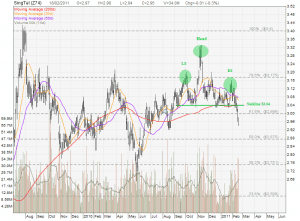

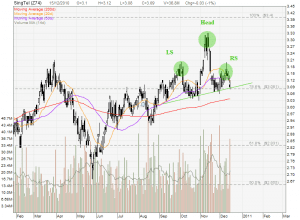

SingTel: Capped by Declining Trend Line

Expect more down side for SingTel as the stock is currently capped by the Declining Trend Line Resistance. A short selling position has higher probability of winning. Favorable Reward Risk Ratio with target price of $3.43 which is a very strong support tested past 5 occasions.

We cannot ignore the short selling trading skill in this bear market because short selling is required to either Hedge our current investment portfolio which we don’t intend to sell because of the dividend payout, or profit from the short term price weakness. Learn how to Hedge your Dividend Stocks Portfolio or Profit from Short Selling Singapore Stocks here.