FRE & FNM – Broke the critical support level!

FRE & FNM broke the critical support level (61.8% Fibonacci Retracement level) after a KBW analyst downgraded the two to the firm’s lowest rating, cut price targets on both stocks to zero from $1. KBW said their common and preferred shares would be “worthless” given the nearly $100 billion they will continue to owe the government, even if recapitalized. FRE broke the critical support level of $1.705 and FNM broke $1.483 support level. Both stocks are below the 20D & 50D MA, all other technical indicators show bearish convergence.

I sold all my stocks to take profit after sighting a bearish convergence signal. I plan to buy back at a lower price when the down trend ends. I think the US government will continue to run the companies, and the companies will not go bankrupt. However, the value of their common and preferred equity will probably be re-capitalized. Thus, buying at a very low price limits the downside risk.

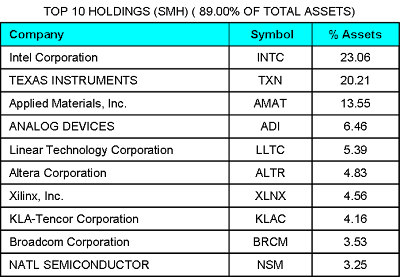

Semiconductor ETF (SMH) rides on semiconductor growth in 2010

Semicondutor industry is a cyclical industry. It is forecasted this industry will grow at a minimum of 10% in 2010. Recent semiconductor industry reviews:

- Global semiconductor revenue could grow about 10 percent next year after two years of declines, as new computers and feature-jammed smartphones help boost chip demand – Gartner

- Global pure-play semiconductor foundry revenue will decline about 11% in 2009, but then increase 21% in 2010 – iSuppli

- The chip sector has been struggling over the last few years as the global economy, oversupply, and price pressures have stalled sales. But as the oversupply and under-demand cycle has stabilized, sales have improved, according to recent reports from the Semiconductor Industry Association.

SMH broke the long term Fibonacci 61.8% resistance of $24.763 and this level had become a very strong support level.

SMH broke the long term Fibonacci 61.8% resistance of $24.763 and this level had become a very strong support level. SMH is currently testing its another strong resistance at $26.24. If SMH can stay above this resistance turned support level, the uptrend is confirmed. Otherwise, it may retrace back to $21.809. SMH has not retraced back to this 61.8% Fibonacci level yet to build the base for future up trend. SMH is currently above 20D, 50D and 200D MA.

SMH is currently testing its another strong resistance at $26.24. If SMH can stay above this resistance turned support level, the uptrend is confirmed. Otherwise, it may retrace back to $21.809. SMH has not retraced back to this 61.8% Fibonacci level yet to build the base for future up trend. SMH is currently above 20D, 50D and 200D MA.- Go to the previous page

- 1

- …

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- …

- 67

- Go to the next page

-740x480.png)