Source: SGX Gateway

Singapore Exchange (SGX) lists three locally incorporated banks, DBS Group (D05), OCBC (O39) and UOB (U11) which together make up a quarter of the Straits Times Index (STI) market capitalisation. A key measure of a bank is its tier 1 capital to risk weighted asset ratio. Tier 1 capital represents the best form of capital and the higher the ratio to risk weighted assets, the more money the bank has to support the risks it takes. Together, the Singapore banks maintain a Tier 1 capital ratio to risk weighted assets of 13.6%, as reported by the IMF Global Financial Stability Report last week.

Singapore maintains the highest Tier 1 to risk weighted asset ratio across Asia, with Tier 1 capital for Japan Banks at 12.3% and Hong Kong Banks at 10.4%. It is a key measure of the strength of a bank, which is why the annual Bloomberg global rankings place 40% of the scoring emphasis on it. These rankings placed OCBC at #1, UOB at #7 and DBS at #8 in 2012. The total return of the three banks over the past year averages to 15%with individual performances as follows:

- DBS Group Holdings (D05) accounts for 9.2% of the STI market capitalisation. The 2012 World’s Strongest Bank rankings from Bloomberg noted DBS maintained a 12.9% ratio of Tier 1 capital to risk weighted assets. DBS has generated a total return of 19.6% in the past year, compared to an average annualised total return of 8.1% over the ten year period ending September 2012. DBS currently maintains an indicative dividend yield of 3.95%.

- OCBC (O39) accounts for 8.5% of the STI market capitalisation. This 2012 World’s Strongest Bank rankings from Bloomberg noted OCBC maintained a 14.4% ratio of Tier 1 capital to risk weighted assets. OCBC has generated a total return of 14.4% in the past year. This compares to an average annualised total return of 14.2% over the ten year period ending September 2012. OCBC currently maintains an indicative dividend yield of 3.33%.

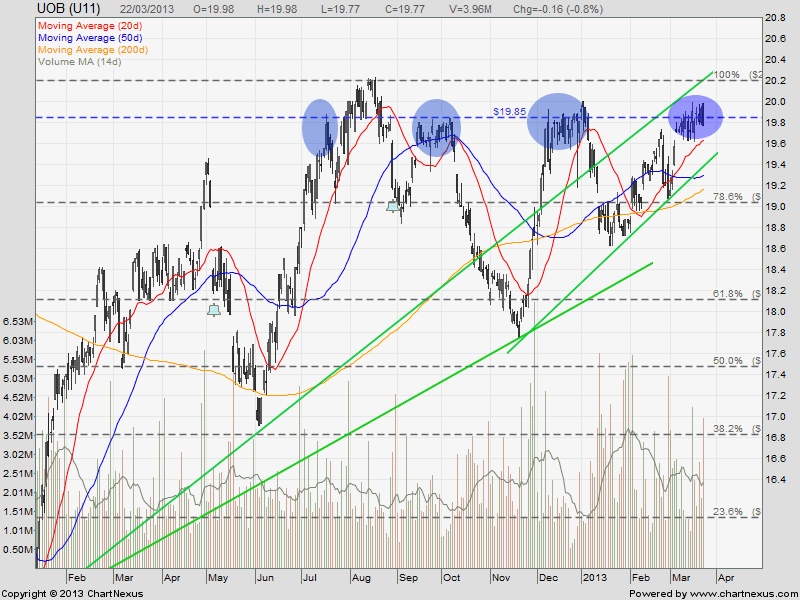

- United Overseas Bank (U11) accounts for 8.1% of the STI market capitalisation. This year’s World’s Strongest Bank ranking from Bloomberg noted UOB maintain a 13.5% ratio of Tier 1 capital to risk weighted assets. UOB has generated a total return of 11.2% in the past year, compared to an average annualised total return of 9.6% over the ten year period ending September 2012. UOB currently maintains an indicative dividend yield of 3.17%.