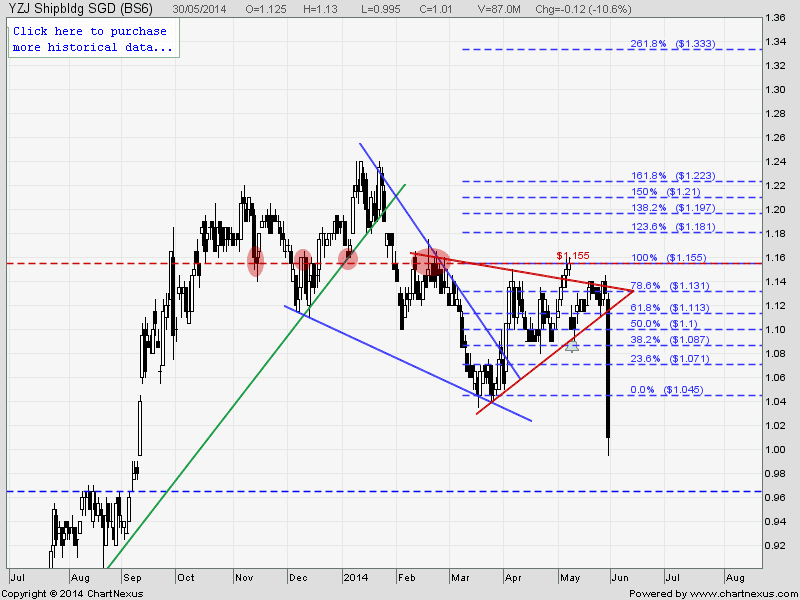

Yangzjiang Shipbuilding Holding: Rebound from 200D SMA Support

Yangzijiang rebounded from the 200D SMA support and also the uptrend line support after recent sell down.

To learn how to use chart patterns to identify trading opportunities, check out the Technical Analysis Hands on class here.

Yangzijiang Fundamental

- Last Done Price = $1.315

- Market Cap = 5.038 B

- EPS = $0.1937

- PE Ratio = 6.789

- PE High (Last 5 Years) = 12.29

- PE Low (Last 5 Years) = 4.26

- P/B Ratio = 1.0739

- Dividend Yield = 4.183%

- ROA = 8.541%

- ROE = 17.012%

- Current Ratio = 1.677

Learn how to use Financial Ratio to analyse the stocks, check out the Fundamental Analysis class (hands on research) here.

Fundamentally and Technically Yangzijiang Shipbuilding looks good to long at this level.