Over the month of October, the FTSE ST Mid Cap Index outperformed both the Straits Times Index and FTSE ST Small Cap Index. The FTSE ST Mid Cap Index added 0.15% in October, taking the 2012 year-to-date gain to 25.88%. On a total return basis, to account of dividend distributions over the ten months, the FTSE ST Mid Cap Index gained 32.00%.

The FTSE ST Mid Cap index is made of 50 stocks listed on Singapore Exchange (SGX) and maintains a dividend yield 4.65%.

The top five performing stocks of the Mid Cap Index in October were as follows:

- OSIM International (O23) belongs to the Recreational Product Subsector and has a net market capitalisation of S$467 million. The stock gained 16.07% in October. OSIM International has gained 40.26% in the year-to-date, with dividends boosting the total return to 44.80%.

- Super Group (S10) belongs to the Food Product Subsector and has a net market capitalisation of S$1.02 billion. The stock gained 11.42% in October. Super Group has gained 95.44% in the year-to-date, with dividends boosting the total return to 101.13%.

- Suntec REIT (T82) has a net market capitalisation of S$3.58 billion. The REIT gained 8.08% in October. Suntec REIT has gained 46.98% in the year-to-date, with dividends boosting the total return to 57.88%. Note that Suntec REIT is the third largest constituent of the Mid Cap Index in terms of net market capitalisation.

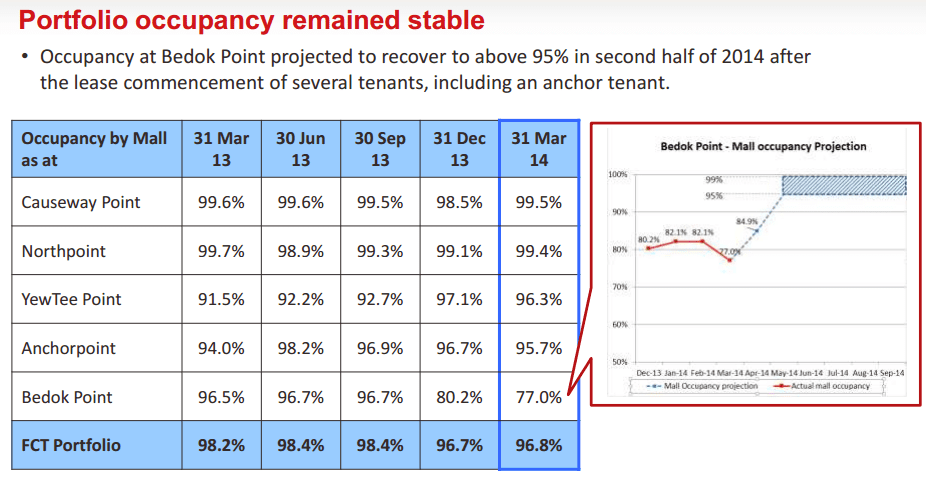

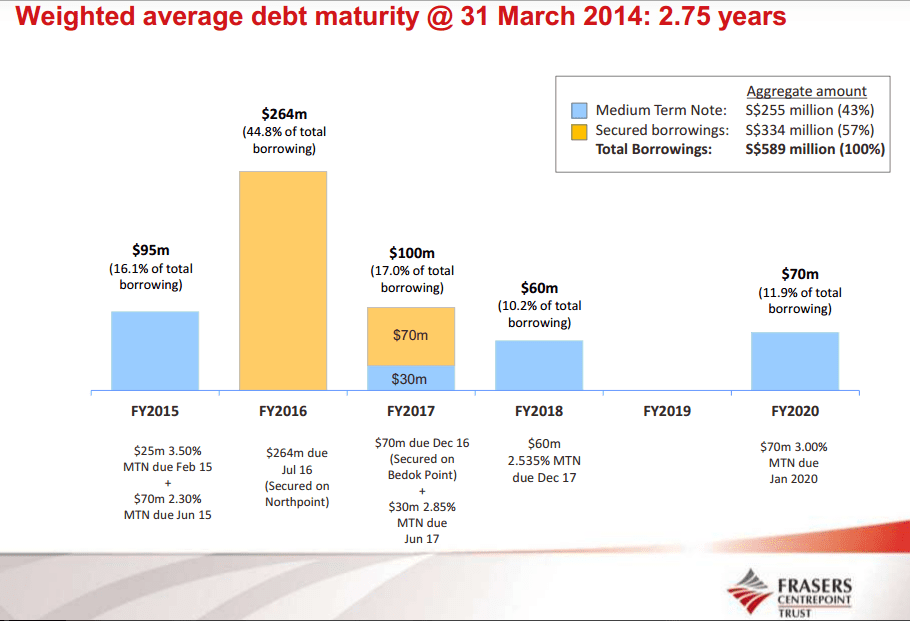

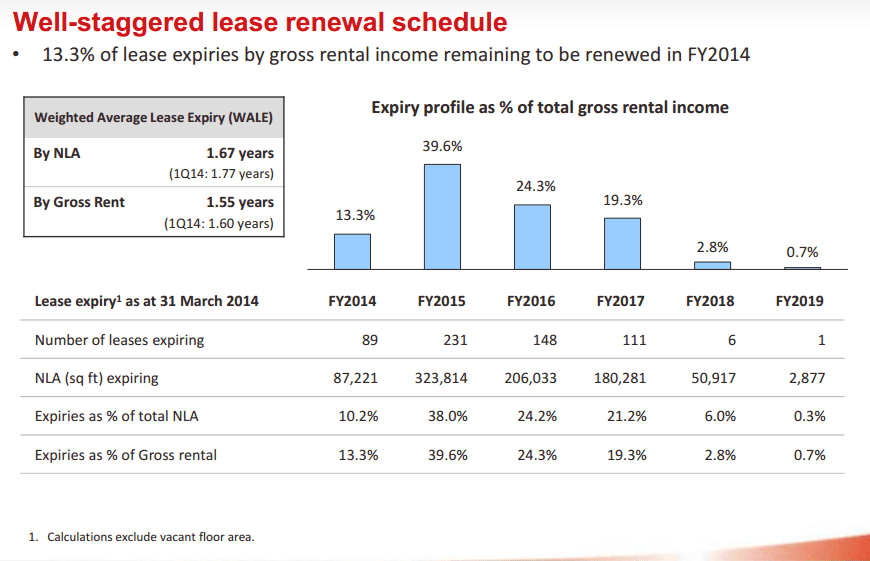

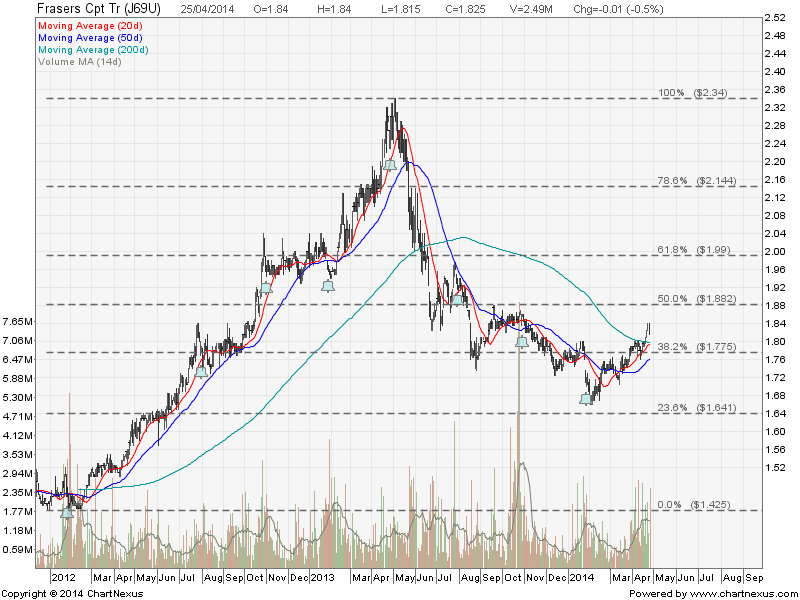

- Frasers Centrepoint Trust (J69) has a net market capitalisation of S$1.20 billion. The REIT gained 8.01% in October. Frasers Centrepoint Trust has gained 35.76% in the year-to-date, with dividends boosting the total return to 44.23%.

- Hutchinson Port Holdings Trust (NS8U) has a net market capitalisation of S$4.14 billion and gained 7.11% in October. The business trust has gained 25.81% in the year-to-date, with dividends boosting the total return to 36.29%. Note that Hutchison Port Holding Trust is the second largest constituent of the Mid Cap Index in terms of net market capitalisation.

The remaining three of the five biggest Mid Cap Index stocks and their respective moves for October are Ascendas REIT (-2.07%), CapitaCommercial Trust (+5.02%) and UOL Group (-1.22%). The five Mid Cap stocks that underperformed in October and the respective declines on the month were Biosensors International Group (-11.07%), Cosco Corp (-8.81%), Indofood Agri Resources (-7.69%), Yangzijiang Shipbuilding Holdings (-7.65%) and GMG Global (-7.35%).

Of the 50 Mid Cap stocks, there are 14 Real Estate Investment Trusts (REITs) that account for 40% of the Index Weightings. The year-to-date volatility of the FTSE ST Mid Cap Index at 10.56%, is lower than its 16.58% volatility of 2011.

On a total return basis, the FTSE Asia Monthly Index Performance Report for October revealed that in the year-to-date the FTSE ST Mid Cap Index has outperformed similar indices for Malaysia, Indonesia, Hong Kong, Taiwan, South Korea, Japan, China and India.

Source: SGX My Gateway