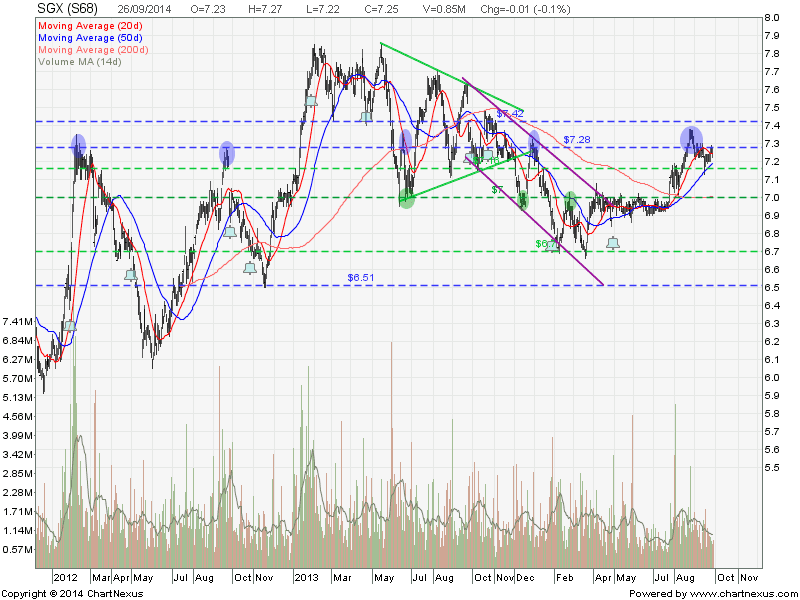

Singapore Exchange (SGX): Testing 200D SMA Support

Singapore Exchange (SGX) has dropped about 11% since the May 2015 high of $8.80. Base on current chart pattern, SGX has broken the uptrend support and currently testing 200D SMA support at about $7.75. Current uptrend support has now turned to resistance. Keep a close eye on the current support level ($7.84 and $7.75) to see whether there is a change in trend for SGX. It is good opportunity to short sell SGX if these supports are broken because SGX will enter into bearish territory and starts down trend.

Original post from My Stocks Investing Journey.