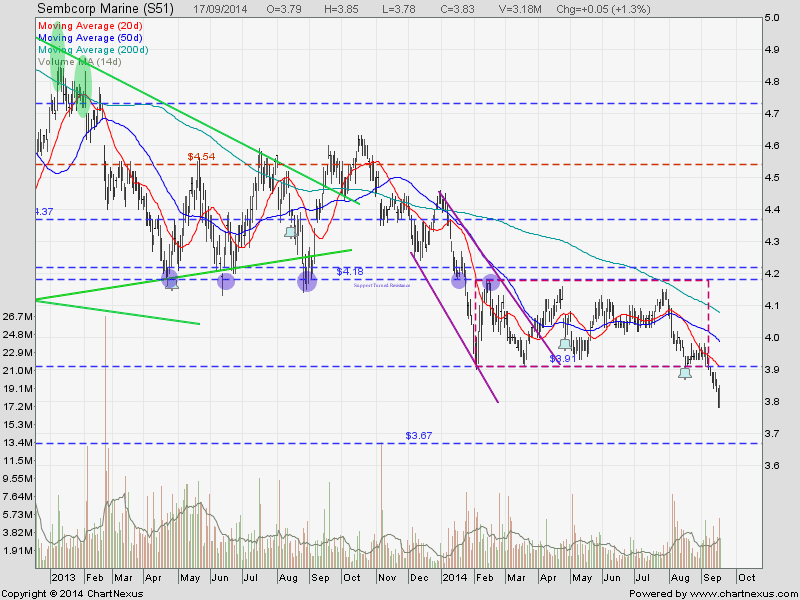

Semb Marine: Breakout from Descending Triangle?

Looks like Semb Marine is breaking out from Descending Triangle and the 50D SMA resistance. This 50D SMA used to be a tough resistance for past 5 occasions. Immediate resistance at $3.30 followed by the 200D SMA. Immediate support is the 50D SMA.

Original post by Marubozu My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 11.4051 |

|---|---|

| Estimated P/E(12/2015) | 11.6350 |

| Relative P/E vs. FSSTI | 0.8142 |

| Earnings Per Share (SGD) (ttm) | 0.2683 |

| Est. EPS (SGD) (12/2015) | 0.2630 |

| Est. PEG Ratio | 5.8030 |

| Market Cap (M SGD) | 6,391.54 |

| Shares Outstanding (M) | 2,088.74 |

| 30 Day Average Volume | 2,905,500 |

| Price/Book (mrq) | 2.1566 |

| Price/Sale (ttm) | 1.0958 |

| Dividend Indicated Gross Yield | 4.25% |

| Cash Dividend (SGD) | 0.0800 |

| Dividend Ex-Date | 04/27/2015 |

| 5 Year Dividend Growth | 3.40% |

| Next Earnings Announcement | 04/27/2015 |