LinkedIn (LNKD) Earning Play

- Earning Release: May 1 AMC (Thursday).

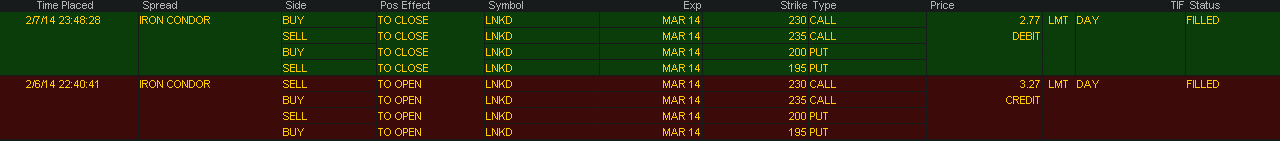

- Objective: Directionless. Sell IV.

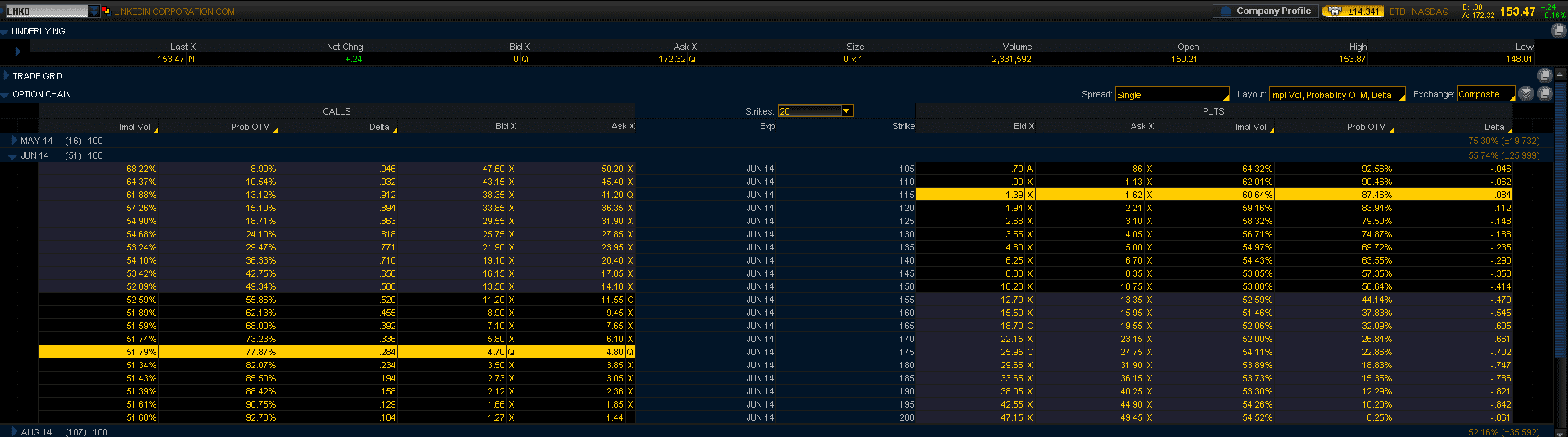

- Last Closing Price = 153.47

- IV Percentile = 88.5%

- IV = 0.6297

- Floor IV = 0.39

- Option Strategy:

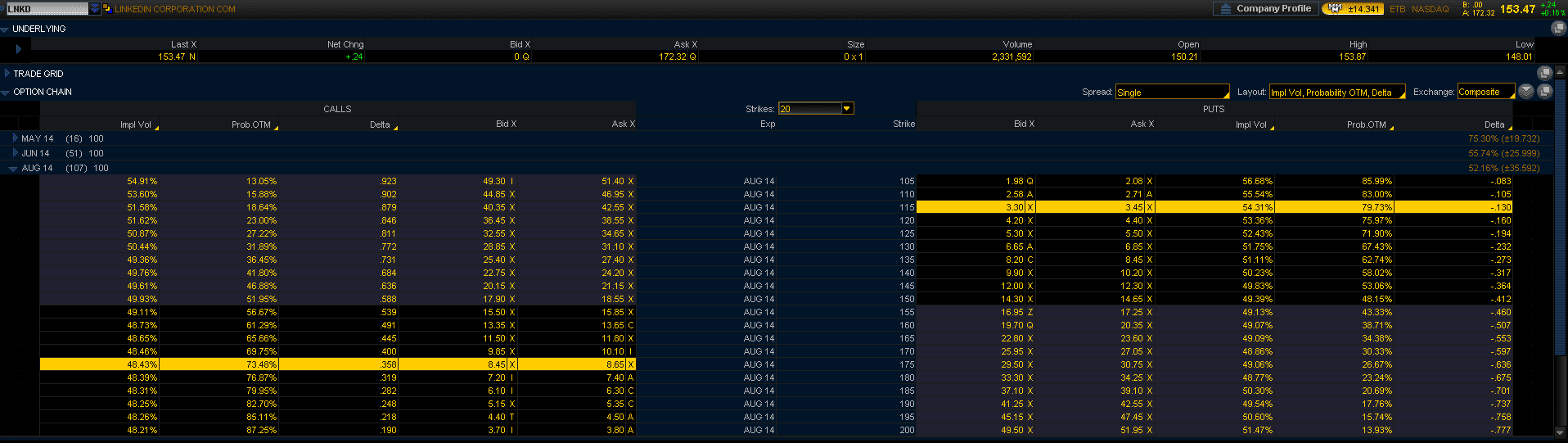

- Iron Condor: LNKD Aug14 105/115/175/185

- Iron Condor: LNKD June14 105/115/175/185

- Note:

- Factor in 10% Gap up and Gap Down

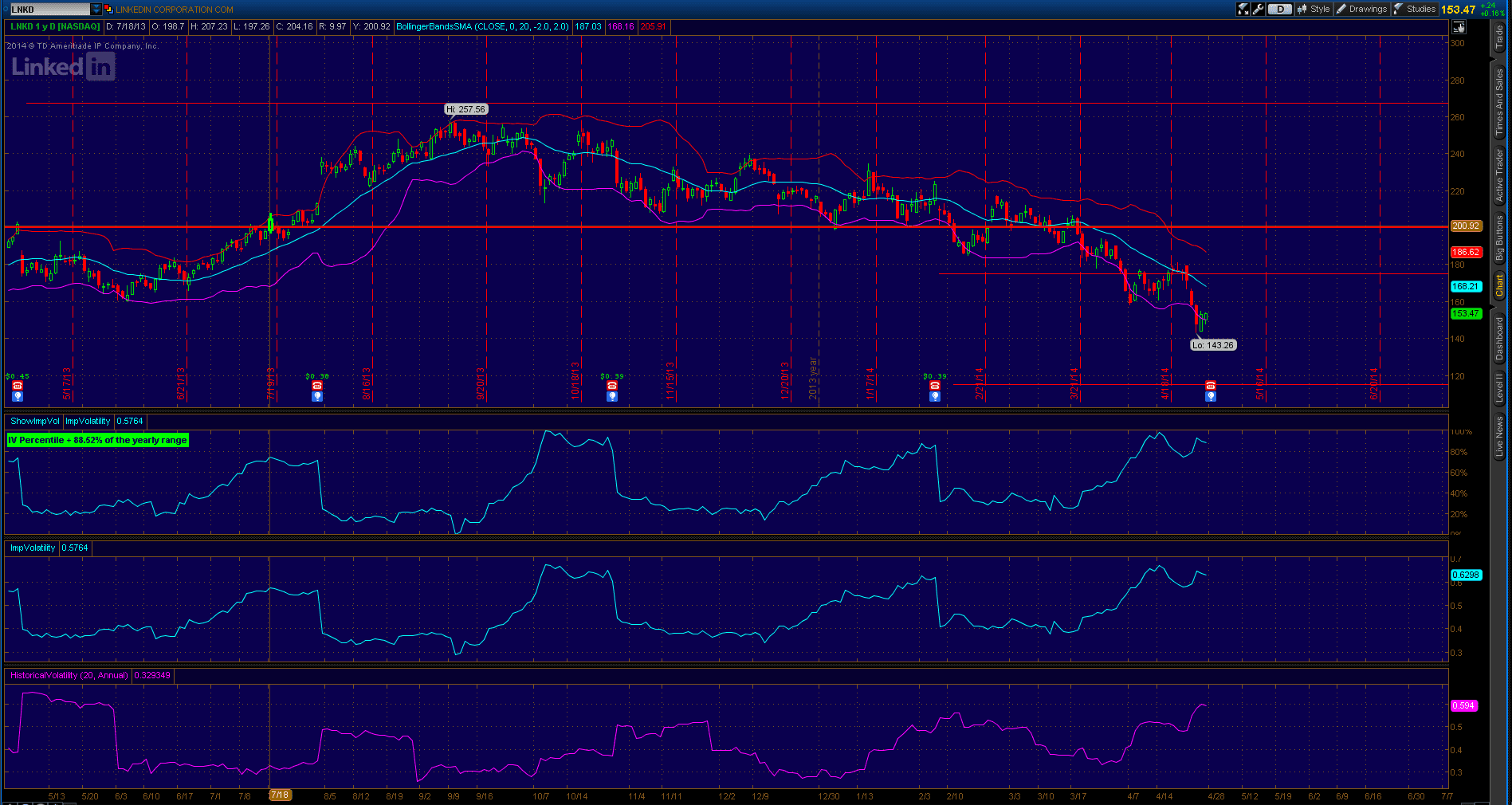

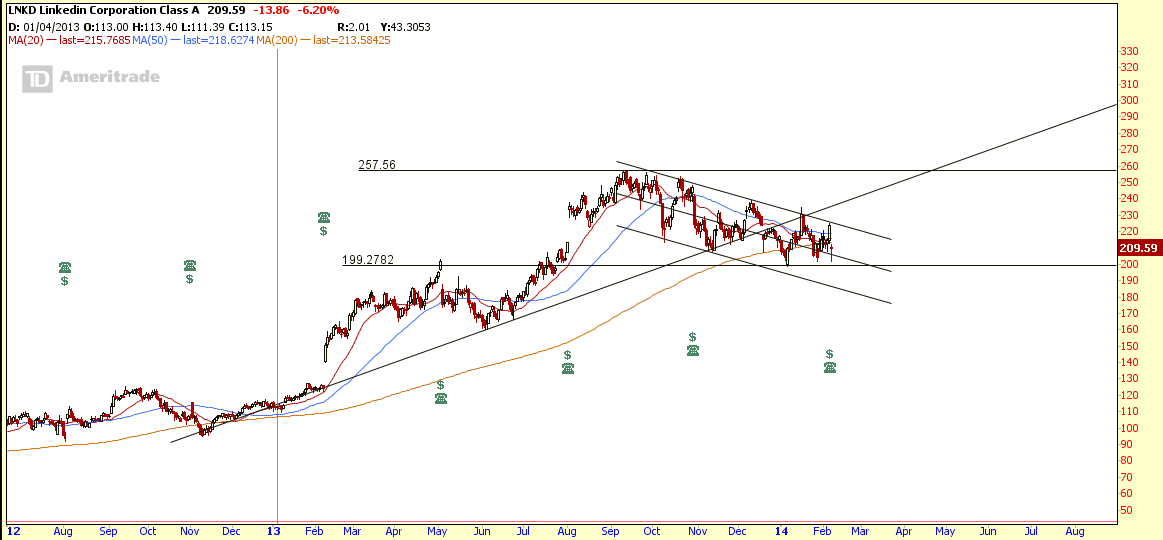

- Slight Bearish bias as LNKD chart is bearish

- Sell in May Month

- Fundamentally super over value, PE = 807!!

Original Post by Marubozu @ My Stocks Investing Journey.

LNKD Fundamental

LNKD Earning

LNKD IV Chart

LNKD IV Risk Profile

LNKD Option Chain (June 2014) with slippage = 0.16 to 0.32

LNKD Option Chain (August 2014) with slippage = 0.2 to 0.25