IREIT Global IPO Balloting Result

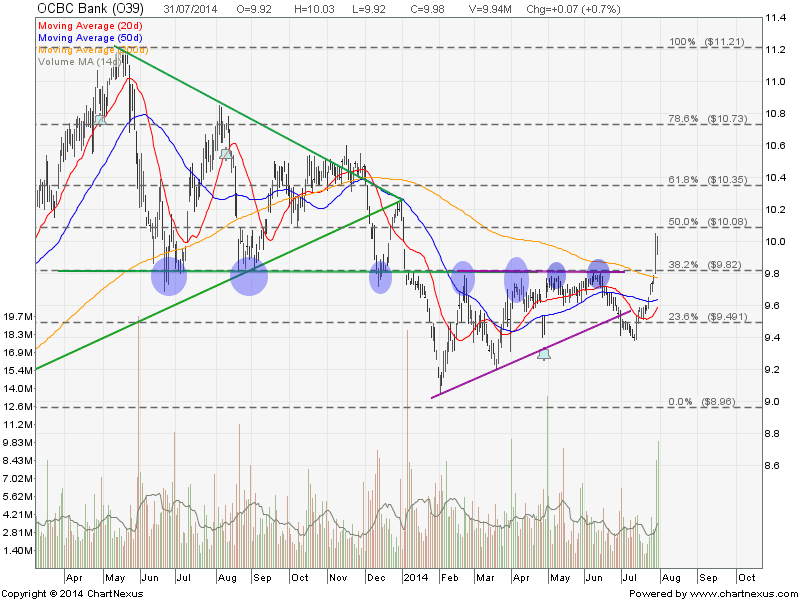

Trading debut: IREIT Global joins Mainboard after $370m IPO

Its public offer was more than 7 times subscribed. The Singapore Exchange today welcomed IREIT Global, its first office REIT focusing only in properties in Europe.

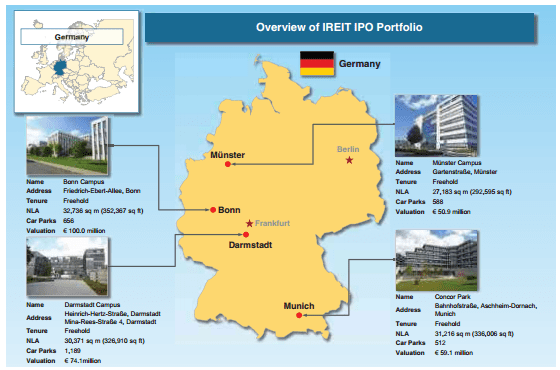

This comes after an IPO that was 7.6 times subscribed and raised about $370 million. The Public Offer received 4,054 valid applications for 86,865,000 Unit. Its initial portfolio comprises four office properties in Germany in key cities of Bonn, Darmstadt, Münster and Munich, valued at approximately S$478 million.

According to Lawrence WOng, Head of Listings at SGX, “We welcome IREIT Global to Mainboard. Its focus in Europe adds geographical diversity to our REITs cluster and provides our global investors with access to the property sector in Germany and Europe. We look forward to welcoming more REITs and real estate companies from Europe to tap into Asia’s growing wealth base via a listing on SGX,

IREIT Global will trade under the stock code “UD1U”.

IREIT Global IPO Balloting Result from SGX website.