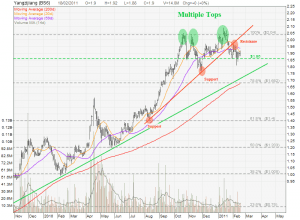

Yangzijiang: Bull is Missing!

Yangzijiang current chart shows that Bull is Missing for this China ship building stock. The following bearish signs are observed:

- Yangzijiang has formed a Multiple Tops.

- Yangzijiang has broken the short term up trend support (red line). This up trend support has since tured to resistance.

- Yangzijiang is unable to break the 20D MA resistance.

- A “Lower Low, Lower High” chart pattern is observed in Jan 2011 to Feb 2011.

Next immediate support is $1.86 followed by the long term uptrend support (green line) which close to the 200D MA and 78.6% Fibonacci Retracement Level.