Boeing (BA): Trading Opportunity!

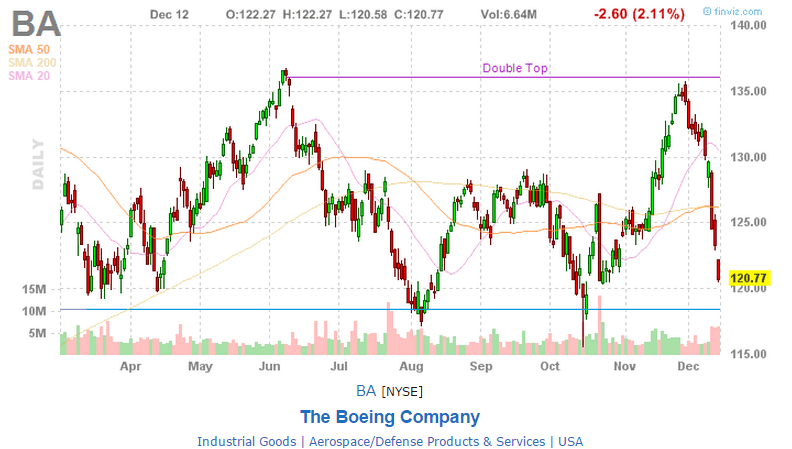

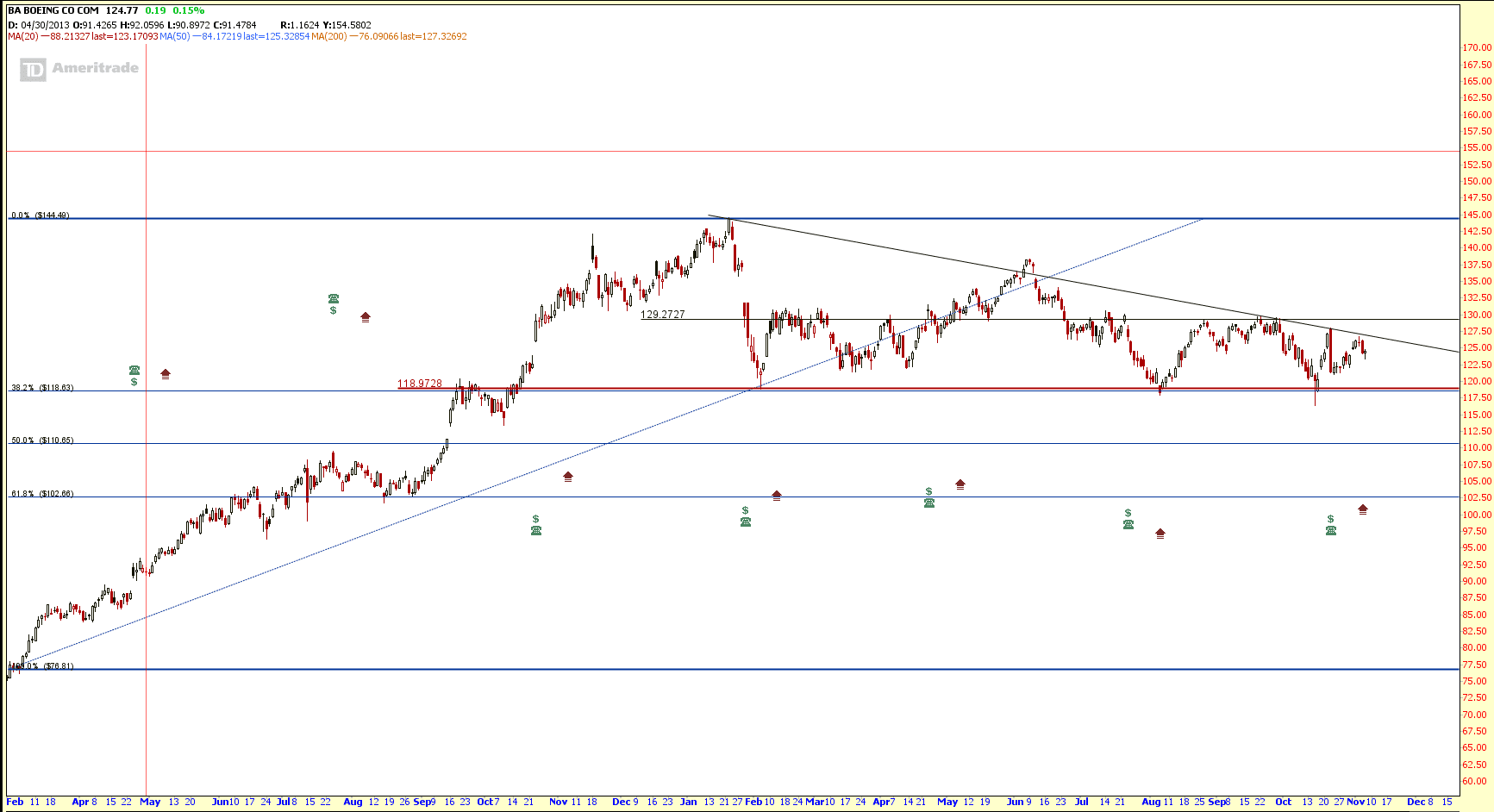

BA is one of my favorites in option trading. Look at the chart pattern and the swing between high and low! Strategy: Short at Resistance and Long at Support.

BA is getting near to the support. Waiting to take profit for Short position and prepare to setup the next trade.

BA is good for trading but not for investing unless you have very strong heart. You look at the yo-yo wild swing pattern and you will know why.

See previous analysis of Boeing (BA) here.