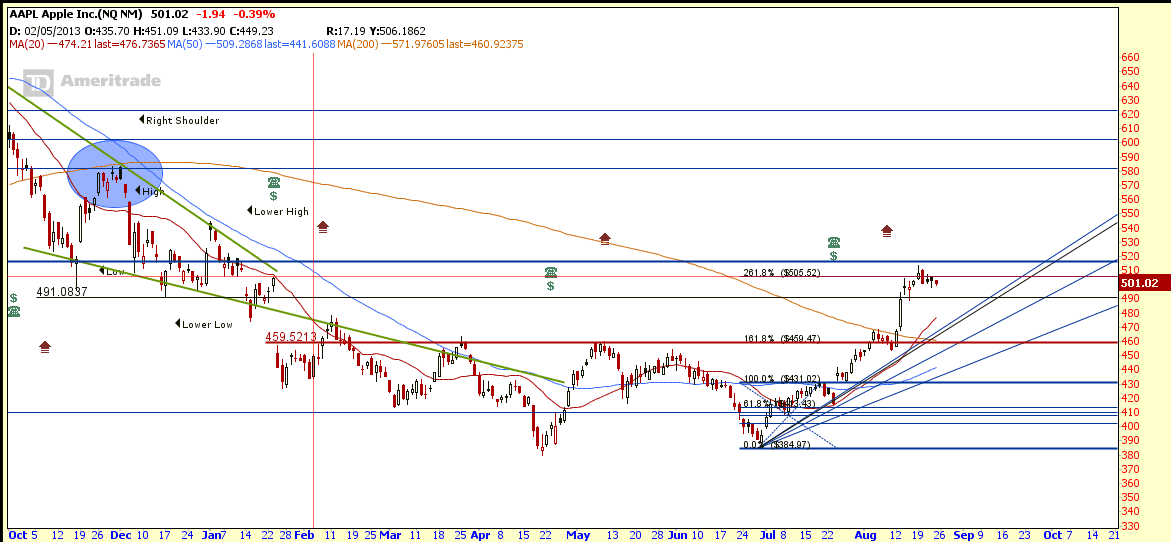

Apple (AAPL) Trade Idea

Chart Pattern: AAPL breakout from Inverted Head and Shoulders with neckline about $460. AAPL also broke the 200D SMA resistance and technically entered into bullish trend. The stock also retraced to retest the neckline support to confirm this is a successful breakout.

Trading Strategy: Short Put Spread.

- Target Entry zone:

- Scenario 1: $470-$480 when AAPL retraces back to Fibonacci Fan support. Currently AAPL is facing the 261.8% Fibonacci Resistance.

- Scenario 2: If AAPL breakouts from current Bull Pennant / Bull Flag (above $510)

- Scenario 1

- STO AAPL Oct 13 480 Put

- BTO AAPL Oct 13 470 Put

- Scenario 2

- STO AAPL Oct 13 510 Put

- BTO AAPL Oct 13 500 Put

- Minimum Price Target : $530 (Inverted Head and Shoulders Breakout Target)

AAPL Chart

AAPL Fundamental

AAPL Intrinsic Value

- Operating Cash Flow = $52,894 Million

- No of Shares outstanding = 908.5 Million

- Beta = 0.98

- Discount Rate = 6%

- No Growth (0% for next 10 years), IV = $443

- Conservative Growth (5% for next 10 years), IV = $563

- Moderate Growth (9% for next 10 years), IV = $709

- Adjusted Growth Rate (12% for next 10 years). IV = $826

Chart from thinkorswim, get FREE chart here.

Original post by Marubozu from My Stocks Investing Journey.