Original Post by Marubozu My Stocks Investing Journey

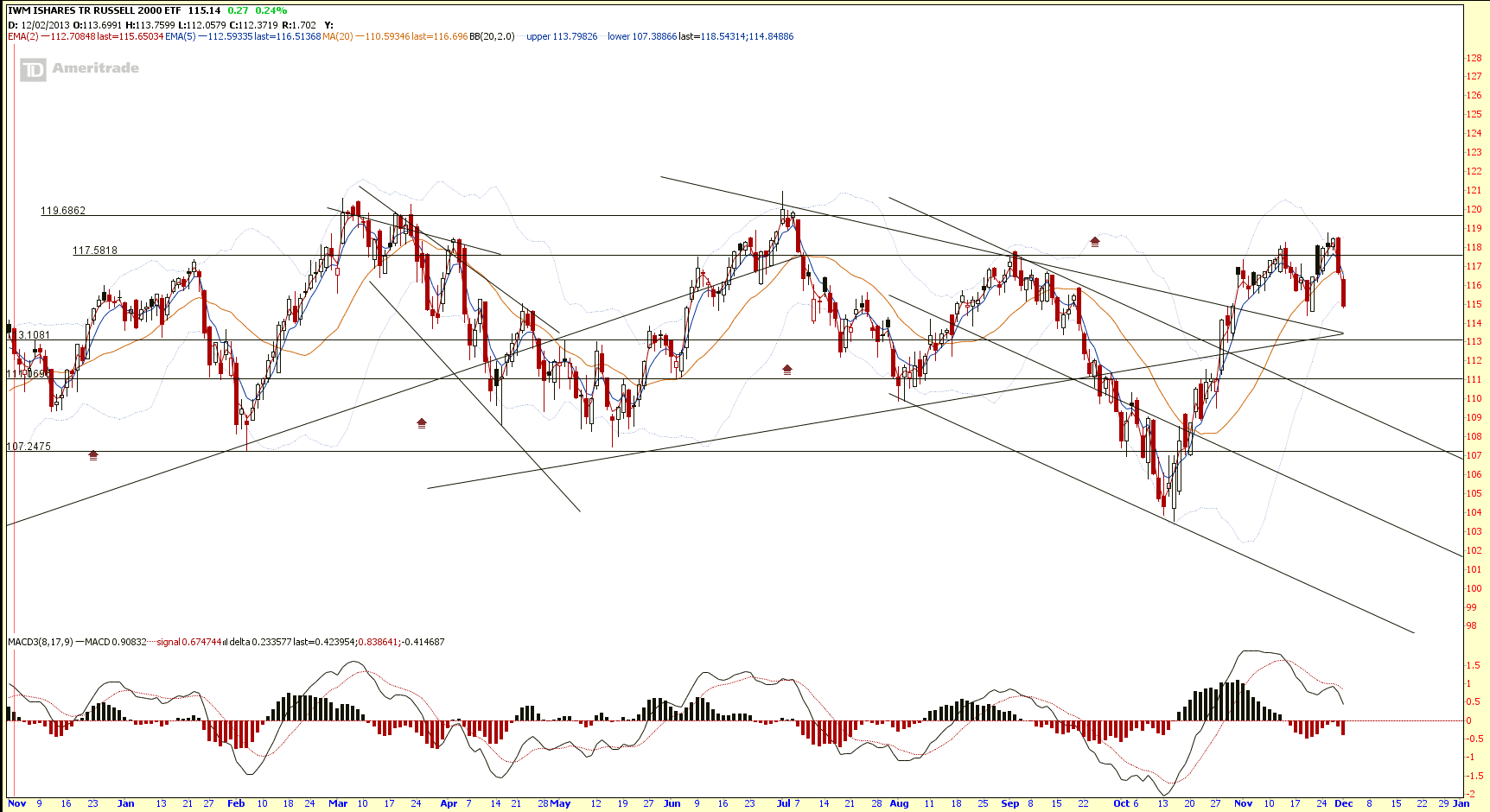

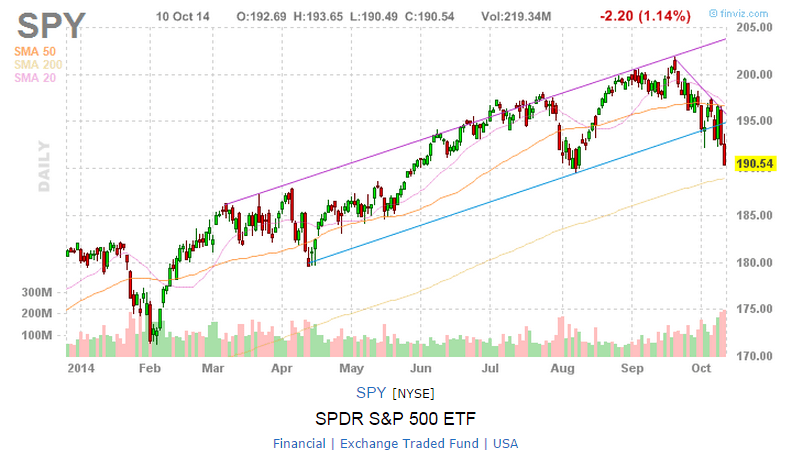

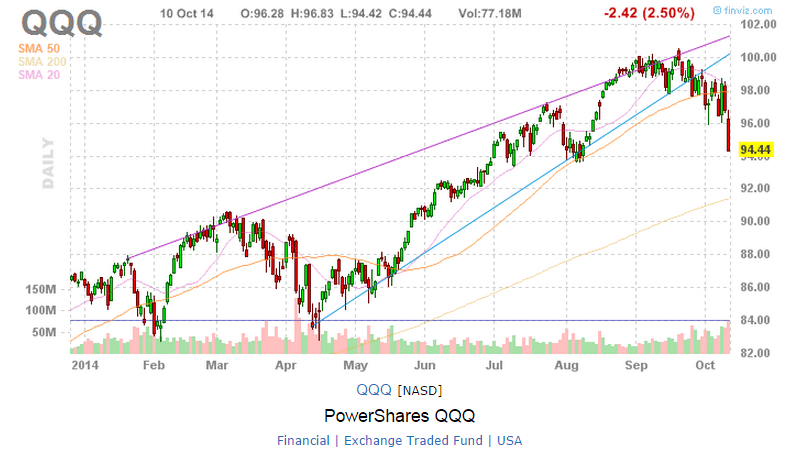

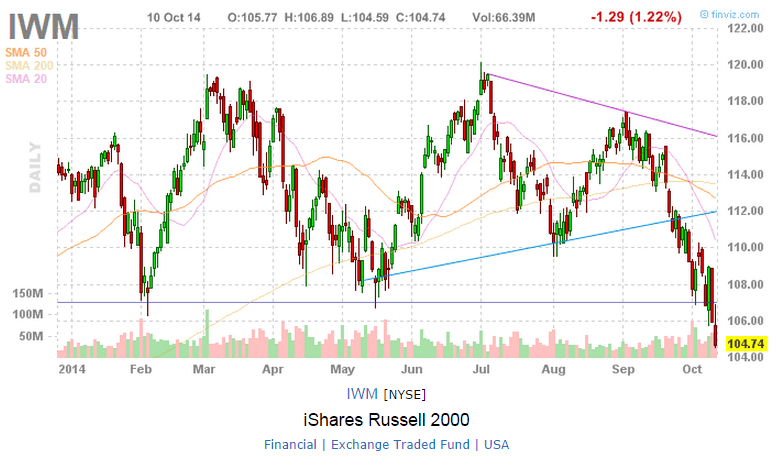

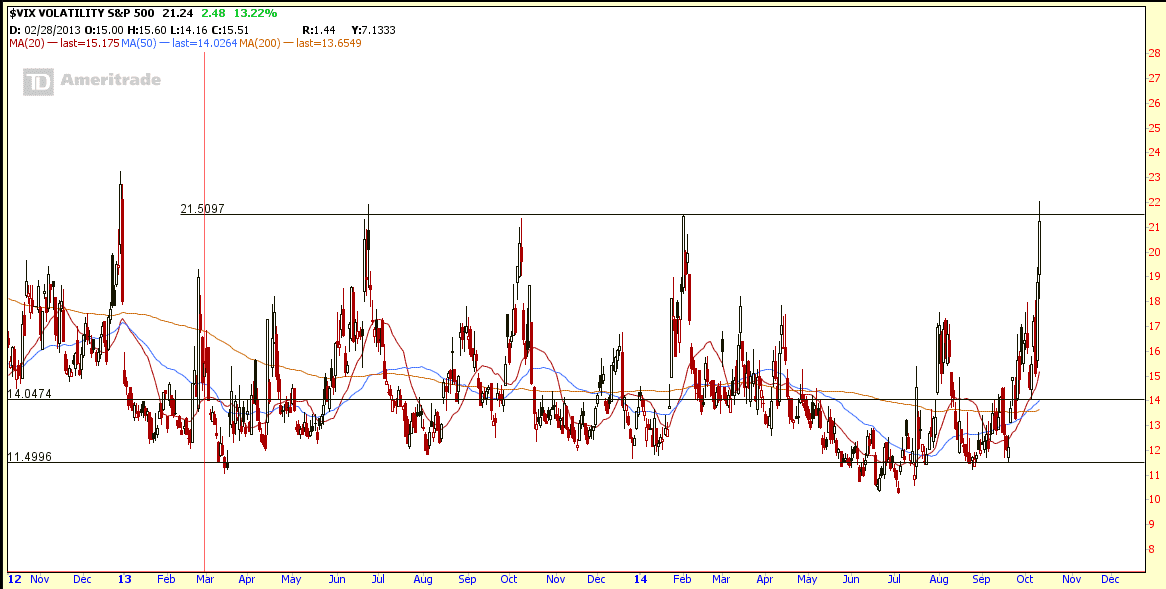

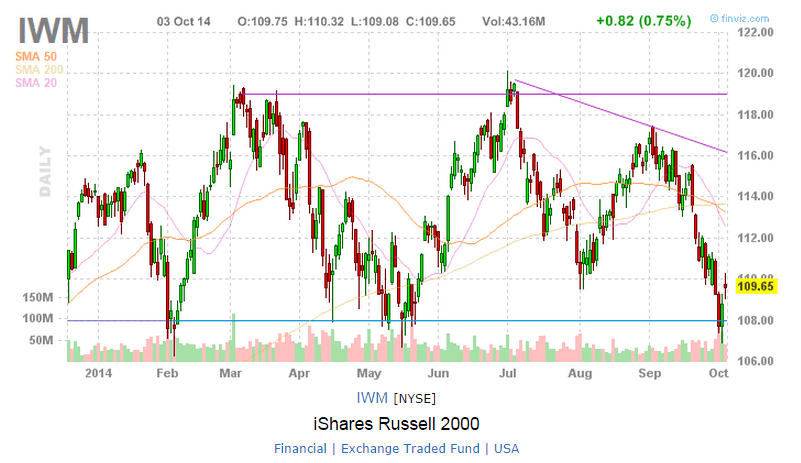

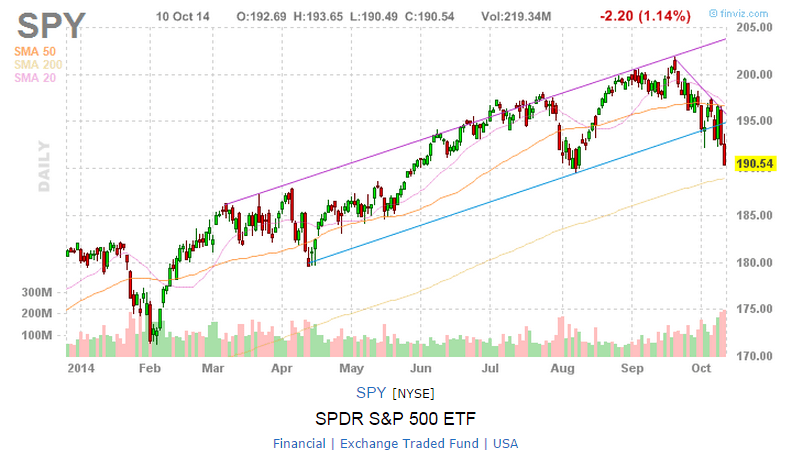

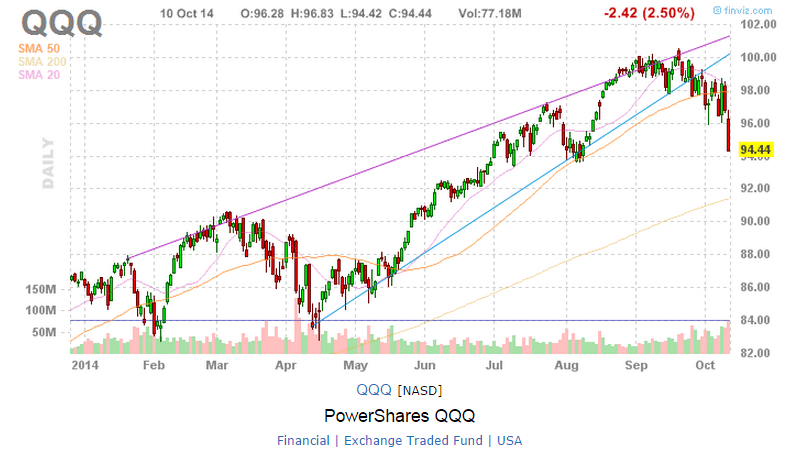

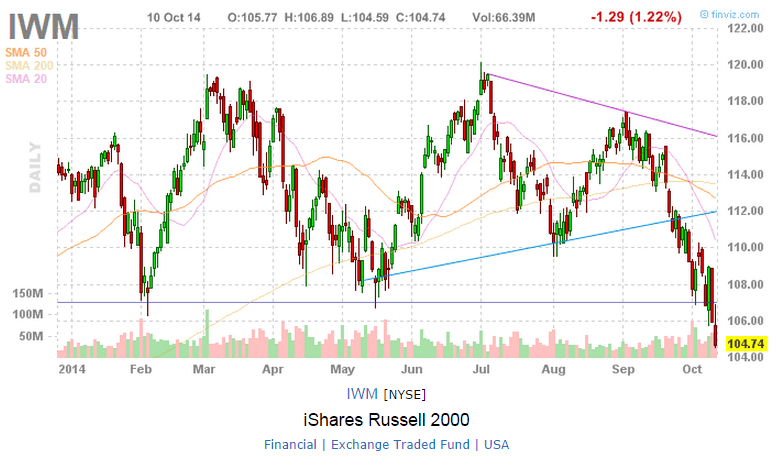

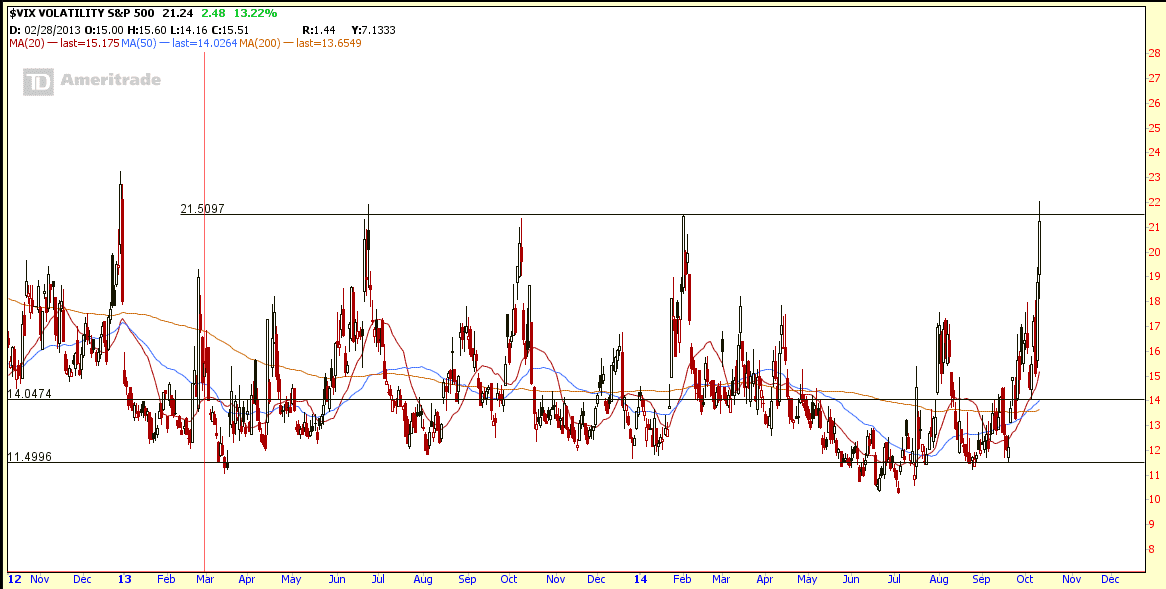

DIA, SPY, QQQ and IWM all broke the support last Friday and VIX hit almost 2 Years high at 21.24!

However, DIA, SPY and QQQ are still not in technically bearish territory yet as they are still above the 200D SMA (trending up). Only IWM is officially in the down trend. Watch out for a technical rebound at 200D SMA.

Looking at the VIX past 2 years pattern, the Fear will not last forever if there is a rebound at 200D SMA support. It is a high winning probability trade by shorting VIX at this level.

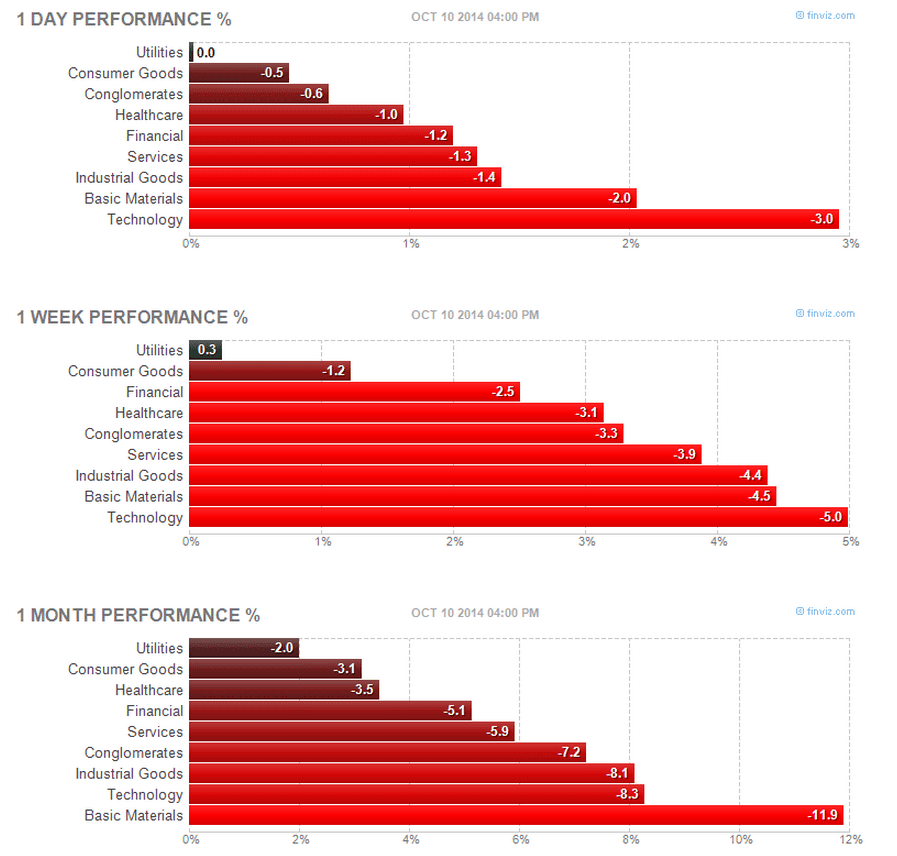

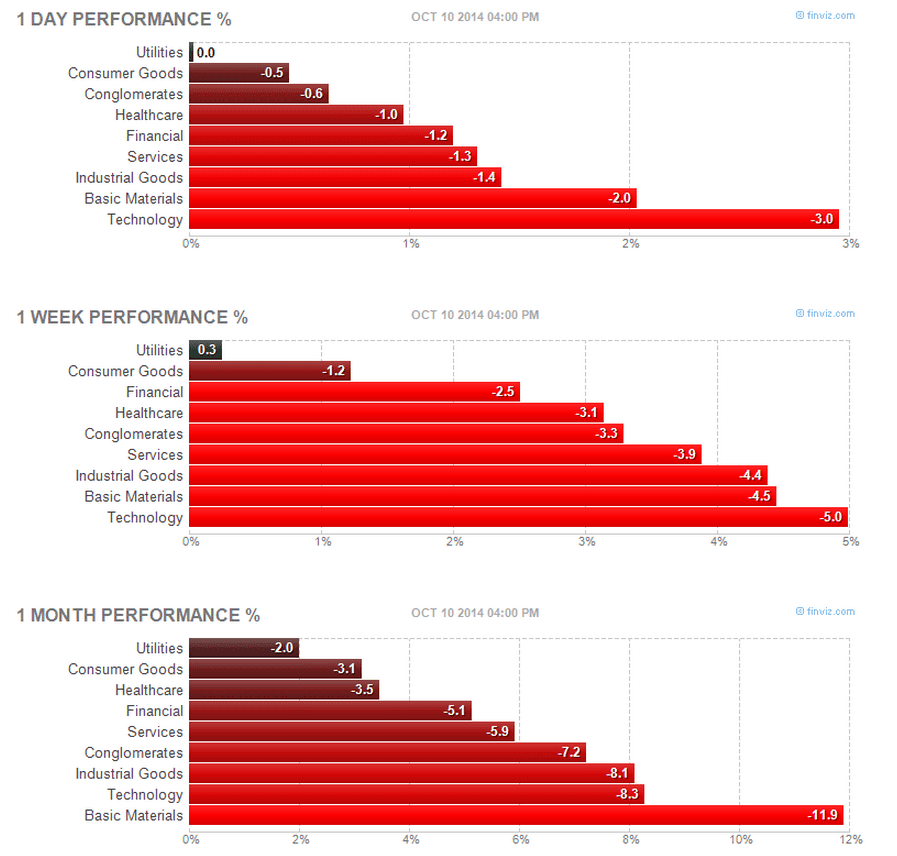

Healthcare, Consumer Goods & Utilities (Defensive sectors) are the better performing sectors relatively in the last one month. Technology & Basic Material are the worst performing sector. This is a typical sectors pattern in the bear market. Beware of the Big Bear Awakening!

Plenty of Trading Opportunities during the recent sell down:

- Short Call Spread on DIA, SPY, QQQ or IWM (after breaking the support)

- Short Call Spread on VIX

- Short Put Spread for DIA, SPY or QQQ (when rebound from 200D SMA)

- Iron Condor (Sell Volatility)

Disclaimer: This is NOT the recommendation or trading tips. This post is for own analysis only.