COSCO PK Yangzijiang: Which one is Better?

Comparison from Fundamental Perspective

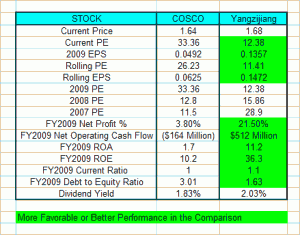

- COSCO is clearly overvalue from current PE and rolling PE perspective. Current COSCO stock price is way too expensive compares to Yangzijiang and compares to COSCO’s PE in FY2007 and FY2008.

- Yangzijiang current PE of 12.38 and rolling PE of 11.41 are still below the past 3 years average PE.

- In terms of Net profit margin, Net Operating Cash Flow, ROA and ROE, Current Ratio, Debt to Equity Ratio, Yangzijiang is a much better performer compares to COSCO.

Technical Anaylsis

- Both COSCO and Yangzijiang stock charts show an uptrend and the stock prices are above 20D, 50D and 200D MA.

- However, COSCO looks a bit exhausted where the stock is not able to break $1.70 resistance on two occassions, and probably will be forming an ascending triangle.

In Summary

Yangzijiang is a better bet for these two shipbuilding stock base on fundamental and technical analysis. A pull back to the uptrend support level (between $1.5o to $1.55) is a good entry for medium to long term investment.