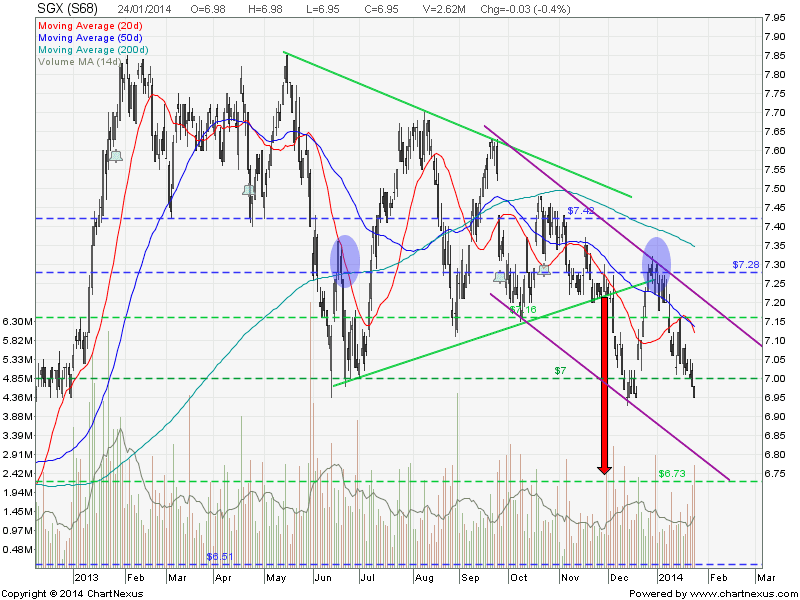

SGX: Turning Down

SGX was rejected at the support turned resistance at about $7.00. This $7.00 is also the psychological resistance and down trend channel resistance. Expect more selling pressure ahead!

Original Post by Marubozu @ My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 20.9951 |

|---|---|

| Estimated P/E(06/2014) | 21.3580 |

| Relative P/E vs. FSSTI | 1.5074 |

| Earnings Per Share (SGD) (ttm) | 0.3296 |

| Est. EPS (SGD) (06/2014) | 0.3240 |

| Est. PEG Ratio | 2.0149 |

| Market Cap (M SGD) | 7,403.71 |

| Shares Outstanding (M) | 1,069.90 |

| 30 Day Average Volume | 1,528,067 |

| Price/Book (mrq) | 9.1863 |

| Price/Sale (ttm) | 10.0187 |

| Dividend Indicated Gross Yield | 4.05% |

| Cash Dividend (SGD) | 0.0400 |

| Dividend Ex-Date | 01/28/2014 |

| 5 Year Dividend Growth | -6.41% |

| Next Earnings Announcement | 04/23/2014 |