Green Mountain Coffee Roasters Inc. (GMCR) Trade Idea

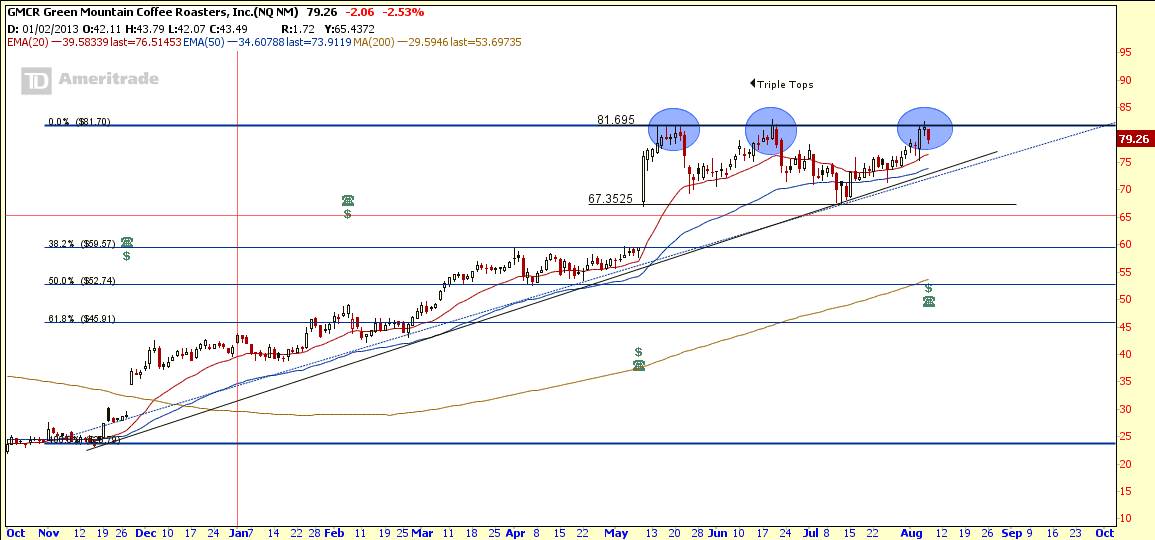

Chart Pattern: GMCR is forming a Triple Tops with resistance at about $81.70.

Trading Strategy: Short Call Spread 80/82.5

- STO GMCR Sept 13 80 Call

- BTO GMCR Sept 13 82.5 Call

- If break $81.70 resistance and move above $82.5, BTC GMCR Sept 13 80 Call to repair (1 month before expiry), else close both positions.

- If break uptrend support (about $74.00), short by BTO GMCR Oct 13 72.5 Put.

- If break Triple Tops Neckline at $67.35, may consider to Long another Put option to continue shorting. Price target $60.00 (Gap Support & 38.2% Fibonacci Retracement Level)

GMCR Chart

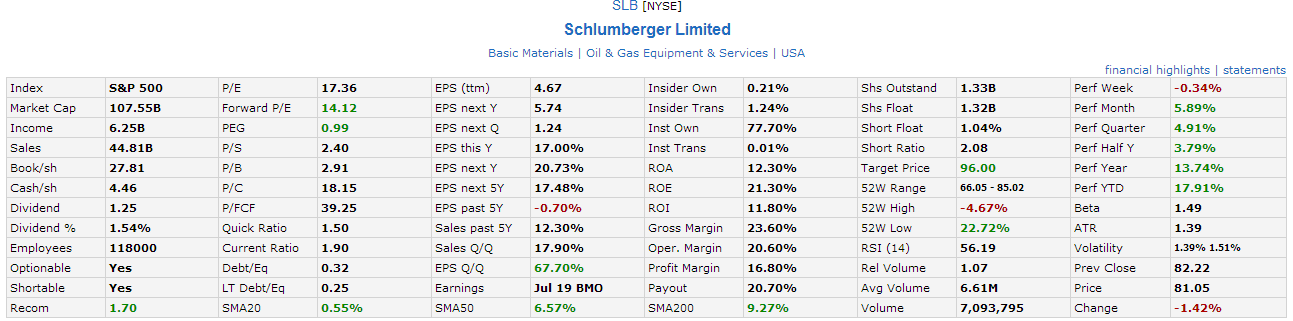

GMCR Fundamental

Chart from thinkorswim, get FREE chart here.

Original post by Marubozu from My Stocks Investing Journey.