Lippo Malls Indonesia Retail Trust (LMIR): Fundamental & Technical Analysis, Risk Assessment

Fundamental Analysis of Lippo Malls Indonesia Retail Trust (LMIR):

- Last Price = $0.37

- NAV = $0.415

- Price / NAV (Current) = 0.89

- Price / NAV (High) = 1.0219

- Price / NAV (Low) = 0.7596

- Distribution Yield = 7.5%

- Gearing Ratio = 28.3%

- Occupancy Rate = 95.0%

- WALE = 4.6 Years

- WADM = 1.8 Years

- Note: Base on latest earning report on Nov 12-2014.

- Last Analysis on Lippo Malls Indonesia Retail Trust (LMIR)

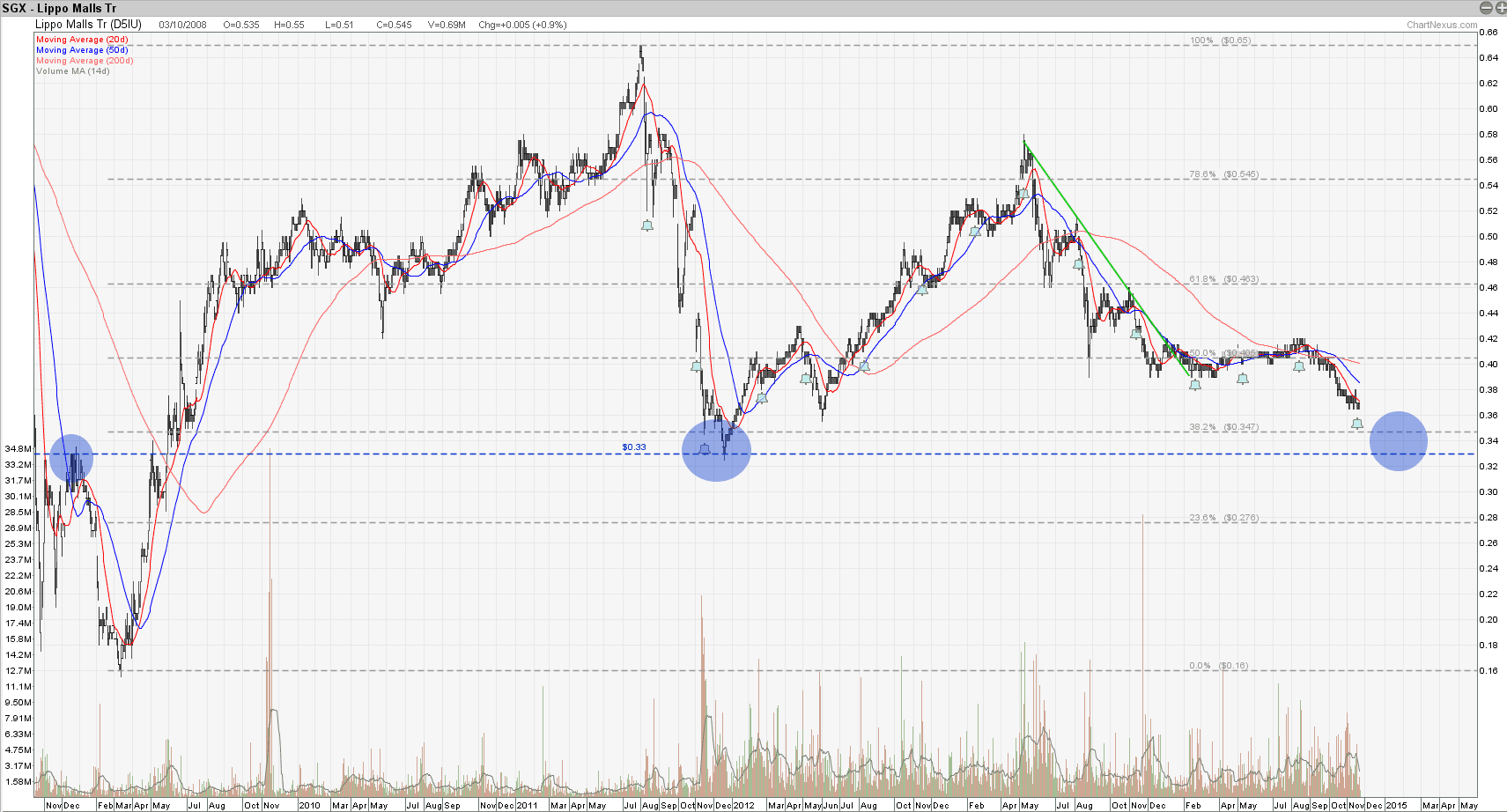

Technical Analysis of Lippo Malls Indonesia Retail Trust (LMIR):

LMIR is currently on the down trend but approaches the previous resistance turned support level at about $0.33. If LMIR is able to hold above $0.33 and consolidate around this support zone, it may be a good entry point in view of the strong fundamental, undervalue NAV and nice DPU yield. Keep an eye on the reversal chart pattern and candlestick patterns when LMIR reaches this support zone.

Risk Assessment:

One of the biggest Risks is currency exchange risk, where LMIR collects rental in IDR but DPU pay out in SGD. Looking at the SGD/IDR chart, SGD/IDR is trading within the range of 9,000 and 9,500. It is good news to LMIR if SGD is weaken against IDR and vice versa.

.

.

.