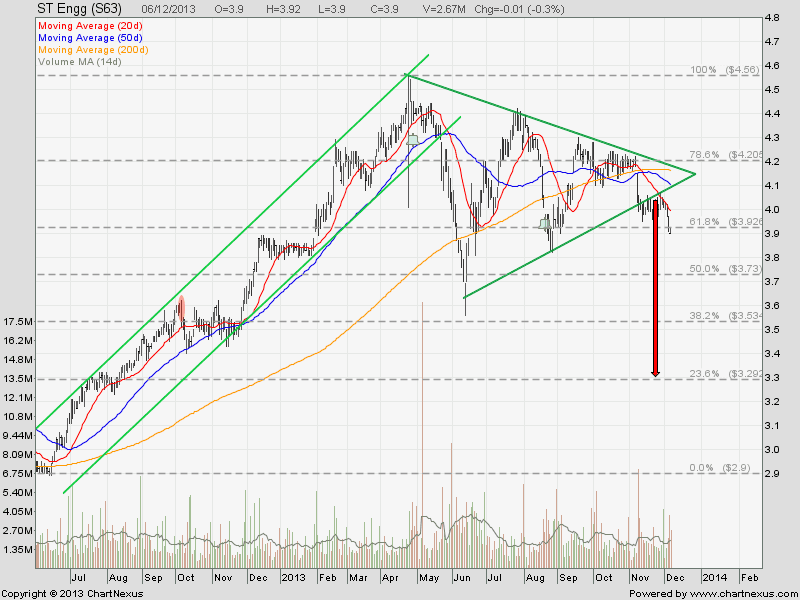

Singapore Technologies Engineering: Watch the Support!

Singapore Technologies Engineering (ST Engineering) is going to test the $3.83 support for the 3rd time. More selling pressure if this support is broken and continue within the down trend channel to the price target of $3.30. MACD is bearish.

See previous Fundamental Data & derivation of the price target in the last few analysis of Singapore Technologies Engineering.