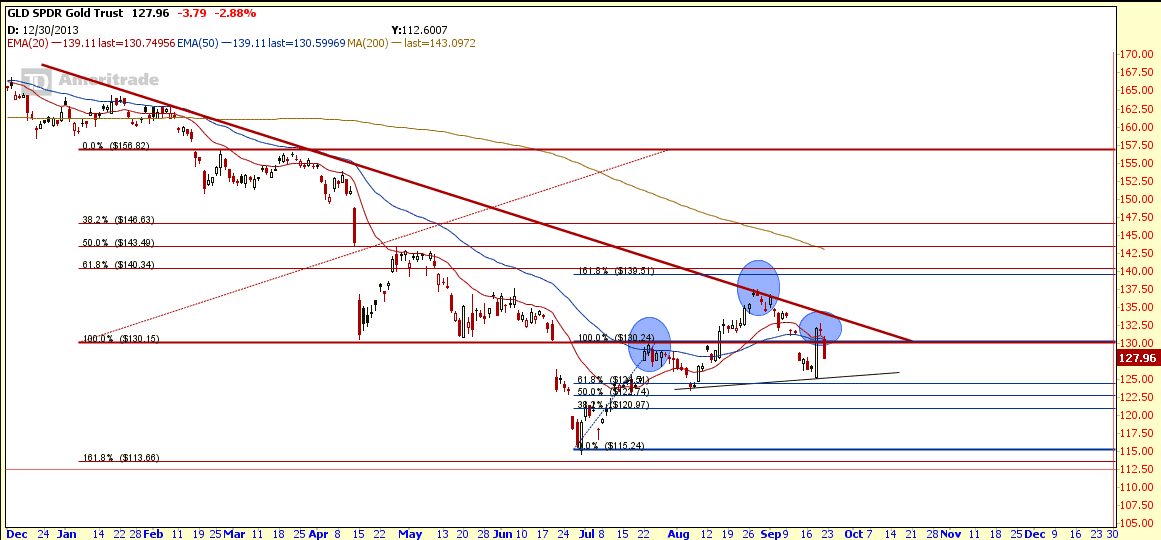

Ben Bernanke delay QE Tapering: Time to Buy Gold?

Mr. Market does not believe Mr. Benanke and continue the down trend after rejected at the down trend resistance line. In addition, GLD broke the critical support of $130 and in the process of forming a Head and Shoulders pattern. Watch the neckline support (also the 61.8% Fibonacci Retracement) at about $124-$125. Breaking this support will send GLD to test the recent low of $115.

See Previous Analysis Gold Starts to Rally?