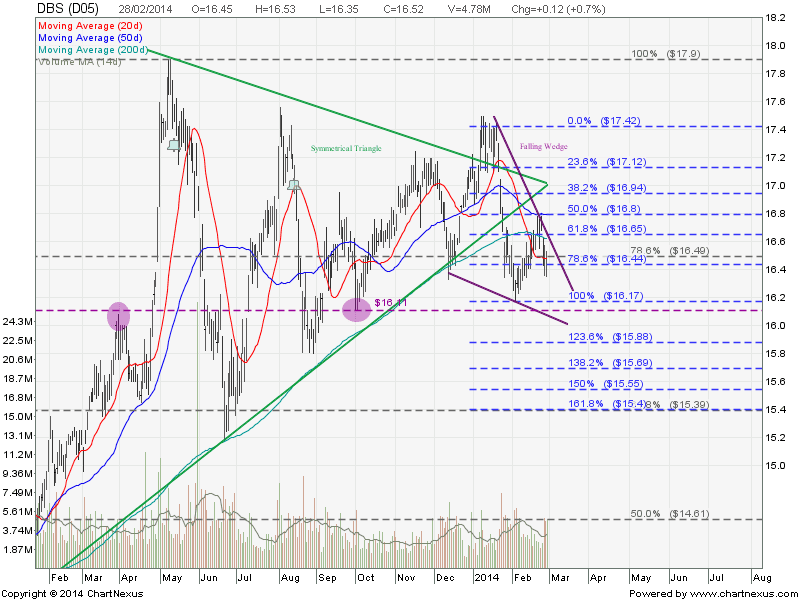

DBS Bank: Huge Down Side Risk!

DBS is currently trading within a Falling wedge and trading below the 200D SMA. DBS retraced back to 50% Fibonacci Retracement and continue the downward movement to the price target of $15.40 (short term) and $14.40 (medium term base on the breakout from Symmetrical Triangle). Base on current chart pattern and technical analysis, the down side risk is very huge for DBS Bank. Good trading opportunities for shorting but bad for investors who do not know how to hedge. Sit tight!

Original Post by Marubozu @ My Stocks Investing Journey.

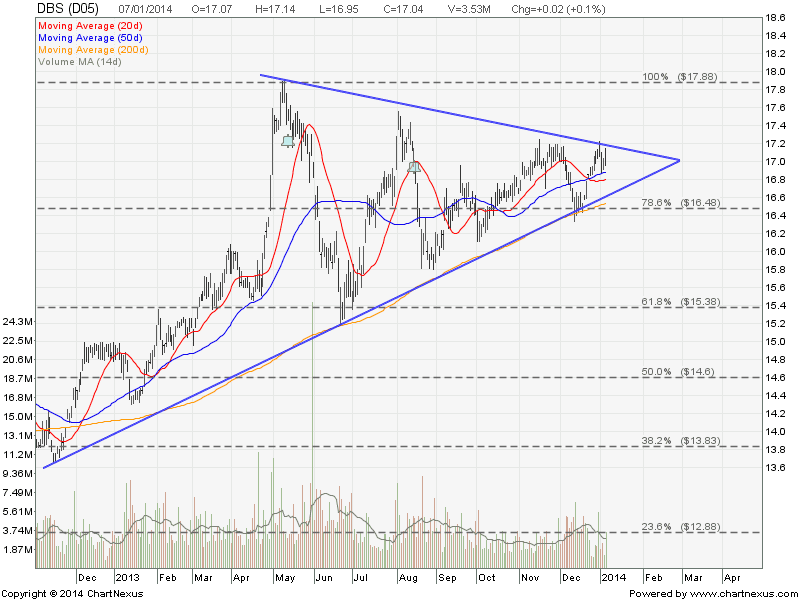

Join the Technical Analysis Workshop to learn how to derive the target price of the chart pattern of Symmetrical Triangle, Falling Wedge and using Fibonacci Retracement, to increase the probability of winning in your trade.