Keppel Data Center REIT: Under Watchlist

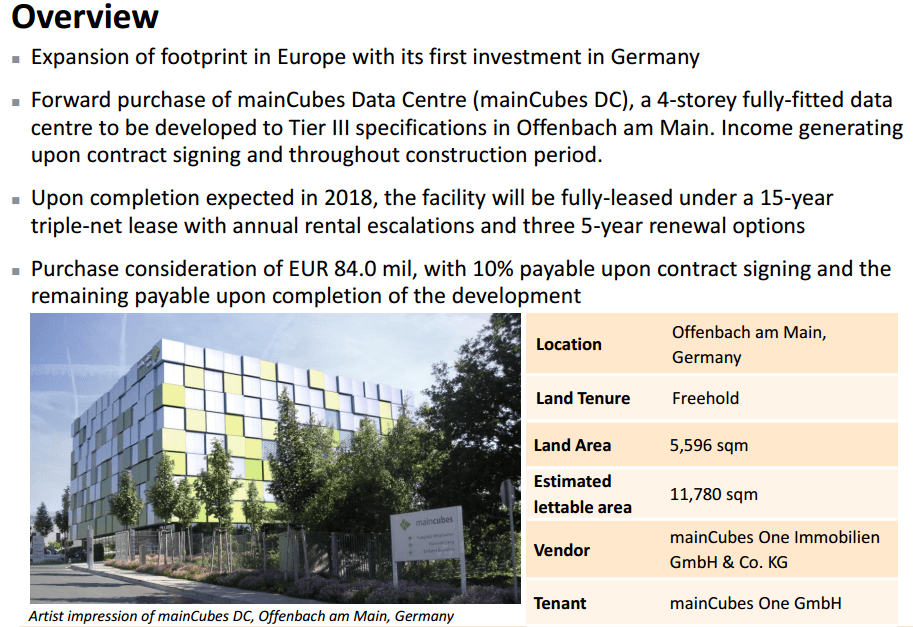

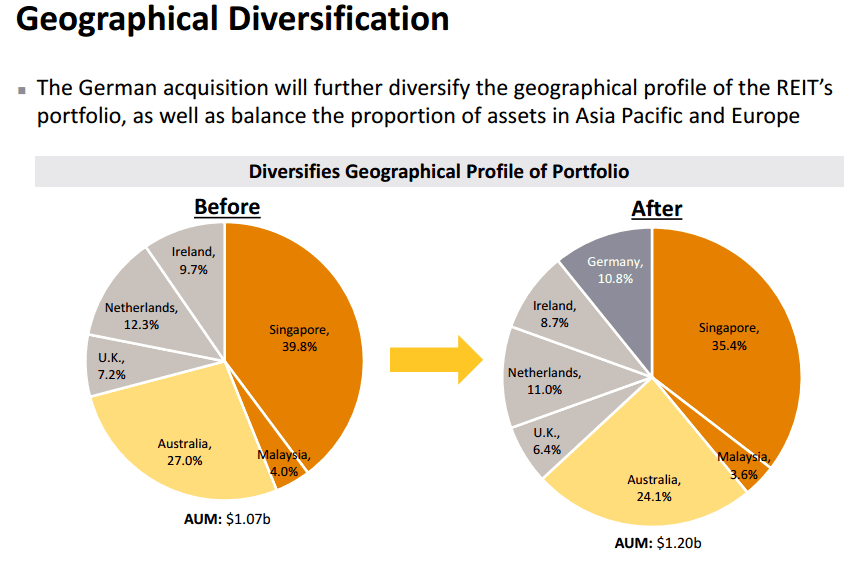

Keppel DC REIT Investor Presentation after German’s mainCubes Data Center acquisition on Oct 28, 2015 and Keppel DC REIT Earning Presentation on Oct 15-2015.

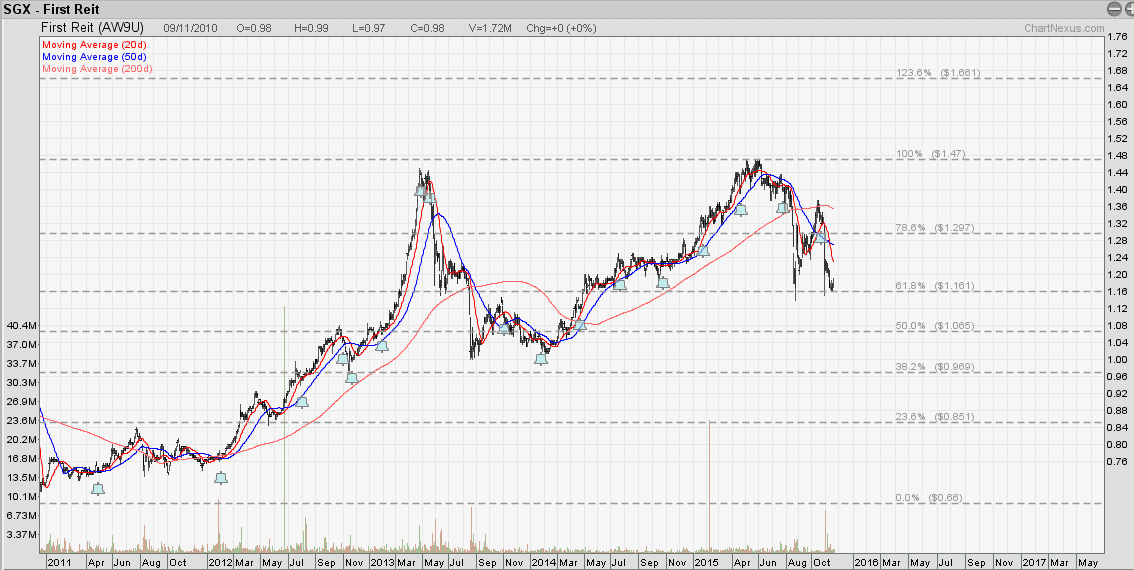

- Last Done Price = $1.045

- Market Cap = $922.7 M

- NAV = $0.86

- Price / NAV = 1.22 (22% Premium)

- Price / NAV (High) = 1.28

- Price / NAV (Low) = 1.18

- Distribution Yield = 6.278%

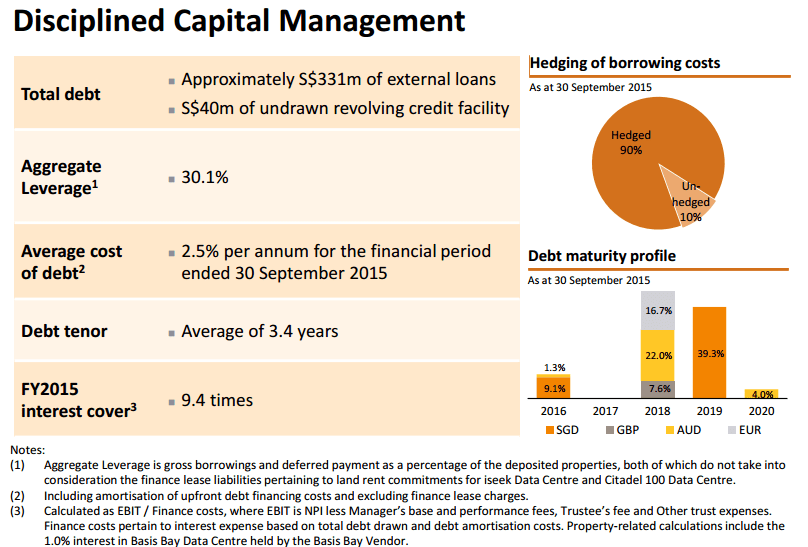

- Gearing Ratio = 30.1% to 31.1% (with acquisition)

- WADM = 3.4 Years

- WALE = 8.9 Year to 10 Years (with acquisition)

- Occupancy Rate = 95.1%