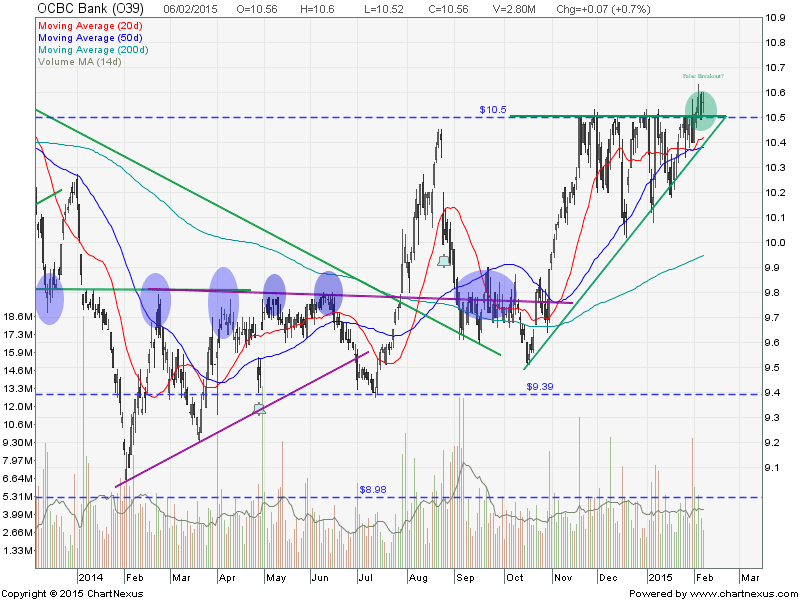

OCBC Bank: Facing Resistance

OCBC Bank Technical Analysis and Stock Chart.

OCBC Bank is currently facing a channel resistance. Expect pull back at this level because MACD is weakening as well. Immediate support at $10.50 (20/50D SMA and also the previous resistance turned support level).

Original post by Marubozu My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 10.2170 |

|---|---|

| Estimated P/E(12/2015) | 11.1414 |

| Relative P/E vs. FSSTI | 0.7319 |

| Earnings Per Share (SGD) (ttm) | 1.0414 |

| Est. EPS (SGD) (12/2015) | 0.9550 |

| Est. PEG Ratio | 1.2154 |

| Market Cap (M SGD) | 42,363.69 |

| Shares Outstanding (M) | 3,981.55 |

| 30 Day Average Volume | – |

| Price/Book (mrq) | 1.4272 |

| Price/Sale (ttm) | 3.5308 |

| Dividend Indicated Gross Yield | 3.34% |

| Cash Dividend (SGD) | 0.1800 |

| Dividend Ex-Date | 04/30/2015 |

| 5 Year Dividend Growth | 4.56% |

| Next Earnings Announcement | 04/30/2015 |