Is It Time to Invest in Singapore REIT to build up Passive Income?

Debt Ceiling settled (at least for the time being), US Government re-opens, no sign of QE tapering yet, Dow Jones Industrial Index, S&P500, NASDAQ are recording historical high and still on the solid uptrend, Europe is coming out from recession, China and US GDP are doing well again….. so many good news, IS IT A GOOD TIME TO ENTER THE MARKET?

I received many inquiries regarding whether this is the right time to buy Singapore REIT. To tell you the truth: I do NOT know as I am not the fortune teller. No one can predict the direction of the stock market but it is important to understand the global economy and how those events can affect our investment plan and portfolio.

Besides looking at those Singapore REIT Fundamental data like NAV, Distribution Yield, Gearing Ratio, etc .. (See the Comparison Table for Singapore REIT here.), there are a few risks that we need to be aware as far as investing in Singapore REITs are concerned:

- The hike of interest – The day will DEFINITELY come and the only question is when? REITs (Unit price and Distribution) will be hit because REIT has to pay more interest to the bond holders and banks due to the debt especially REITs with high gearing ratio. The hike of interest will double hit the REIT’s NAV and Distribution.

- REITs are sensitive to economy cycles. Any weakness in rental will affect the distribution income.

- Currency risks for REITs which have the properties oversea.

- REITs which high gearing may issue Rights to raise more fund to improve the working capital.

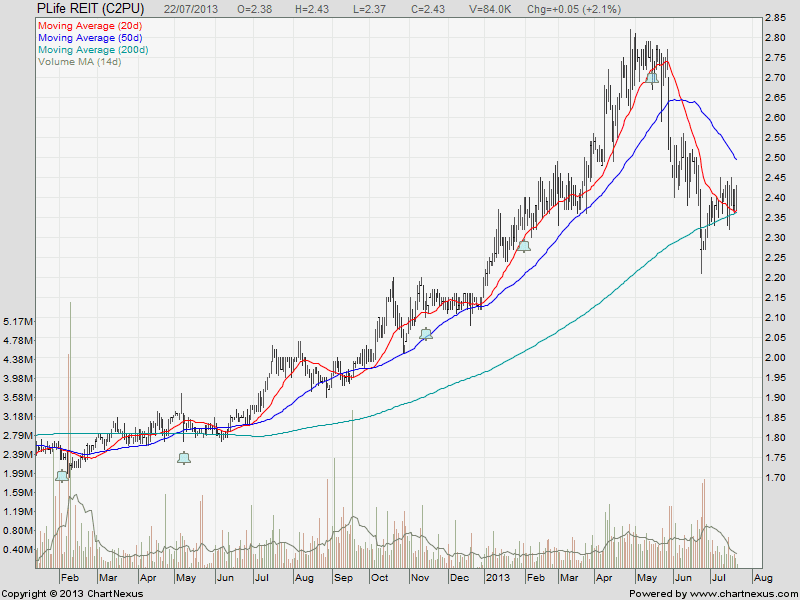

It is impossible for us to 100% understand what is happening in the world and how it will affect our REITs portfolio. However we can make better investment decision by analyse the charts using technical analysis. The charts will tell us when to invest or when to take profit / cut loss.

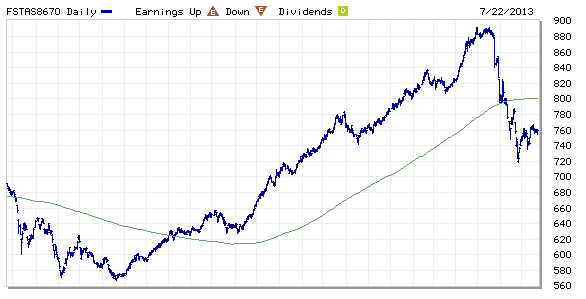

Base on the chart, FTSE ST Real Estate Investment Trust Index is still trading below 200D SMA (long term trend) but there is potential sign of reversal base on chart pattern. However, the upside potential is limited as long as the index stay below the 200D SMA.

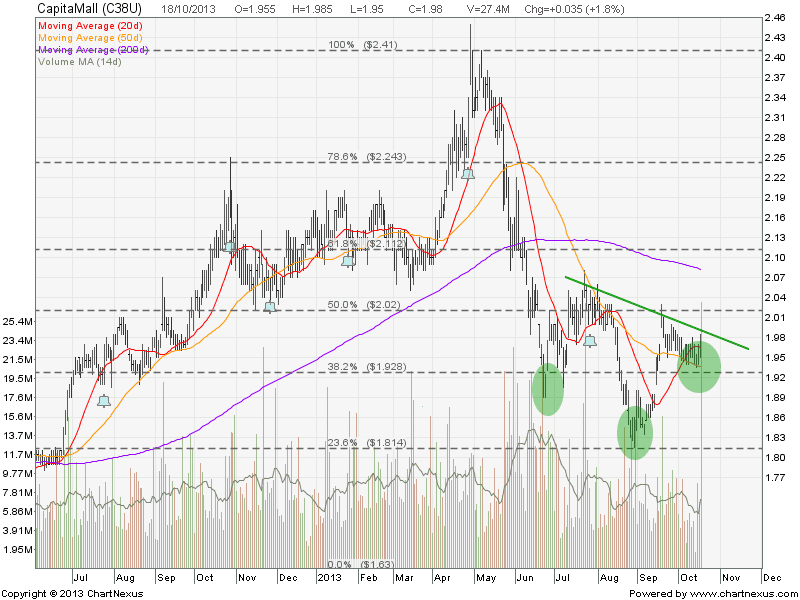

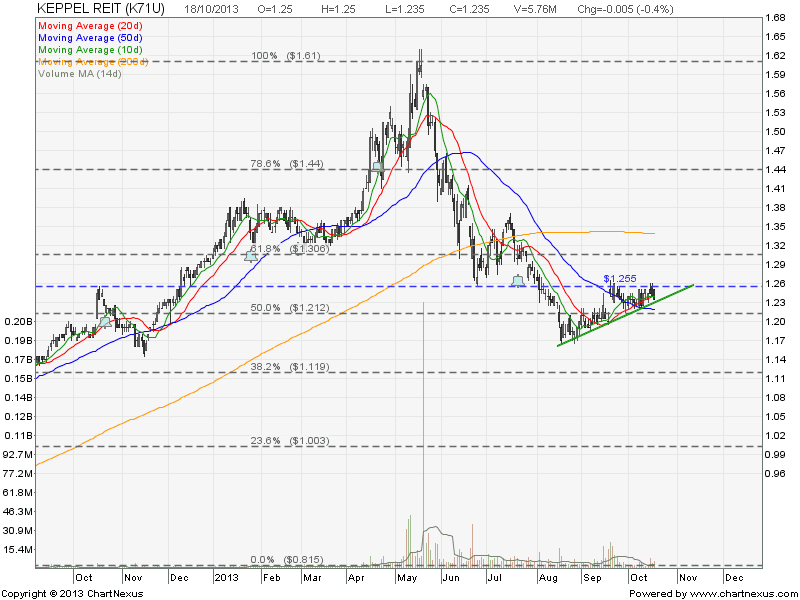

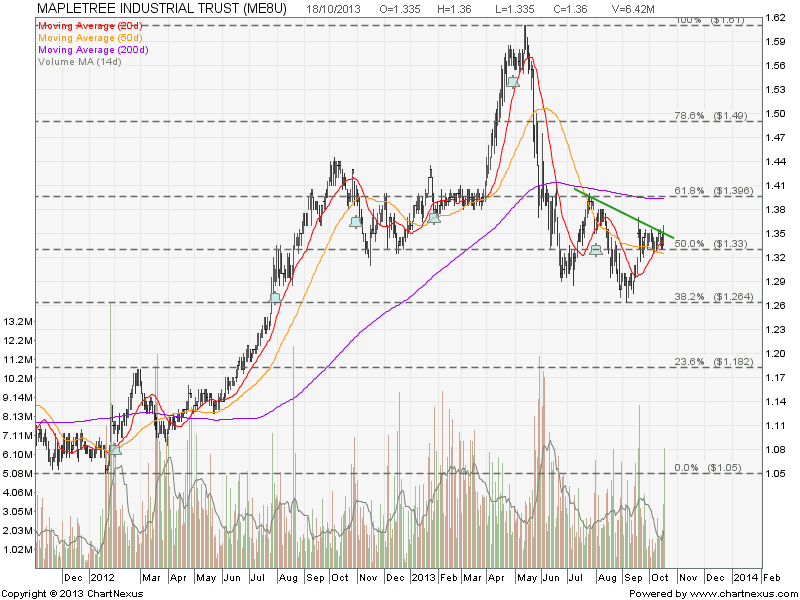

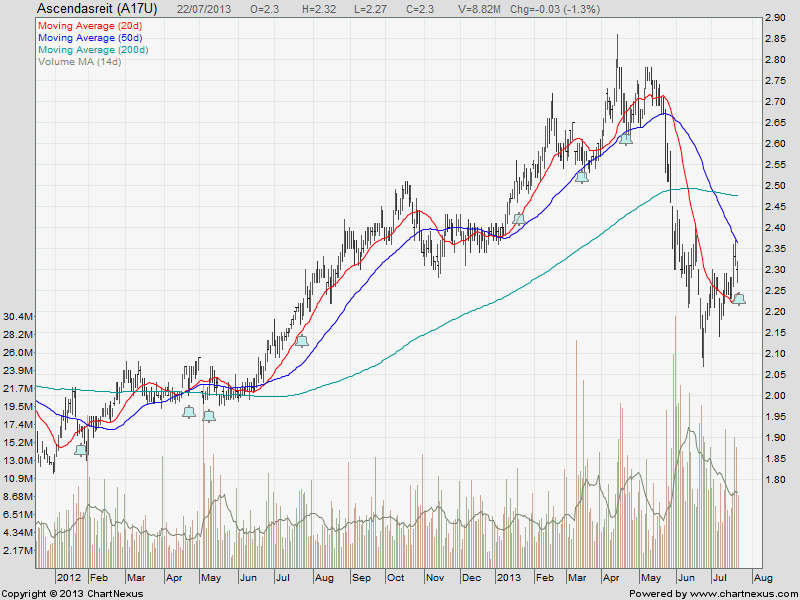

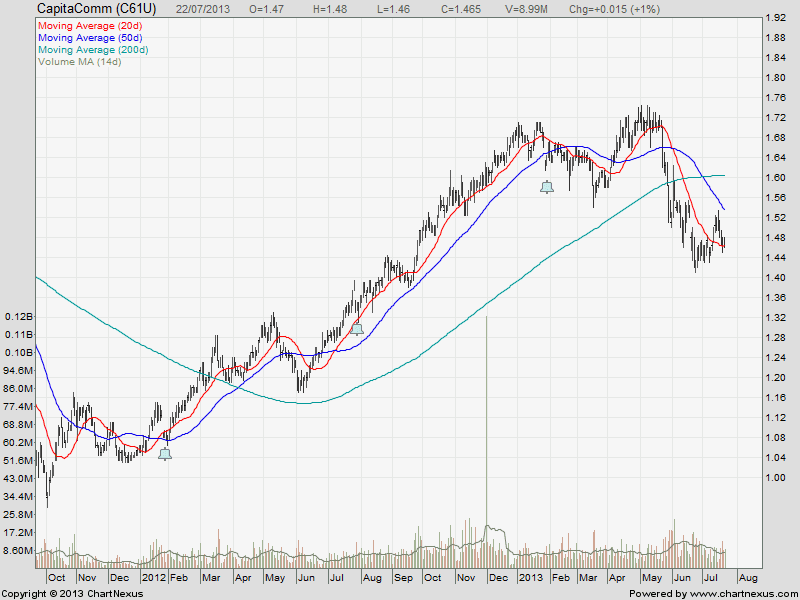

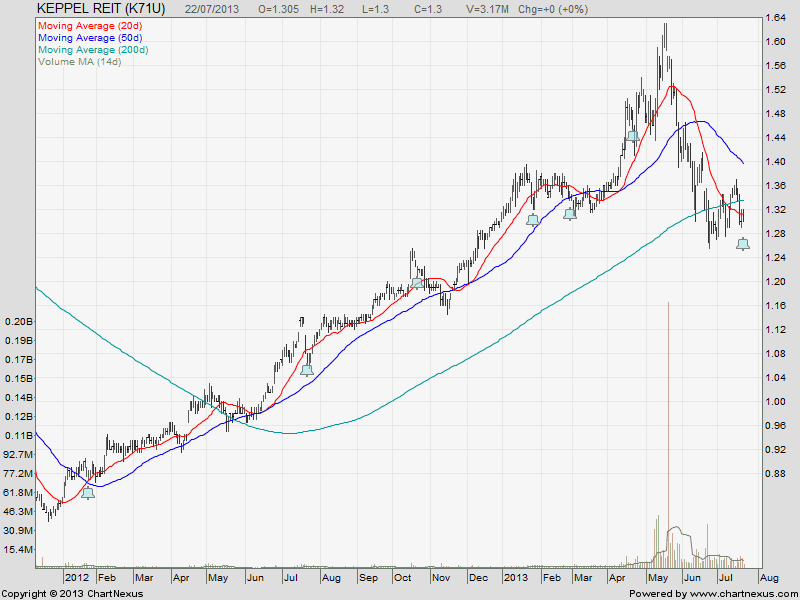

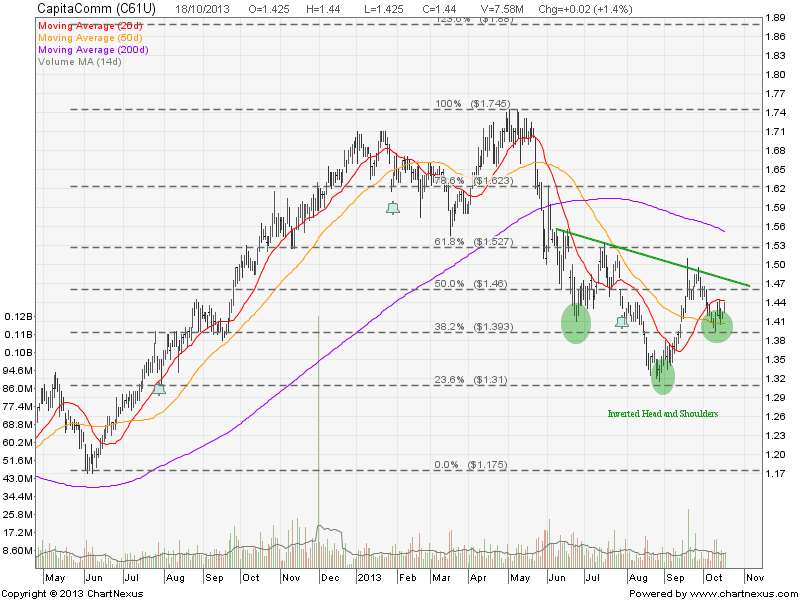

Similar chart patterns shown in the following REITs, all of them are in consolidation mode but upsides are limited.

Ascendas REIT

CapitaMall

CapitaComm

Keppel REIT

Mapletree Comm

Mapletree Ind

Suntec REIT

I will be sharing the Singapore REIT Fundamental Analysis, Technical Analysis and how the interest rate hike will impact your REIT investment in the coming public tutorial on “How to pick Singapore REIT for Dividend Investing” . Sign up NOW as the seats are very limited due to the classroom size.