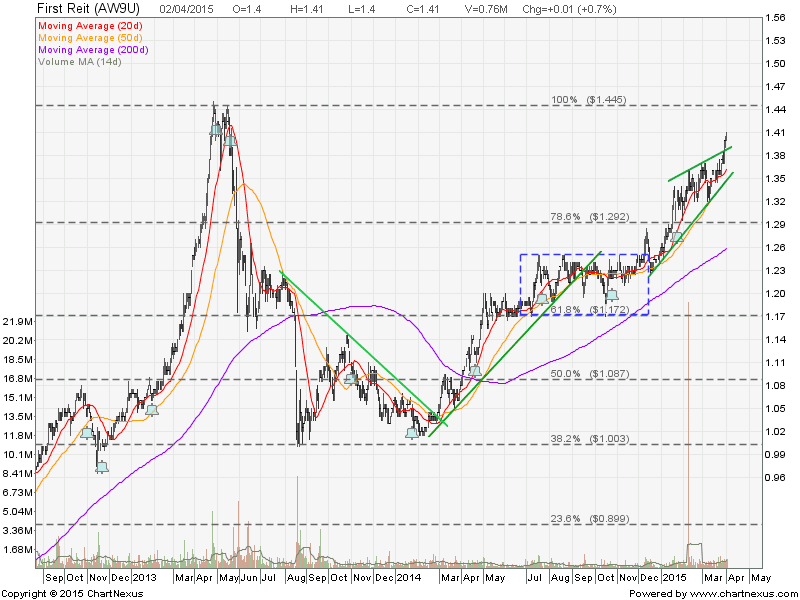

FIRST REIT: Watch the 200D SMA Support

First REIT is one of the very few REITs in Singapore still trading above 200D SMA support. Can First REIT escape the current REIT sector sell off? Watch the 200D SMA support closely. By the way, this Healthcare REIT has formed a “Lower Low, Lower High” down trend channel pattern.

See previous post on FIRST REIT here.