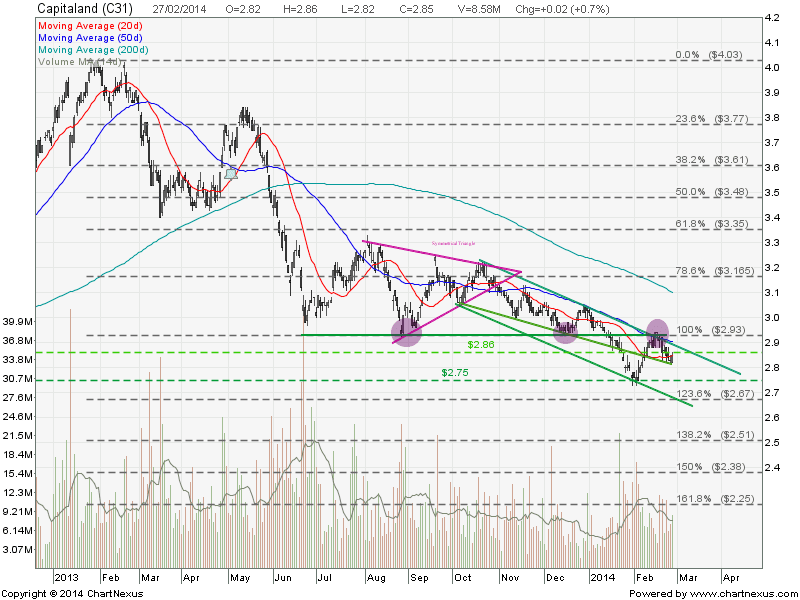

Capitaland: Testing Down Trend Channel Resistance

Capitaland is currently testing the down trend channel resistance after the recent rebound. If Capitaland fails to break this resistance, there will be more selling pressure ahead. If this resistance is broken, the next immediate resistance is $2.93 (support turned resistance) followed by $3.00 (200D SMA and psychological resistance). Current chart pattern favors the bear because it is very tough for the bull to break all these tough resistances.

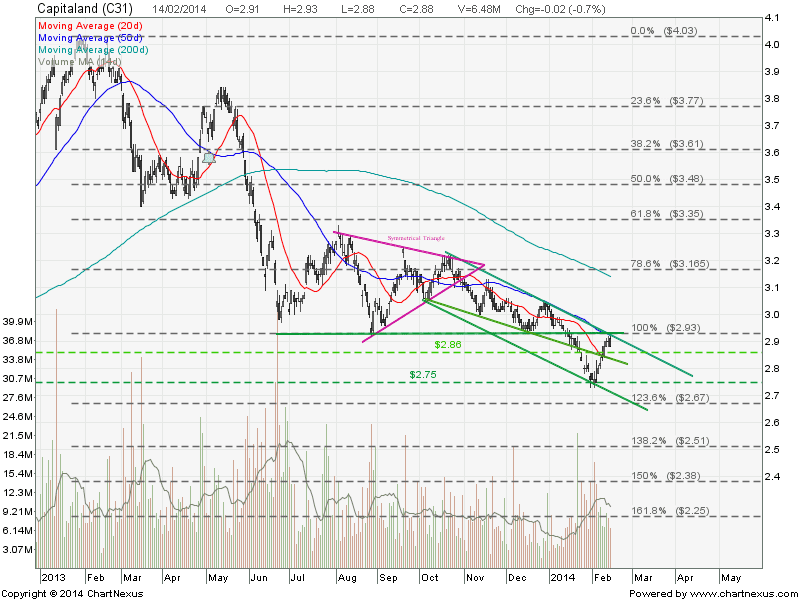

See previous post of Capitaland stock chart here.

| Current P/E Ratio (ttm) | 14.1000 |

|---|---|

| Estimated P/E(12/2014) | 17.7358 |

| Relative P/E vs. FSSTI | 1.0206 |

| Earnings Per Share (SGD) (ttm) | 0.2000 |

| Est. EPS (SGD) (12/2014) | 0.1590 |

| Est. PEG Ratio | 0.6485 |

| Market Cap (M SGD) | 12,007.65 |

| Shares Outstanding (M) | 4,258.03 |

| 30 Day Average Volume | 8,291,600 |

| Price/Book (mrq) | 0.7463 |

| Price/Sale (ttm) | 3.0176 |

| Dividend Indicated Gross Yield | 2.84% |

| Cash Dividend (SGD) | 0.0800 |

| Dividend Ex-Date | 05/02/2014 |

| 5 Year Dividend Growth | -10.84% |

| Next Earnings Announcement | 04/25/2014 |