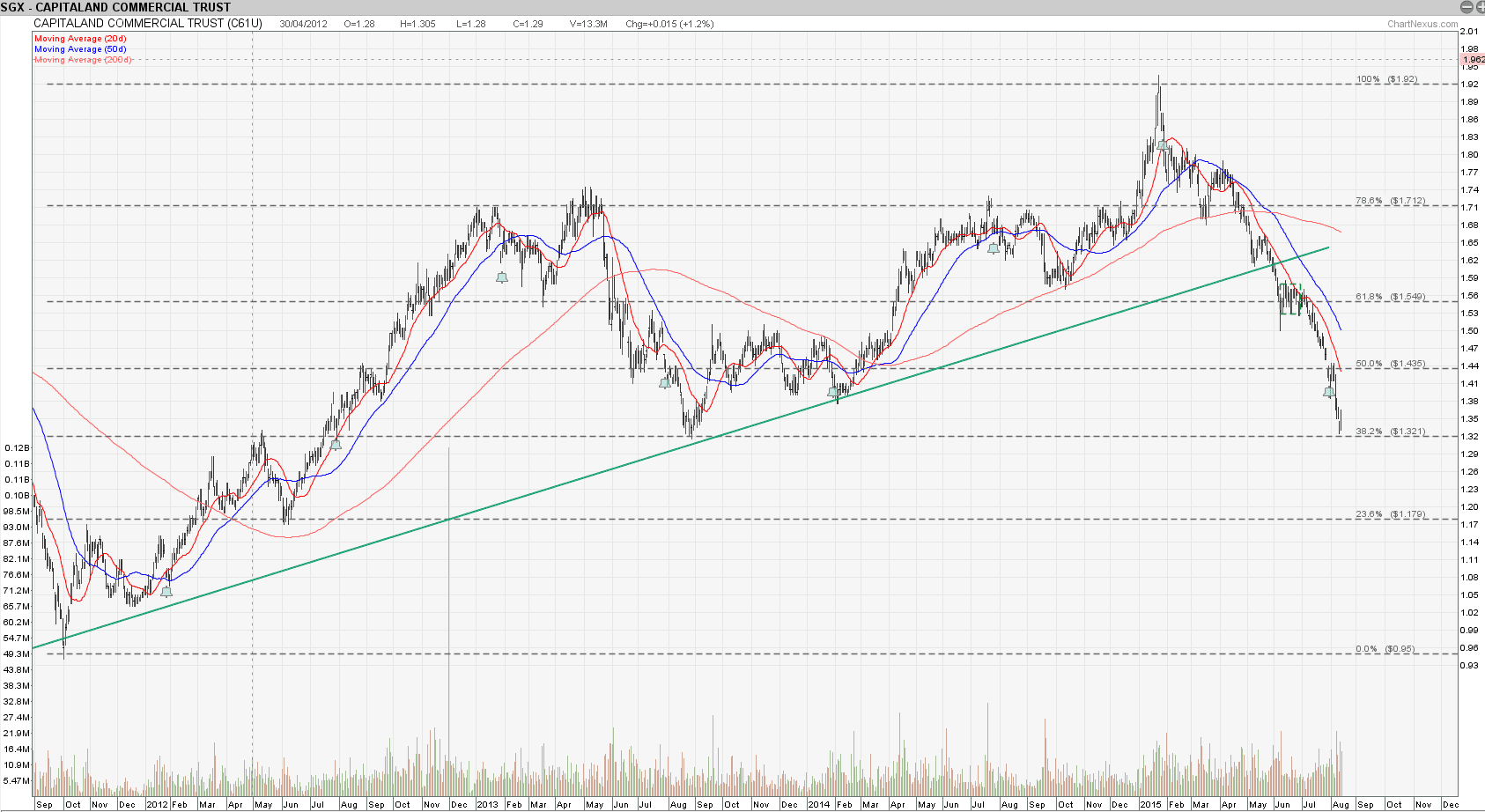

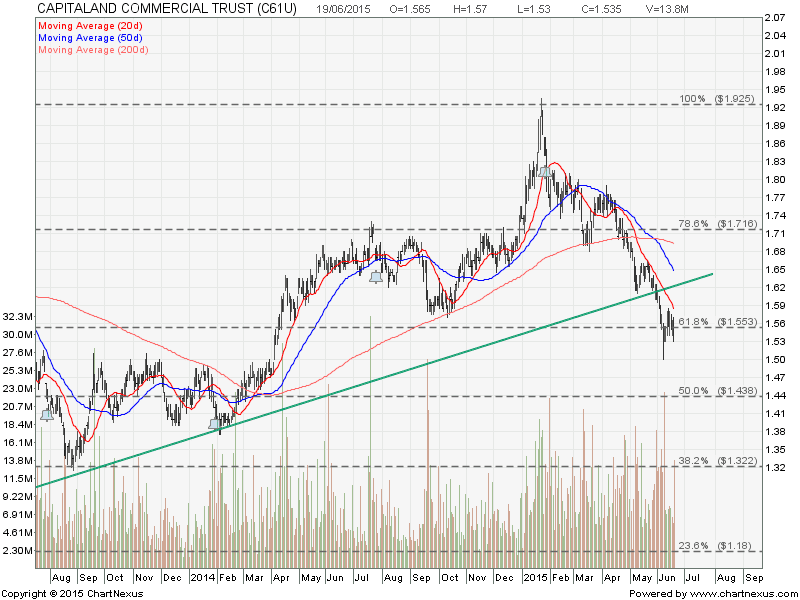

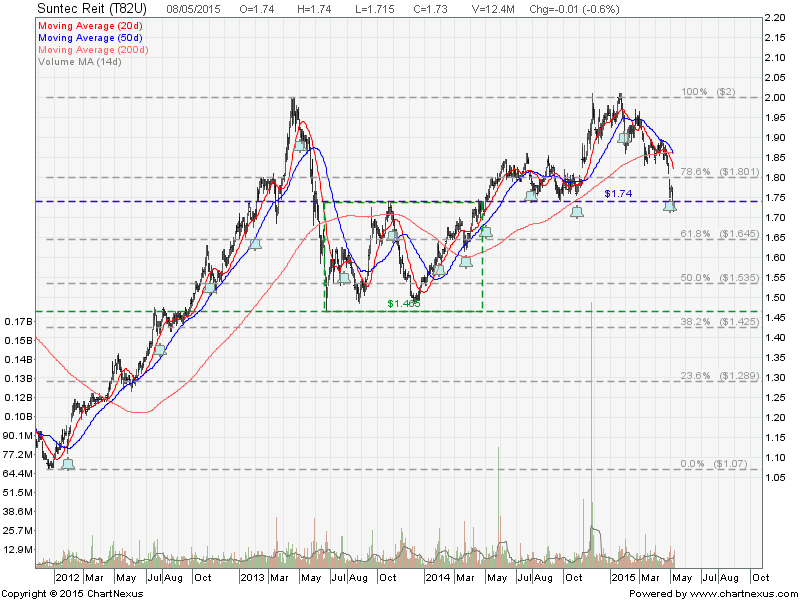

As we are getting nearer to June where US Fed may increase the interest rate, we have to keep a close eye to what is going on for Singapore REITs. Quite a number of Singapore REITs sold off recently as seems from the table below. Top 3 biggest losers are Suntec REIT, Mapletree Commercial Trust and Capitaland Commercial Trust. All these 3 REITs are Office related. Is it a coincidence or some big guys are offloading quietly?

Compare to previous Singapore REITs Fundamental Analysis Comparison Table here.

Technically Suntec REIT is already in bearish territory and starting a down trend. Mapletree Commercial Trust and Capitaland Commercial Trust are just sitting on the uptrend support. If these up trend support is broken, a bad sign for Office REIT. Disregard on what other analysts and newspapers say, the stock chart and share price will tell you the true story. Is this the opportunity to buy on dip or buy for distribution yield of Singapore REIT for long term investing? you have to know what you are doing and make sure you understand the risks.