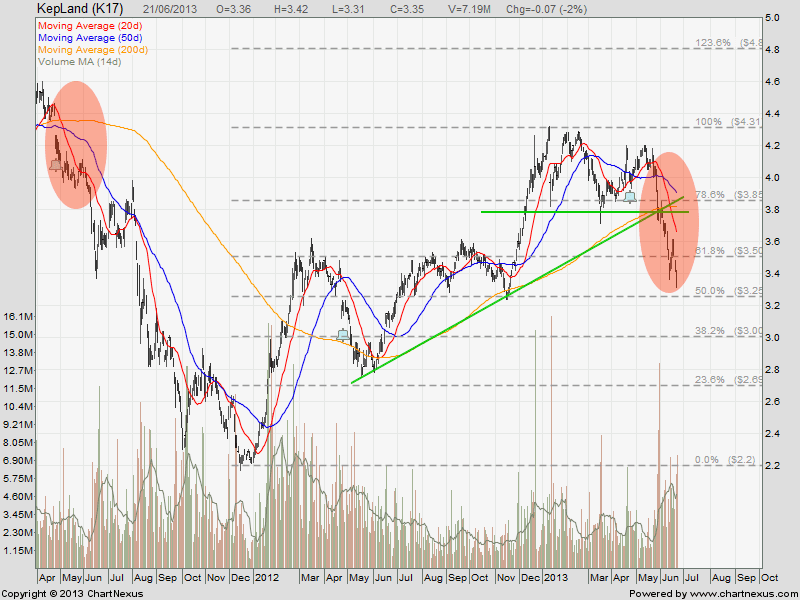

Keppel Land: Dead Cat Bounce Over!

Keppel Land seems completed the Dead Cat Bounce after rejected at the the previous support turned resistance (the neckline of Multiple Tops), 200D SMA and 50% Fibonacci Retracement Level. Keppel Land is clearly trading in a down trend channel and turning down after rejected at the channel resistance. Price target $2.80 which is the 150% FR level.

By Marubozu https://mystocksinvesting.com

Key Statistics for KPLD

| Current P/E Ratio (ttm) | 6.9923 |

|---|---|

| Estimated P/E(12/2013) | 14.0927 |

| Relative P/E vs. FSSTI | 0.5277 |

| Earnings Per Share (SGD) (ttm) | 0.5220 |

| Est. EPS (SGD) (12/2013) | 0.2590 |

| Est. PEG Ratio | 1.3939 |

| Market Cap (M SGD) | 5,642.58 |

| Shares Outstanding (M) | 1,545.91 |

| 30 Day Average Volume | 2,567,200 |

| Price/Book (mrq) | 0.8995 |

| Price/Sale (ttm) | 4.7384 |

| Dividend Indicated Gross Yield | 3.29% |

| Cash Dividend (SGD) | 0.1200 |

| Last Dividend | 04/23/2013 |

| 5 Year Dividend Growth | -3.35% |

| Next Earnings Announcement | 10/17/2013 |