IndoAgri: Short Term Retracement

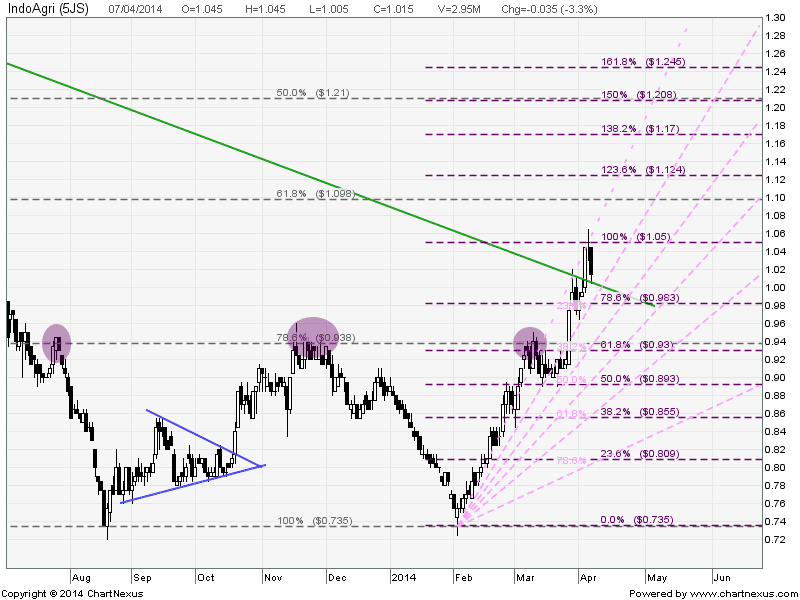

IndoAgri is expected to have a short term retracement back to $0.93-$0.95 region after forming a Evening Doji Star before continue the uptrend. $0.93 is the resistance turned support level. The Fibonacci Fan level provides different up trend support line.

Original Post by Marubozu @ My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 23.6814 |

|---|---|

| Estimated P/E(12/2014) | 14.7686 |

| Relative P/E vs. FSSTI | 1.6930 |

| Earnings Per Share (IDR) (ttm) | 384.3489 |

| Est. EPS (IDR) (12/2014) | 616.3290 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 1,438.54 |

| Shares Outstanding (M) | 1,417.28 |

| 30 Day Average Volume | 2,998,833 |

| Price/Book (mrq) | 0.9210 |

| Price/Sale (ttm) | 0.9823 |

| Dividend Indicated Gross Yield | 0.51% |

| Cash Dividend (SGD) | 0.0052 |

| Dividend Ex-Date | 05/06/2014 |

| 5 Year Dividend Growth | – |

| Next Earnings Announcement | 04/29/2014 |