Singapore Shipping Stocks: Still No Life Yet

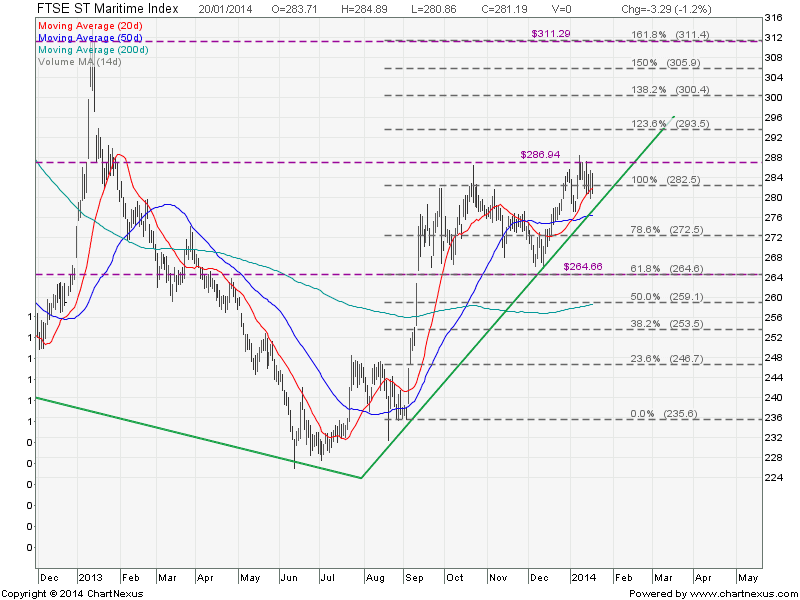

Shipping Stocks in Singapore still very weak and no life seen yet. FTSE ST Maritime Index is currently moving sideway and seems to be finding a good support at about 264.7 level which is the 200D SMA and also the 61.8% FR level.

See previous post on FTSE ST Maritime Index and Singapore Shipping Stocks here.

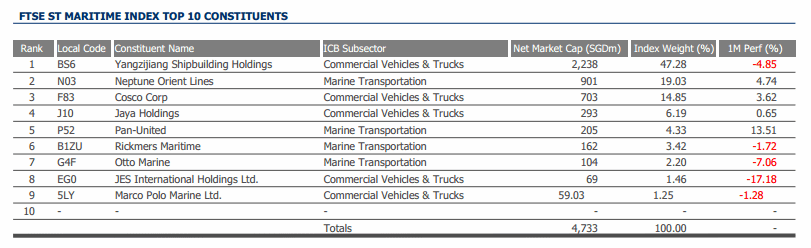

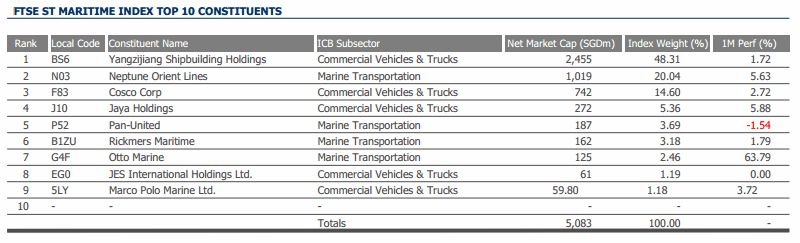

FTSE ST Maritime Index Components Stocks

Yangzijiang has the largest weightage (47.28%) in this index, followed by NOL (19.03%), Cosco Corp (14.85%), Jaya Holding (6.19%), Pan United (4.33%) and the rest. Top 5 stocks contributes to 91.41% weightage to FTSE ST Maritime Index.

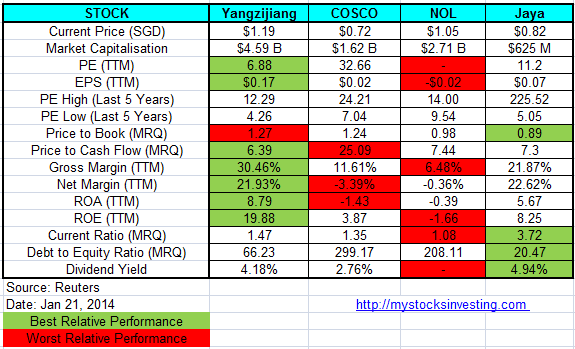

Fundamental Comparison for Key Component Stocks

In general, Yangzijiang has the best fundamental compare with other stocks in this Maritime Index, followed by Jaya Holding. Cosco & NOL fundamental are pretty weak at the moment. We need to monitor Cosco & NOL in the coming earning announcement to see whether there are any significant improvement in the financial. As Yangzijiang has the largest market capitalisation and the best fundamental in all the shipping stocks in Singapore, we shall take a cue from Yangzijiang’s earning and stock chart for any hint for recovery.

If you want to understand more about the meaning of the above financial ratio and fundamental analysis, check out Stock Fundamental Analysis here.

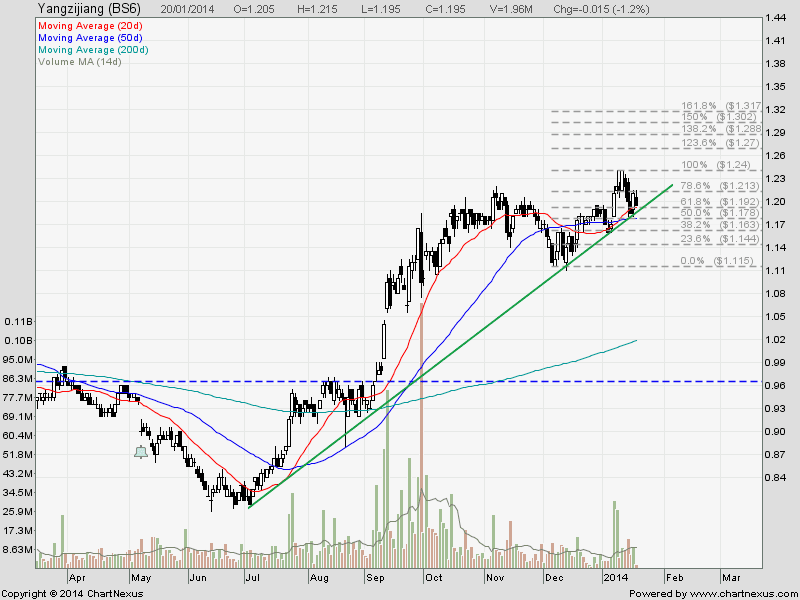

Yangzijiang Stock Chart

Yangzijiang broke out from a Falling Wedge and currently retracing to test the 200D SMA support. If Yangzijiang rebounds from this support level, the stock will start a medium up trend to the price target of $1.20 (Resistance of a Long Term Declining Line)

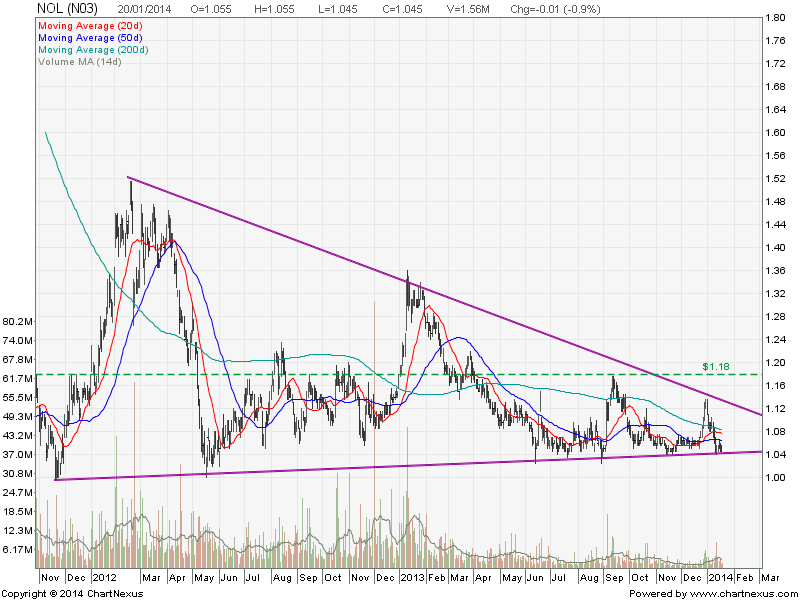

NOL Stock Chart

NOL chart is still very bearish and no sign of reversal yet.

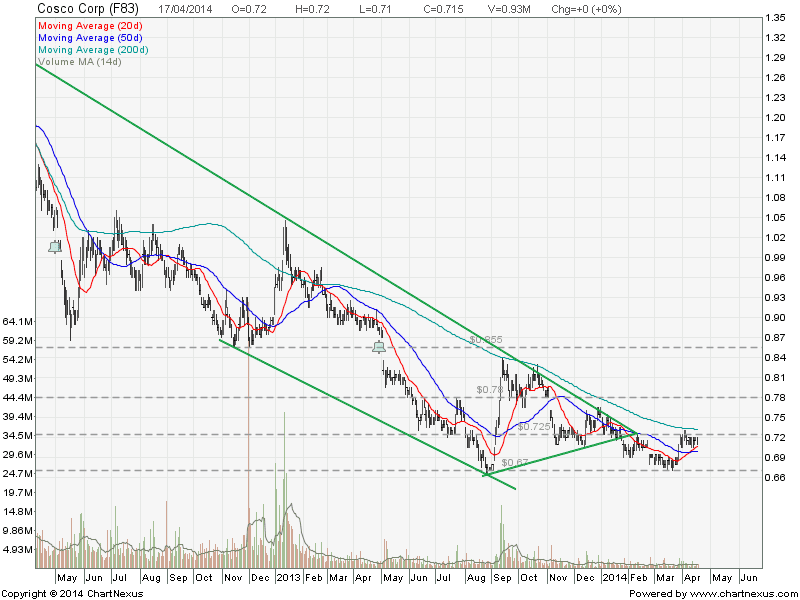

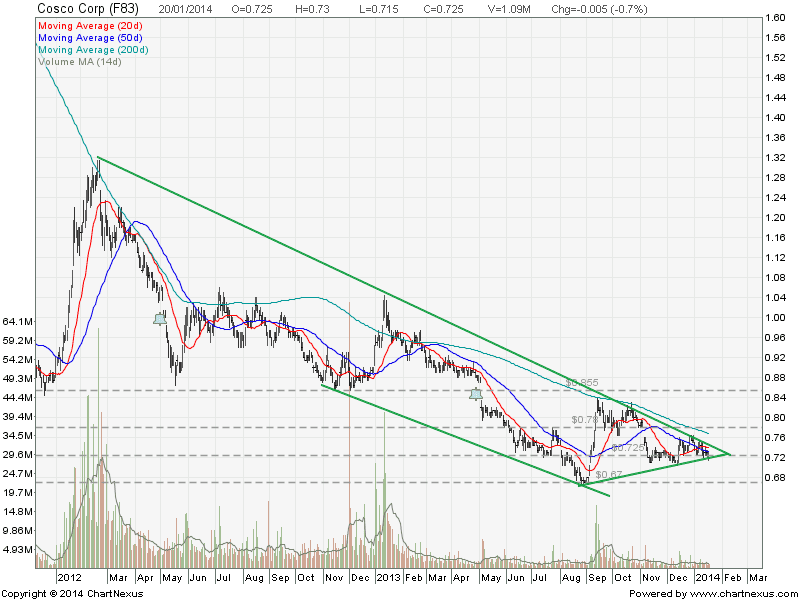

COSCO Stock Chart

COSCO may be finding the bottom (potential forming of Double Bottoms) but need to see whether COSCO can clear the 200D SMA resistance or not before talking about the trend reversal.

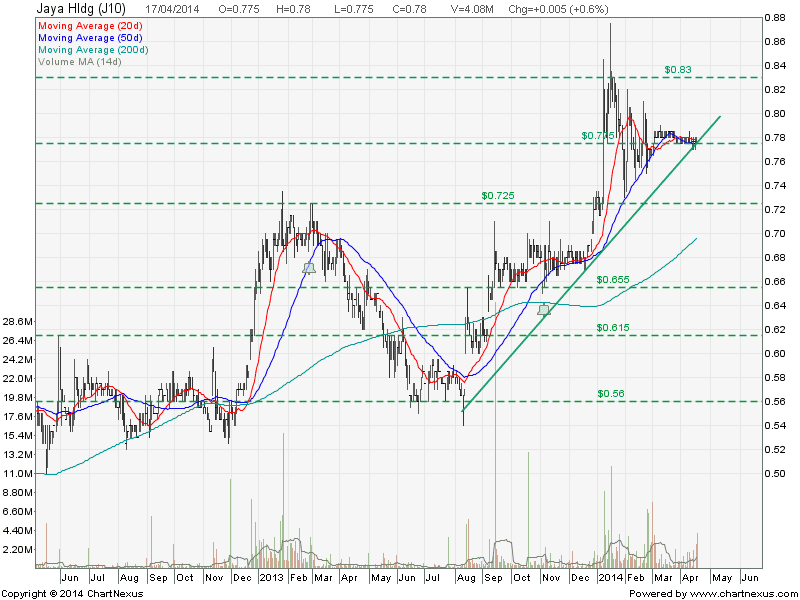

Jaya Holding Stock Chart

Jaya Holding is on up trend and currently retracing to test the up trend support.

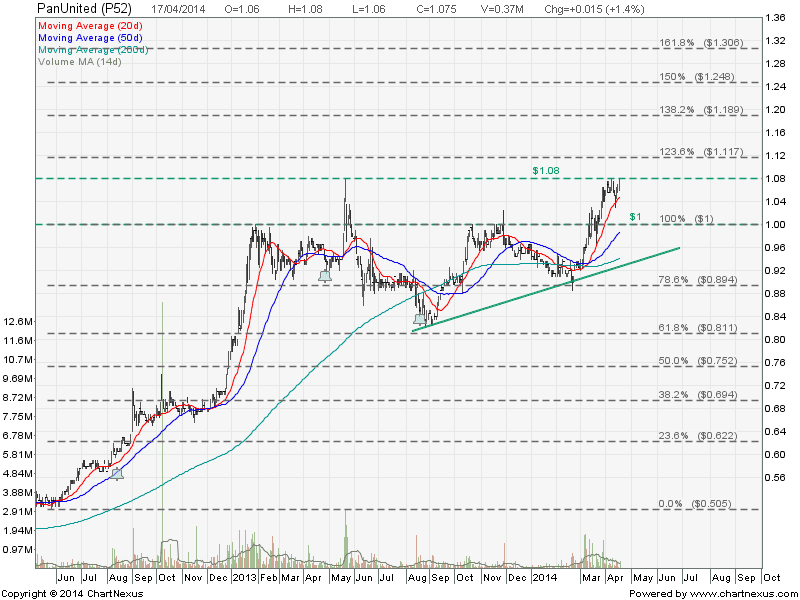

Pan United Stock Chart

Pan United is on uptrend but currently facing the resistance at $1.08. Fundamentally (base on PE ratio) and technically not a good entry level.