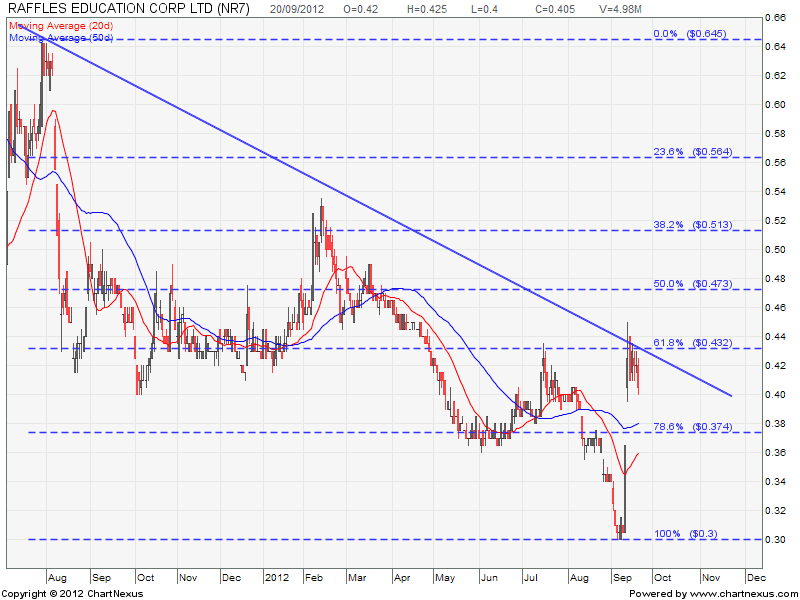

Raffles Education: Think Twice if You are Still Living in Denial

Raffles Education is still trading in a down trend and just bounced down from the Down Trend Resistance Line. Coincidently this $0.43 is also a 61.8% Fibonacci Retracement Level.

Key Statistics for RLS

| Current P/E Ratio (ttm) | – |

|---|---|

| Estimated P/E (06/2013 ) | 40.5000 |

| Earnings Per Share (SGD) (ttm) | -0.0747 |

| Est. EPS (SGD) (06/2013) | 0.0100 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 354.10 |

| Shares Outstanding (M) | 874.31 |

| Enterprise Value (M SGD) (ttm) | 568.28 |

| Enterprise Value/EBITDA (ttm) | 10.52 |

| Price/Book (mrq) | 0.6916 |

| Price/Sale (ttm) | 2.6390 |

| Dividend Indicated Gross Yield | 1.11% |

| Next Earnings Announcement | 11/09/2012 |

- Return On Asset = 1.54%

- Return on Equities = -12.52%

I don’t see any catalysts on the stock price base on both Fundamental or Technical Analysis.

Cut loss, take profit, continue to hope? Your call.