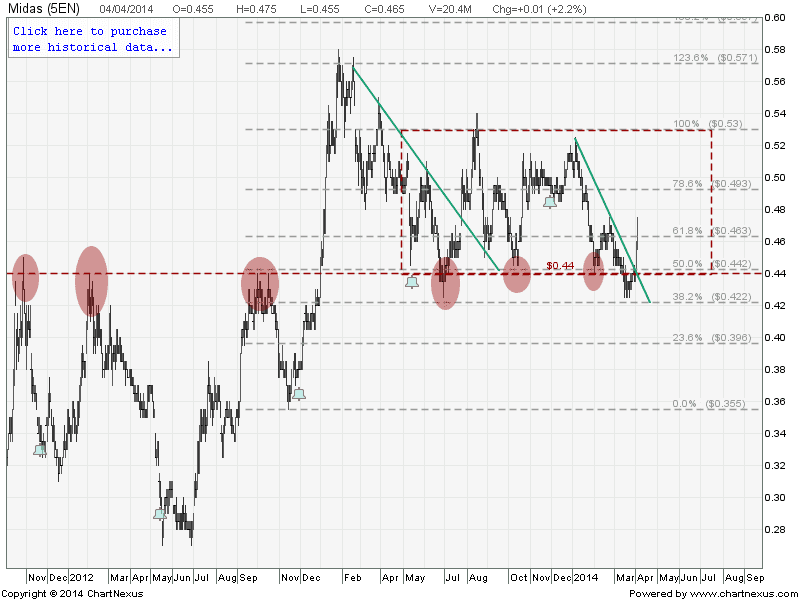

Midas: Rebound!

Midas rebounded from the Rectangle support at about $0.44 and also broke out from the declining trend line (green). $0.44 is a very significant resistance turned support level. Base on the chart pattern, Midas first target is about $0.50 followed by the rectangle resistance of $0.53.

Original Post by Marubozu @ My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 58.5225 |

|---|---|

| Estimated P/E(12/2014) | 18.7974 |

| Relative P/E vs. FSSTI | 4.1861 |

| Earnings Per Share (CNY) (ttm) | 0.0392 |

| Est. EPS (CNY) (12/2014) | 0.1220 |

| Est. PEG Ratio | 0.2859 |

| Market Cap (M SGD) | 566.19 |

| Shares Outstanding (M) | 1,217.62 |

| 30 Day Average Volume | 5,399,367 |

| Price/Book (mrq) | 0.9409 |

| Price/Sale (ttm) | 2.4003 |

| Dividend Indicated Gross Yield | 1.08% |

| Cash Dividend (SGD) | 0.0025 |

| Dividend Ex-Date | 05/15/2014 |

| 5 Year Dividend Growth | -22.16% |

| Next Earnings Announcement | 05/14/2014 |