Far East Hospitality Trust: Under Value and High Distribution Yield – Good Buy?

Far East Hospitality Trust Aug/ Sept 2015

- Last Done Price = $0.64

- Market Cap = $1.1 B

- NAV = $0.9655

- Price / NAV = 0.66 (34% Discount)

- IPO Price = $0.93

- Distribution Yield (TTM) = 7.55%

- Gearing Ratio = 31.4%

- WADM = 3.0 Years

- Occupancy Rate (Hotel) = 84.5%

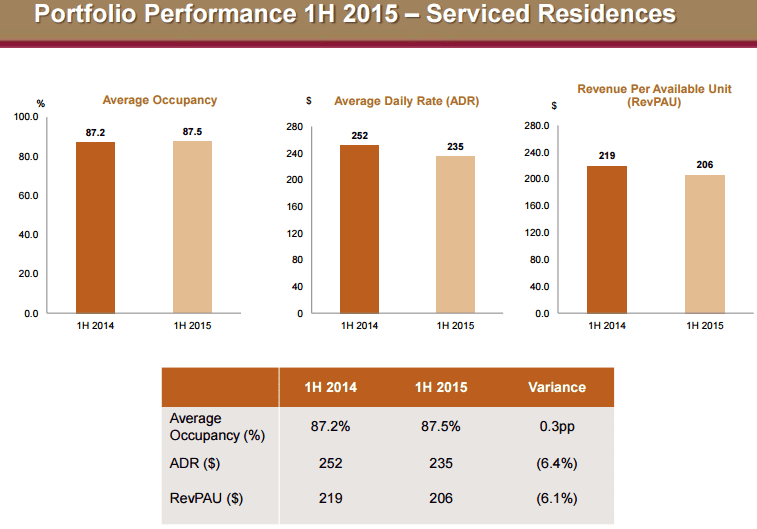

- Occupancy Rate (Service Residential) = 87.5%

- RevPAR (Hotel) = $144

- RevPAR (Service Residential) = $206

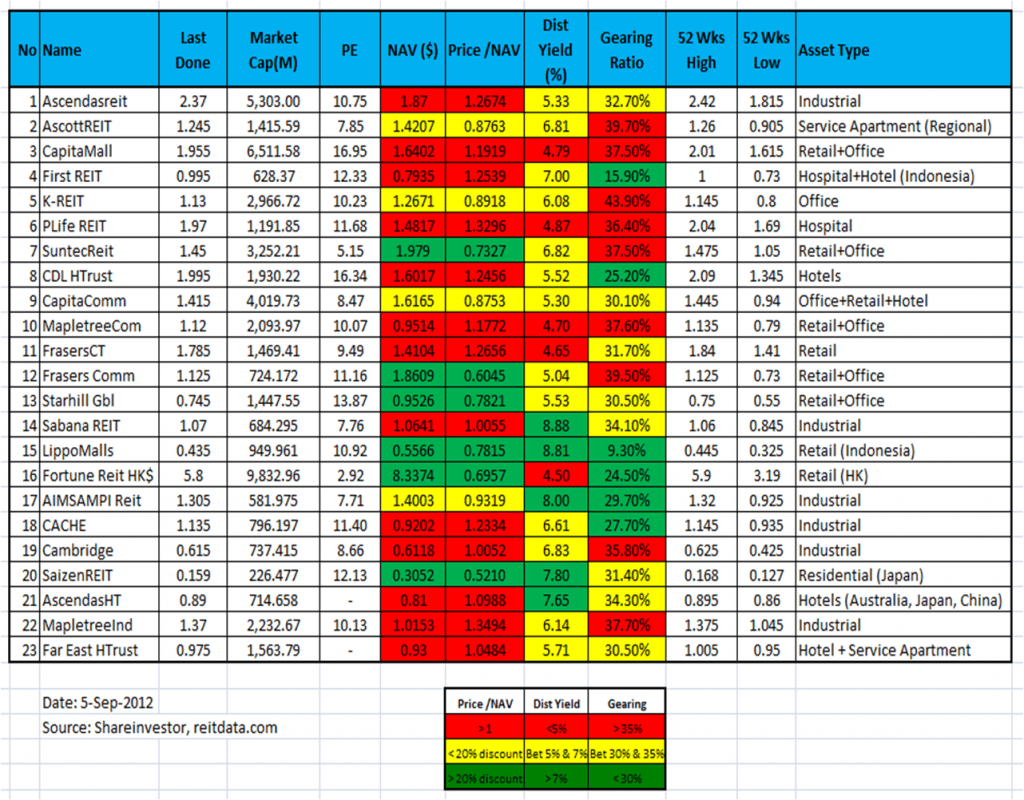

Singapore REITs Fundamental Analysis Comparison Table

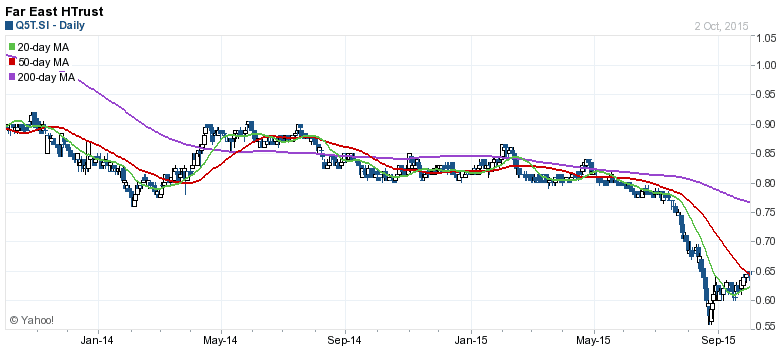

Far East Hospitality (FHT) Trust Technical Analysis & Stock Chart

Far East Hospitality Trust (FHT) is currently trading below 200D SMA and currently on short term rebound and facing the 20D SMA resistance. Medium term and long term trend remain down.

Although valuation and distribution yield of Far East Hospitality Trust looks very attractive but there are short term head winds. However I like Far East Hospitality’s fundamental and long term growth story. I will put this Far East Hospitality Trust into my watch list. I will wait for the right price and let the stock chart to tell me the entry price and entry time.

Check out Singapore REIT Course here on how to time the entry and analyse the fundamental and dividend sustainability of Singapore REIT. https://mystocksinvesting.com/course/singapore-reits-investing/