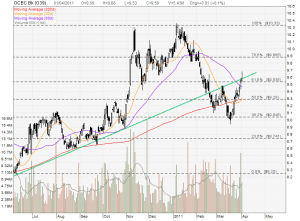

OCBC Bank: Beware of Reversal!

OCBC has been on the uptrend since rebounded from the recent low of about $9.00. OCBC is currently testing the uptrend support turned resistance at about $9.60. This is also the significant 61.8% Fibonacci Resistance. Last Thursday OCBC ended the day with a Hanging Man candlestick pattern but the stock did not reverse. The stock ended with a Shooting Star pattern on Friday. Both Hanging Man and Shooting Star candlestick patterns are trend reversal pattern. The odd of trend reversal is even higher when these patterns are observed at the resistance level. If OCBC does reverse the trend, the stock may retrace back to $9.30 which is the 200D MA support and also the 50% Fibonacci Support.