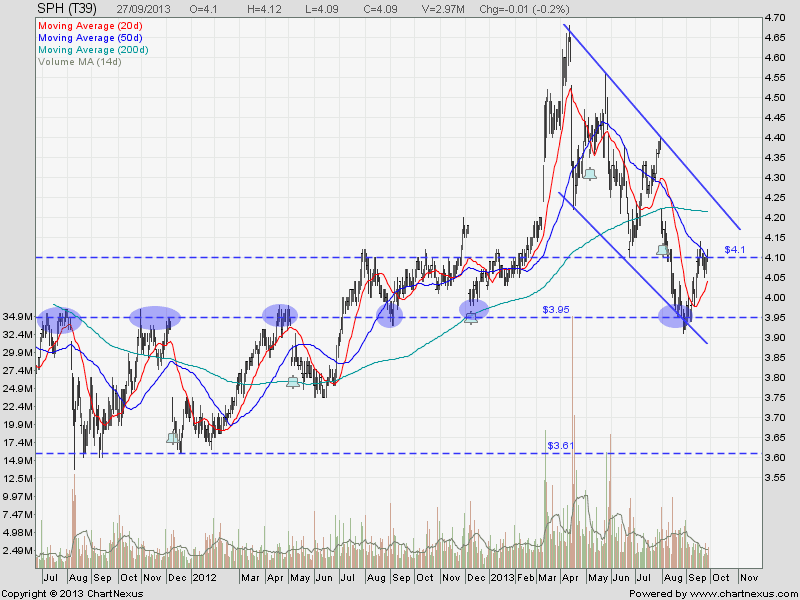

Singapore Press Holding (SPH): Trading in Down Trend Channel

SPH is currently trading in a Down Trend Channel. Currently testing a resistance at $4.10. Next significant Resistance at about $4.20 (200D SMA and the down trend channel resistance). Immediate support at $3.95-$4.00.

Key Statistics for SPH

| Current P/E Ratio (ttm) | 14.6071 |

|---|---|

| Estimated P/E(08/2013) | 18.4234 |

| Relative P/E vs. FSSTI | 1.1091 |

| Earnings Per Share (SGD) (ttm) | 0.2800 |

| Est. EPS (SGD) (08/2013) | 0.2220 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 6,538.48 |

| Shares Outstanding (M) | 1,598.65 |

| 30 Day Average Volume | 3,488,533 |

| Price/Book (mrq) | 1.7589 |

| Price/Sale (ttm) | 5.3156 |

| Dividend Indicated Gross Yield | 3.91% |

| Cash Dividend (SGD) | 0.1800 |

| Last Dividend | 08/01/2013 |

| 5 Year Dividend Growth | 9.24% |

| Next Earnings Announcement | 10/11/2013 |