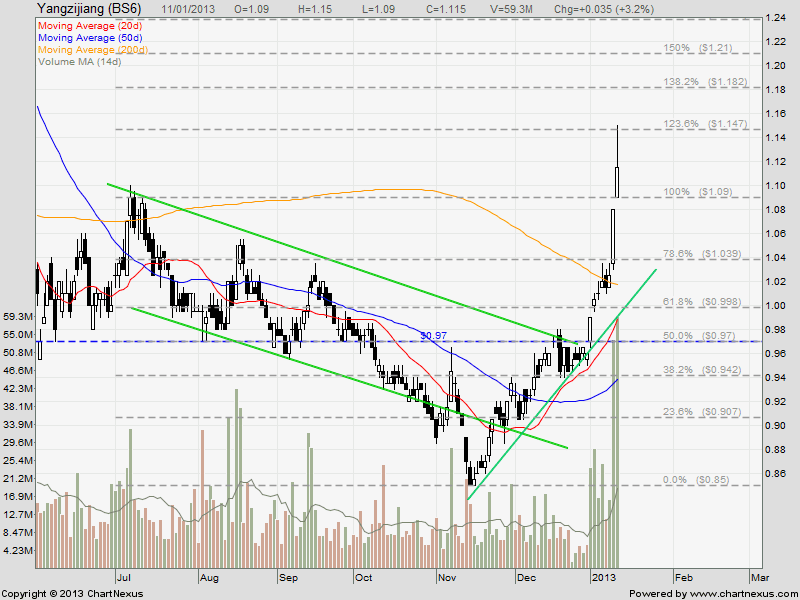

Yangzijiang: Breakout!

Yangzijiang breakout from a few key resistances:

- Neckline of Inverted Head and Shoulders @$0.97

- $1.00 psychological resistance

- 200D SMA @ $1.00

- 61.8% Fibonacci Retracement @ $1.00

This $1.00 is a very significant resistance for Yangzijiang. However the stock is rejected at $1.147 with long upper shadow indicates potential reversal. Anyway it is too late to chase the stock price, it is safer to wait for the retracement to test the $1.00 resistance turned support level.

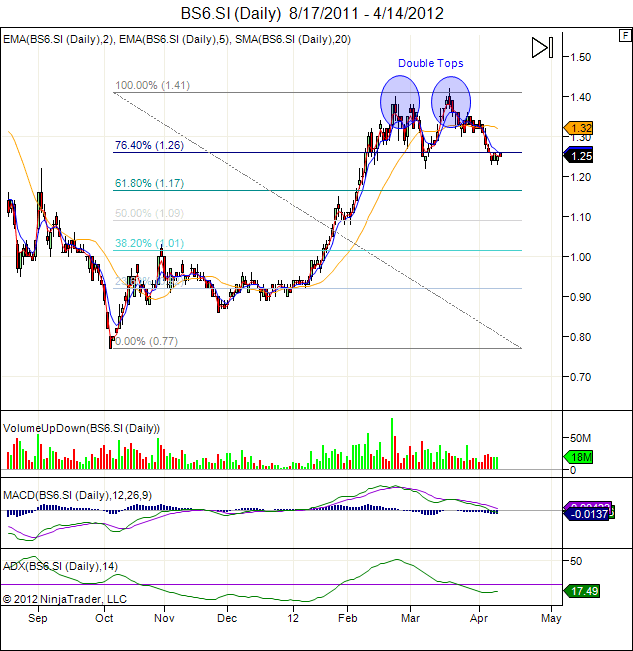

By the way, it is not really a big surprise that big cap China stocks breakout and reverse to the uptrend. Those breakout are supported by the Fundamental of China Economy. Read my previous post of China Big Cap ETF (FXI) here.

Key Statistics for YZJ

| Current P/E Ratio (ttm) | 5.6940 |

|---|---|

| Estimated P/E(12/2012) | 6.1062 |

| Relative P/E vs. FSSTI | 0.4648 |

| Earnings Per Share (CNY) (ttm) | 0.9937 |

| Est. EPS (CNY) (12/2012) | 0.9270 |

| Est. PEG Ratio | – |

| Market Cap (M SGD) | 4,272.77 |

| Shares Outstanding (M) | 3,832.08 |

| 30 Day Average Volume | 14,463,500 |

| Price/Book (mrq) | 1.4746 |

| Price/Sale (ttm) | 1.3167 |

| Dividend Indicated Gross Yield | 4.93% |

| Cash Dividend (SGD) | 0.0550 |

| Last Dividend | 05/17/2012 |

| 5 Year Dividend Growth | – |

| Next Earnings Announcement | 02/26/2013 |