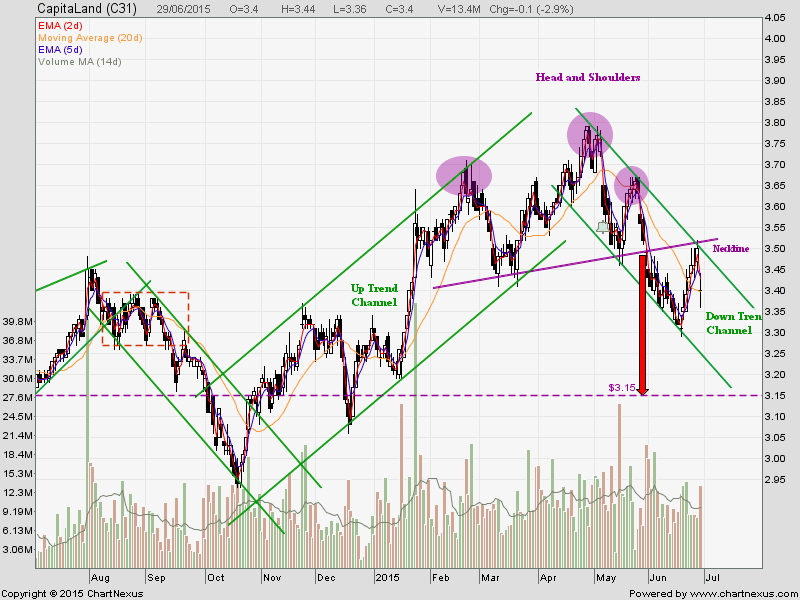

Capitaland: Rejected at the Neckline Resistance

Capitaland is rejected at the Neckline Resistance at about $3.50. This level is also the Down Trend Channel resistance. Capitaland has been trading nicely within the uptrend and down trend channel previously. Feel free to check out the past chart patterns for Capitaland. Base on current bearish chart, short selling Capitaland provides a better Reward Risk Ratio trading strategy,

See previous stock chart analysis for Capitaland.