FIRST REIT: Under Watchlist

Fundamental Analysis of FIRST REIT:

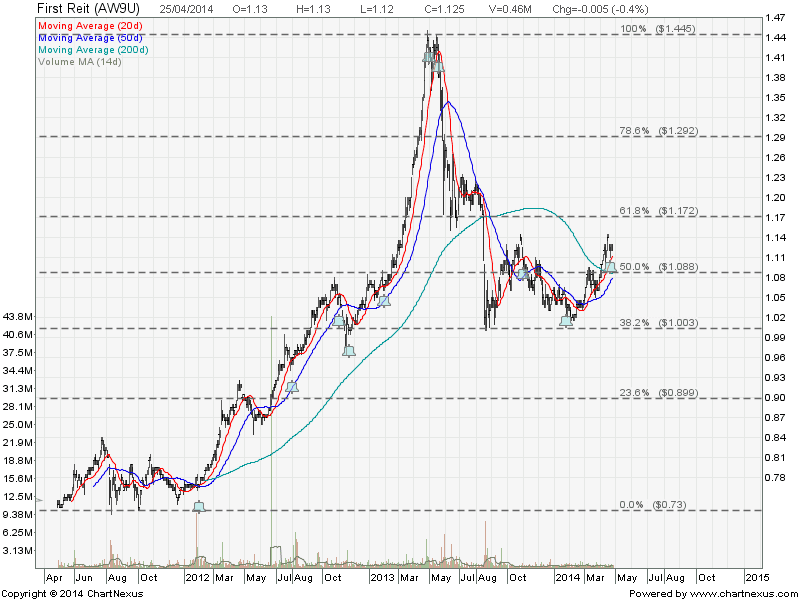

- Last Price = $1.125

- NAV = $0.965

- Price / NAV = 1.165

- Price / NAV (52 Weeks High) = 1.7074

- Price / NAV (52 Weeks Low) = 1.0579

- Distribution Yield = 7.173%

- Gearing Ratio = 32.3%

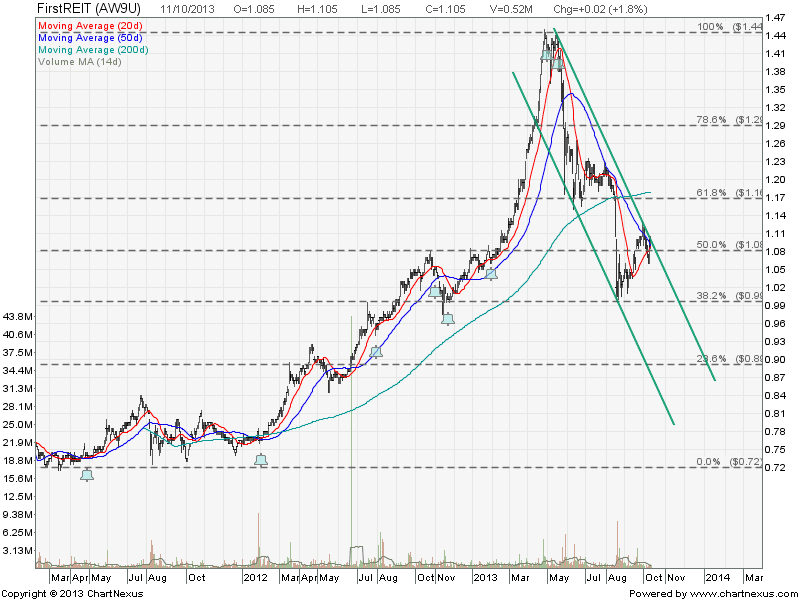

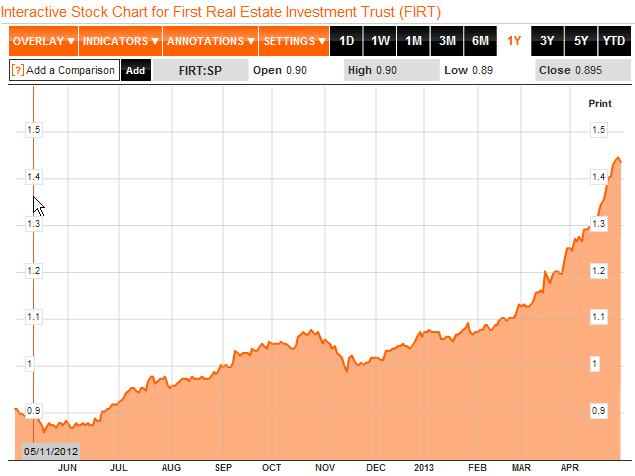

Frasers Centrepoint Trust may have bottomed up. As long as FIRST REIT stay above the 200D SMA support, there is a high probability this is the start of up trend. Watch out for the potential formation of Rectangle with resistance at $1.14 and support $1.00.

Compare with other Singapore REITs to find Good Value and Lower Risks Singapore REITs, in terms of distribution yield and gearing ratio at the current price.

If you want to invest in Singapore REIT to generate passive income but do not understand my analysis, you may want to check out my Singapore REIT Investing public workshop here. It is better and safer to invest in the knowledge first before throwing the money into stock market by making the wrong decision to invest in the wrong timing and choosing the REIT which do not suit your risk appetite.