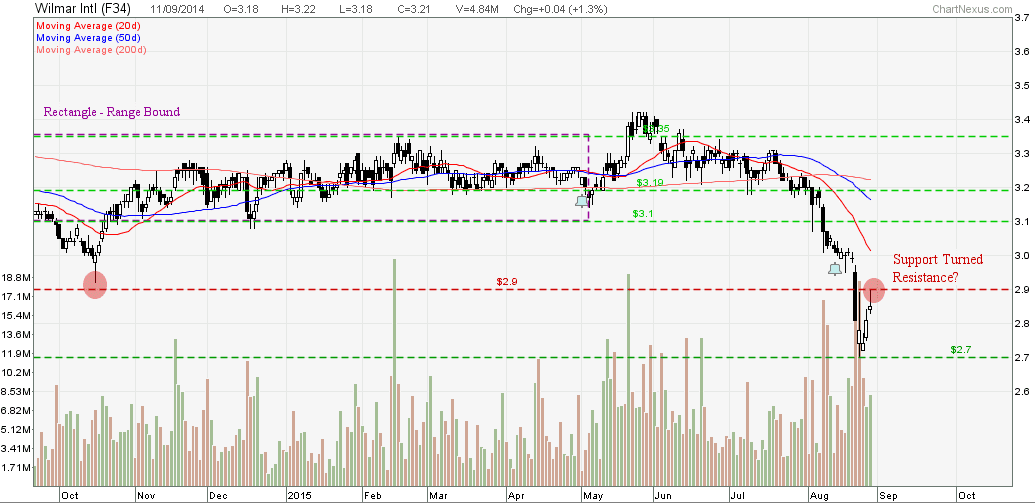

Wilmar: Range Bound in Rectangle

Wilmar is currently trading within a range in a Rectangle chart pattern. Wilmar is expected to move sideway until breakout to either direction. Nothing to trade until breakout.

Original post by Marubozu My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 13.4378 |

|---|---|

| Estimated P/E(12/2015) | 11.9183 |

| Relative P/E vs. FSSTI | 0.9515 |

| Earnings Per Share (USD) (ttm) | 0.1810 |

| Est. EPS (USD) (12/2015) | 0.2040 |

| Est. PEG Ratio | 1.3459 |

| Market Cap (M SGD) | 20,720.77 |

| Shares Outstanding (M) | 6,395.30 |

| 30 Day Average Volume | 4,349,957 |

| Price/Book (mrq) | 1.0039 |

| Price/Sale (ttm) | 0.3612 |

| Dividend Indicated Gross Yield | 2.31% |

| Cash Dividend (SGD) | 0.0550 |

| Dividend Ex-Date | 05/04/2015 |

| 5 Year Dividend Growth | 4.56% |

| Next Earnings Announcement | 05/07/2015 |

Wilmar: Ascending Triangle. Watch for Breakout!

Wilmar is currently consolidating in an Ascending Triangle for 4 months. 20D and 50D SMA are closing the gap with 200D SMA. Watch for Breakout!

Original post by Marubozu from My Stocks Investing Journey.

| Current P/E Ratio (ttm) | 13.5082 |

|---|---|

| Estimated P/E(12/2014) | 13.4328 |

| Relative P/E vs. FSSTI | 0.9999 |

| Earnings Per Share (USD) (ttm) | 0.1760 |

| Est. EPS (USD) (12/2014) | 0.1770 |

| Est. PEG Ratio | 2.0291 |

| Market Cap (M SGD) | 20,592.86 |

| Shares Outstanding (M) | 6,395.30 |

| 30 Day Average Volume | 4,140,227 |

| Price/Book (mrq) | 0.9909 |

| Price/Sale (ttm) | 0.3463 |

| Dividend Indicated Gross Yield | 2.33% |

| Cash Dividend (SGD) | 0.0200 |

| Dividend Ex-Date | 08/14/2014 |

| 5 Year Dividend Growth | 4.56% |

| Next Earnings Announcement | 02/12/2015 |

- 1

- 2

- 3

- 4

- …

- 8

- Go to the next page