Singapore Stocks with High PE Ratio to Short!!

The selling off is bloody.. the US GDP and Job Data are lousy!

China last PMI shows China’s economy is contracting.

Debts in Europe and US are still not solved yet…. only prolong the pain …

For those who know how to short in the bearish market, they will make a lot of money if they know how to short. I am searching for stocks with high PE ratio to short because it has more downside potential (YES! I use downside “potential” now instead of downside risk”). Feel free to contribute your shorting list here…

My Shorting Watchlist

- Singapore Exchange (SGX): PE = 25.8 @$7.13

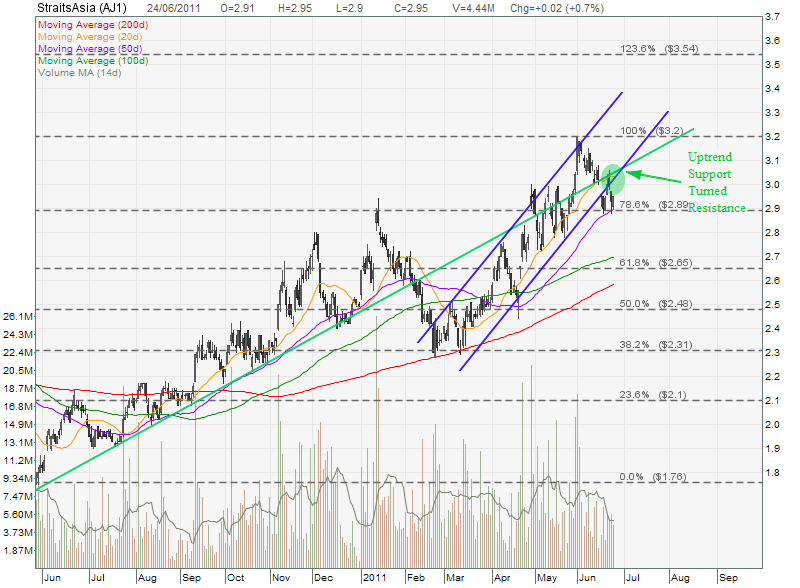

- Straits Asia Resources (SAR) PE = 26.4 @$2.64

- Hyflux PE = 18.3 @ $1.885

- Q&M Dental PE = 55.3 @$0.81

- Wilmar PE = 21.1 @$5.62

- CapitaMall PE = 21.6 @$1.83

- DBS PE = 20.9 @$14.54

- Genting Singapore Rolling PE = 29.5 @$1.79

- Goodpack PE = 19.1 @$1.815